The #3 rarely makes money in most economies. But economies need them to keep #1 and #2 under checks. Yes, in the global telecommunication industry, you need a fairly strong #3 if you want to keep the price of telecom services to be optimal. In U.S., Verizon and AT&T ruled the domain but the old Sprint and TMobile were there, and can now become a combined stronger #3.

In Nigeria, there are fairly strong three players in MTN, Airtel and Glo. And even the presence of #4’s 9Mobile cannot be discounted. The implication is that price stays fairly optimal.

So, when you have strong two players and your laws are open and free, allowing market forces to run the system (in other words, you cannot rule by fiats and mandates), lack of a strong #3 will hurt.

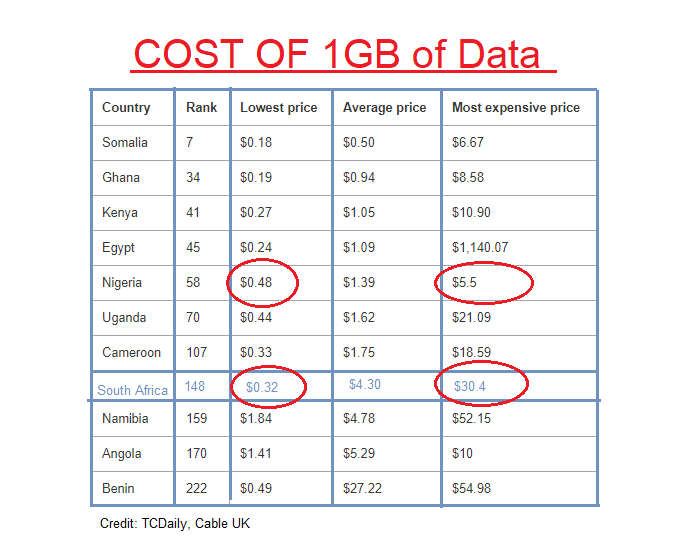

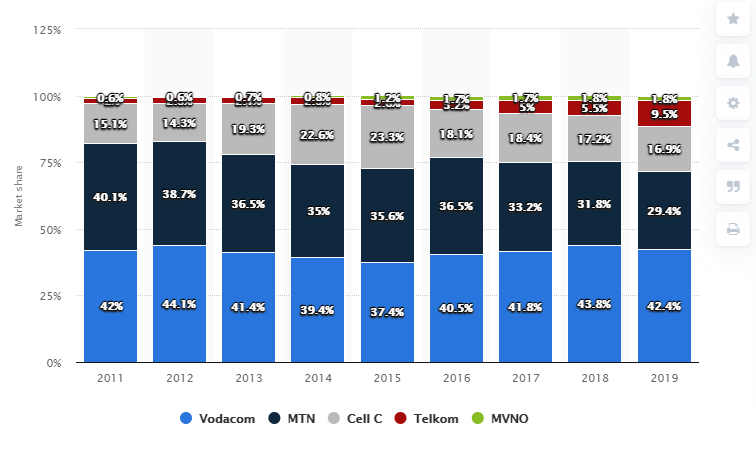

That is what is happening in South Africa where data cost is out of order. Vodacom holds close to 43% of the market. MTN follows at 29% while Cell-C is at 17%. The implication is that Vodacom cares about MTN. See the distribution on click https://www.tekedia.com/cost-of-data-the-irony-in-south-africa/ In Nigeria, MTN has to track Airtel and Glo at the same time as both are largely strong #2 and #3.

Every market needs competition. Yes, it is a big irony that the most developed economy in Africa is the one that seems to have data cost which is out of order.

The Egypt data is not a typo.