Elda Kehinde Samuel is a Resident Policy Fellow at the Nigerian Global Affairs Council (NIGAC). He shares his opinion on how the frictions in the Nigerian education such as its inability to produce employable graduates, infrastructural deficit, funding and incessant industrial conflicts in the sector. Here are his thoughts….

An Economics Undergraduate studying in a University in New York pays about between 4.8 – 6.5 Million Naira when converted to our Local Currency per annum as School Fees. In a private University in Nigeria, an Economics Undergraduate pays between 800k – 1 Million Naira as School Fees per annum. Bring that down to an Undergraduate in a Federal University who pays an average of 30k per annum as School Fees as a returning Undergraduate. If you attend a State University, you might probably pay between 70 – 100k per annum as school fees. Now, looking at the difference, can we see why Nigerian Universities can never ever compete with their counterparts across the globe or even in Africa?

To make matters worse, ASUU has taken on an Industrial Action (Since March 2020) with no end in sight, our Undergraduates in Nigeria have effectively spent one full year at home doing and achieving nothing – even with the forced lockdown of our Universities, Nigeria was and has never been equipped to deliver learning to our undergraduate community using virtual tools or platforms. What’s the way forward for Nigeria? The Federal Government needs to divert from our Tertiary Educational System and set up a quasi Public/Private Partnership System where it owns a 30% Stake in our Universities then OPEN up the Industry for Private Sector Players to establish private Universities through the length and breadth of this Nation.

I believe that our Universities should charge a minimum of 1 Million Naira per annum, Government 30% ownership stake should strictly focus on providing for Research and Innovation through an Innovation Fund managed by an Independent Board. The Federal Government of Nigeria through the Central Bank of Nigeria will then set-up a single-digit interest percentage Education Fund that enables prospective Undergraduates to access Student Loans whilst studying – part of the package these school fees covers is a brand new laptop, smartphone, and unlimited access to Internet whilst on campus. Students will also be given accommodation with two students per room and this room comes furnished with mattresses, microwave, and small fridge. The School Fees also comes with daily nutritious feeding (Breakfast, Lunch, and Dinner) – Enabling these basics will reduce the incidence of student-led prostitution or cheating, I didn’t say stop but reduce drastically as everyone will be able to focus primarily on why they were admitted in the first place.

Members of ASUU

The loan package should also provide for a minimum monthly allowance for those whose parents can’t afford it – these monies will go a long in ensuring that Nigerians can have a stable academic life, yes, it is a loan, they pay back upon graduation and the single-digit interest rate will begin to count immediately they graduate, they also get to enjoy a 3 years moratorium before they begin to pay back the loan (this is to ensure that those without a job immediately can afford to stabilize whilst the moratorium also covers folks who want to further their education with a Masters or Ph.D., they can do so immediately and still access further student loans.

An average of 1.9 Million Students wrote the University Entrance Exam in 2019, less than 650,000 earned admission not because the other failed but because the system can only take such numbers in – imagine, if our Universities are quasi-privatized and quasi-owned by the private and public sector, it means an average state can have up to 10 Universities or more dependent on the attraction put in place by the State Government.

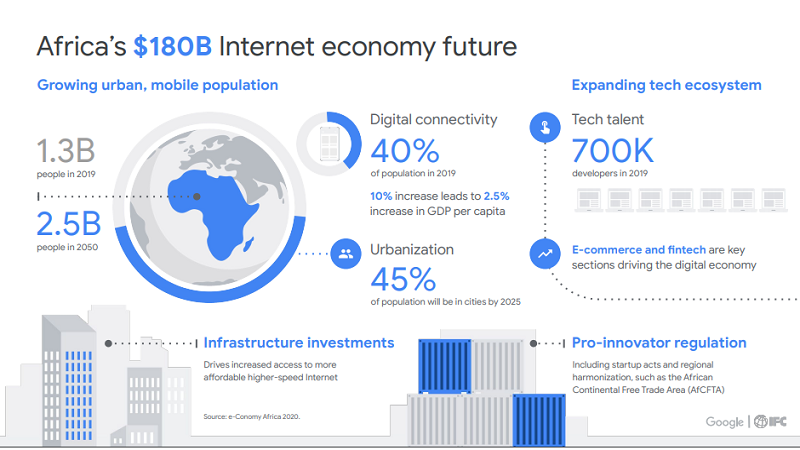

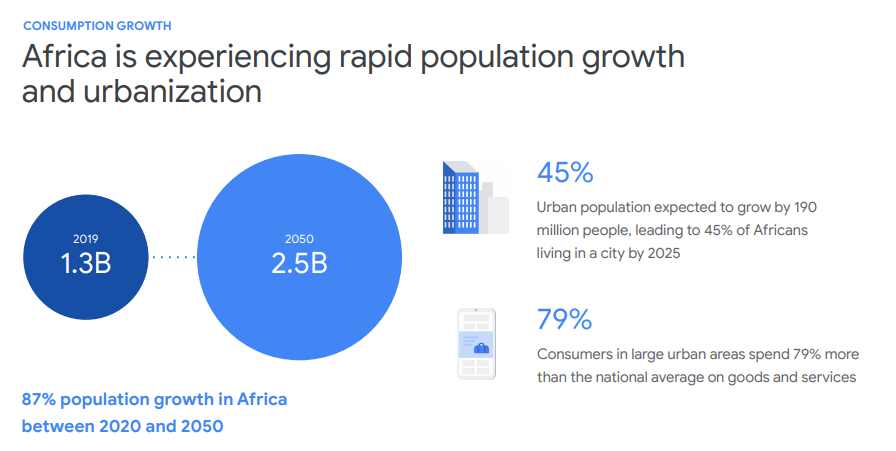

Let’s talk about the economic advantage of running a quasi-system of Ownership. At a minimum of 1 million Naira as school fees, our Universities will become centers of innovation as they have the funds to go through the entire life-cycle needed for Innovation to strive (Research, Build (Develop), Prototype, Test, Pilot, and Scale)- imagine the ideas and solutions our Undergraduates will churn out because the system has the tools and wherewithal to support their innovations. Companies both nationally and globally will begin to pay more attention.

Our Academics will better compensated as Professors and Senior Academics can negotiate their terms of service based on their perceived VALUE, they can also shift their services to other tertiary institutions, the system can also allow for an Academic with years of built-up expertise to teach in a maximum of 3 schools thereby earning extra income for years of experience, number of innovation and likely patents attached to their names.

We will never ever see an Industrial Action again although the system will encourage Unionism and active engagement in an organized format with the stakeholders so that issues are resolved quickly and efficiently.

Imagine the number of vendors that would be engaged and the number of folks they will employ (Cleaners, Gardeners, Security, Caterers, Electricians, Plumbers, Mechanics etc) – all these folks will be guaranteed a job and money gets to flow in the economy because people are engaged and paid regularly.

Even our undergraduates will begin to think from an entrepreneurial point of view because the system has been tweaked in that regards – we can not continue to operate an educational system that is taking the nation backward moreover freeing up billions of Naira on salaries and operational cost will enable our Federal Government concentrate on funding Innovation through its Independent Fund Board.

The Federal Government needs to also think of the benefits by way of tax that this model will bring to its purse – we are also convinced that a University system tweaked to work as a Private Entity will create jobs and opportunities for our teeming graduates but more importantly, it will create Innovators cum Entrepreneurs who also create jobs and employ people.

Whilst the very thought of a student loan might seem scary, the truth is that our tertiary educational system is at a precipice at the moment and we have to advocate for deep-rooted reforms that starts with our Federal Government divesting in a major way from the running of our University Education.

Along the line of these thoughts, our Federal Government can begin to sell and convert of its Polytechnics and Colleges of Education to these private entities, anyone seeking for specialized education as a Teacher or Technical Person can easily assess the newly set-up education and technical centres across our quasi-owned private-public universities – the current model of polytechnic and college of education system we have has outlived its purpose and they are no longer centres of excellence.Lastly, let’s imagine the impact having almost 20 private/public Universities in Lagos with an average of 30,000 students will have on the economy of that town or local government – the economic benefit will be massive and lifelong.

Our Private Universities and the standards they have set should be an eye-opener that this can work – it will impact on the quality of graduates Nigeria churns out. Will our Government ever summon the political will to make this happen?

Like this:

Like Loading...