This may be the only strategic plan and investment your business needs in order to stay afloat, and become profitable or cash flow positive in the year 2021.

It has become very obvious that the Covid-19 Pandemic had challenged and changed your business. It has made you sit up and become very strategic in the future planning of your business.

It has made you think in this line. How can my business be profitable post Covid-19, after staying at home for months?

Well, we discussed a lot on the importance of innovation in making a business profitable, because it helps to change the basis of competition.

We also talked about effective marketing, because it actually builds brand awareness and leads to sales.

But here is how things have been changed by the pandemic: innovation and marketing involves huge investment in order to implement their strategies in your business.

The reality is that you must find a way to survive and stay afloat in business in a cost effective way, while making profit in Post covid-19.

The best strategy to deploy is value creation, cost reduction or cost minimization strategy through AI and IoT technologies.

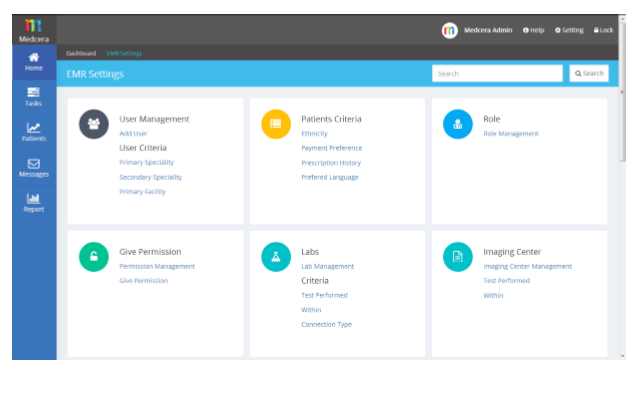

This is the mission of Eonsfleet. To make businesses profitable, efficient and stay afloat by providing them the technologies that will help them to reduce waste, cut unnecessary cost, become efficient, optimize decisions among others.

Eonsfleet is a managed service designed to allow distributors of bulk lubes and fluids, propane gas, and other liquids to remotely monitor tank fill levels (in moving trucks, depots, fuel stations, etc.), optimize distribution and ascertain compliance to desired destinations. Purpose-built to improve inventory management.

To extend its services beyond the fuel supply chain market, Eonsfleet offers IoT applications around the fleet, fuel and energy remote monitoring solutions which include the remote monitoring for diesel generator, fuel and grid for facility managers.

The Eonsfleet IoT Platform, a proven, highly scalable, customizable IoT Platform, powers Fleet Management Software, Smart metering solutions, E-logistics, Warehousing and Supply Chain Control Tower Software. (SaaS).

It brings a gamut of powerful capabilities in energy management, remote asset management, environment monitoring, location tracking, alerting, intelligent dashboards, reporting and analytics.

How Eonsfleet Value Propositions Will Solve Problems Associated With Business Equipment and Properties Management.

Here are the real and measurable values that Eonsfleet solutions will have on your business operations, as it relates to asset, fuel, and equipment management.

With our specialized solutions and products, such as Fleet Management Software, E-logistics software, Supply chain Control tower, Fuel Tanker Content Monitoring, Diesel Generator Monitoring Solution and Fuel Station Manager (Forecourt), the central goal is to use data to achieve efficiency for your business.

You will be able to cut waste and have real time information on your fleets, your diesel generators and other logistics through the data that will be provided by these technologies.

We helped you to remove all the guesswork that is associated with your decision making process, by providing you real time data.

A great example is the fleet monitoring solution, we provide you with your diesel level, the quantity of fuel filled, how many litres are available etc. This can be monitored from anywhere, at anytime.

This makes your decision making to be supported by data. The same is applicable to your fleet or logistics operations.

When there is a protection of your fleets and your drivers are law compliant, it impacts the business performance. With the fleet monitoring solution, we ensure we have data to monitor the behavior of your drivers and other important data about your fleet.

This helps to ensure compliance and security of both the vehicles and drivers.

We help to optimize your operation by using the data available from your fleet monitoring software to make strategic planning on what business decisions to make that will impact your bottom-line.

The overall impact of this solution is profitability which is caused by the realization of efficiency, and optimization of your business operations.

At the end, you will invest less and derive massive values while reducing cost of operation strategically. This is what we want to help your business to achieve in post covid-19.

Businesses Are Already Making Strategic Deals and Partnership with Eonsfleet.

Some businesses with strategic foresight, who know the quantitative impacts of our solution to businesses in Africa are already deploying the solutions.

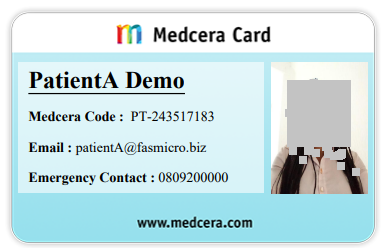

Moove Africa is a car rental service provider that provides customers cars to use on Uber, on a weekly basis.

This company has sealed a deal with Eonsfleet to provide a fleet monitoring solution that will ensure that the company has data to monitor the activities of its vehicle, in real time, and at all times.

This will help them to achieve many benefits such as, real time visibility of asset’s condition, set asset maintenance module, set some vital restrictions to ensure proper and standard asset usage and lot more!

Eonsfleet is here to serve.

Like this:

Like Loading...