Far from other continents in the world, African businesses and creative people have been denied the full benefits of their ideas or innovations. From Nairobi to Lagos and Johannesburg to Cairo, pirated copies of creative works are everywhere. This has largely been linked to the poorer institutional and legal framework for intellectual rights protection on the continent.

What African Entrepreneurs Need to Know About Filling and Protecting PIP

Patent in Africa is not an easy task and not protecting one’s invention is never an option. Patent aims to give patent holder time to capitalize on their investment and promote investment. Protection of intellectual property is significant as it sets one’s business apart from competitors. It can be sold or licensed which provides an important revenue stream. It also forms an essential part of marketing or brand.

All business has intellectual property worth protecting regardless of the size and sector. Intellectual property could be brand, investment, design or any kind of creation. Intellectual property is more democratic in the sense that you do not need large capital or goods to generate more capital but brain, intellect and creativity.

From the north to the east and south to the west of Africa, businesses and creative people need to know that protecting their works is very imperative. It has numerous benefits. Over the years, those in advanced economies have been capturing value from their patents and trademarks. In our experience, we have learnt that patent and trademarks are part of strategic capital that businesses and people convert into value [monetary].

When one intends to file a patent or trademark, there are a number of national, regional and global bodies for it. The World Intellectual Property Organisation is the largest body, which has more than 45 million records from some 55 national and international collections. A click on the body’s official website gives clues of what is required to understand availability or the otherwise of a patent or trademark globally.

Our check shows that a total of 2,680,900 patent applications were received by the body in 2014. Africa had 180,300 resident applications and 880, 600 non-resident applications. This is not quite different from what the continent had between 1995 and 2010. Between 2015 and 2018, South Africa filed resident patents than Nigeria and Ghana, analysis reveals. In a recent research, it also emerged that the majority of patent filings in Africa are from Europe, the United States, and other high income countries. Yet, in South Africa, between 15% and 20% of patent filings are by residents of South Africa, and 3% are from other developing and emerging economies. Only a small share of inventions globally are made in sub?Saharan Africa, but for those inventions that do arise in Africa, foreign filings are made widely outside of Africa. Trademark seems the most active IPRs in sub-Sahara Africa most especially in Kenya, Ghana, Gambia, Nigeria, and South Africa. This is the area of IPRs which had witnessed numerous applications from nationals of the region.

The Struggle to Protect PIP

In Africa, due to the poor legal system, protecting a patent is not advisable and can be immaterial and this is majorly as a result of a flawed legal system. Archaic old laws are another serious problem that must be faced in tackling one of out of many challenges we have as regards patent in Africa. Lack of enforceability is an aggravation of archaic laws. Lack of expertise in court to deal with intellectual property matters is also an issue. Basically, there are laws regulating intellectual property, but these laws are neither enforced nor effective. It is safe to say new legislations at this point are not remedies, but enforcement of the already laid down legislations.

Registering patent can be time consuming and lengthy process. Typically, 3-4 years and market may change or technology may overtake invention by the time an inventor gets patent. It is costly, whether the patent holder or business holder is rich or not due to the application and search for existing patents. It is however important to note that the potential for making profit should outweigh the time, money and effort it takes to maintain a patent because not every patent has financial value. This implies that the whole patent, registering must be worth the whole stress and profitable in a way that it outweighs the amount being spent.

Despite the fact that a business, regardless of the size ought to be patented, it is not a smart move to patent when it is not beneficial. In Nigeria, even the due to the active nature and awareness surround IP protection and the development of a number of institutions responsible for protecting it, they still lack the explicit policy and legislative backing.

To Increase Innovation Ecosystem, African Leaders Need to Ensure Sustainable PIP Protection

To increase innovation ecosystem, our analyst notes that African leaders need to ensure sustainable patent and intellectual property protection. This is highly imperative in Nigeria, Kenya, Tanzania, Uganda and other countries where failure to file patent and trademark is reducing innovation output.

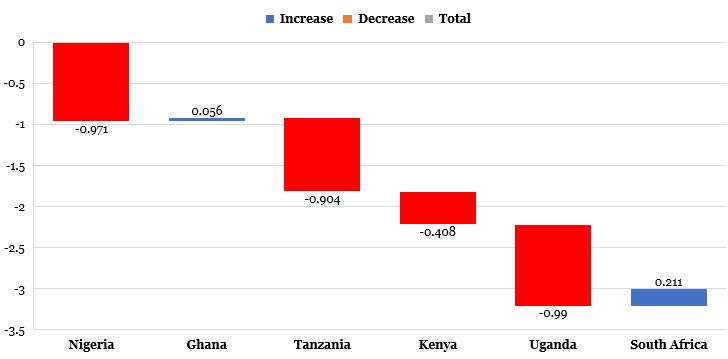

In our analysis, we found no significant difference between the innovation output of Nigeria and South Africa in 3 years [2017 to 2019]. However, we discovered the difference between Kenya and Uganda’s innovation output during the period. There was a significant difference between Nigeria and South Africa intellectual property protection during the period. South Africa has better intellectual property protection environment than Nigeria.

During the years, our analysis reveals that Nigeria, Ghana, Tanzania, Kenya, Uganda and South Africa intellectual property protection and innovation output related negatively. We found -76.6% connection. This indicates that the higher the poor intellectual property protection the less businesses and people innovated in the countries between 2017 and 2019. The intellectual property protection capability of the governments of select countries only contributed 58.7% to the innovation outputs.

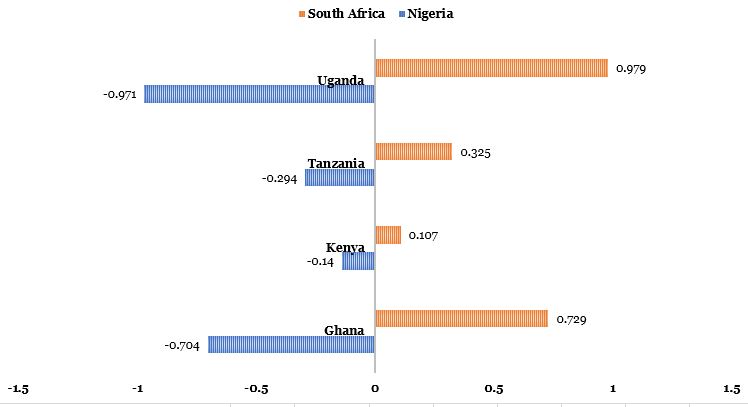

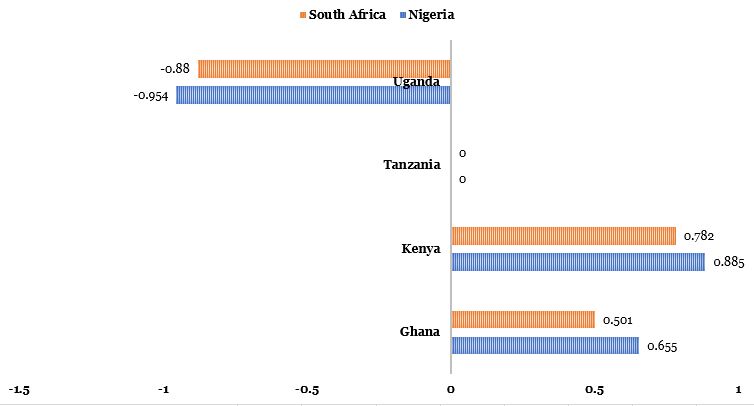

Shielding, Nigeria and South Africa for proper understanding of submitting patent and trademark applications in relation to other countries, analysis shows that the higher Nigeria filed patent, the less other countries did. This is differed from what we found for South Africa [see Exhibit 2]. For the trademark applications, we found mixed results [see Exhibit 3].

Exhibit 1: Link Between Intellectual Property Protection and Innovation Output (2017-2019)

Exhibit 2: Patent Applications

Exhibit 3: Trademark Applications

Strategic Options

Laws. There are initiatives that the continent should tap into like ensuring basic and enabling laws are up to date and in line with global trends.

Policy. Articulating national innovation policy goals and objectives, milestones and a clearly identifiable plan of action which advance effective policy goals by setting up a specific commission or agency charged with the responsibility for addressing challenges in each sector. A good example is the Nigerian Copyright Commission (NCC) which has accomplished several milestones in the Copyright sector.

Empowerment. Empowering agencies with the requisite tools and funding to enable them to achieve their industrialisation, innovation and development aspirations. A need to design a systematic process for teaching, training and supporting our creators and innovators. Part of these initiatives involve the training of law students, lawyers and judges on the fundamentals of IP law and enforcement, and on the drafting of statutes in the IP sector.

Collaboration. The collaboration of the various agencies of government with a bearing on innovation and development is vital in achieving national goals in the long run. Much like the importance of regional is strength and weaknesses of member nations to advance our common economic goals.

It is important that the government take note of the factors hindering the growth and effectiveness of patent and intellectual property as a whole and take active measures to face these factors or challenges for rapid growth.