Union Bank of Nigeria, one of the country’s oldest financial institutions, has officially completed its merger with Titan Trust Bank Limited, following final approval from the Central Bank of Nigeria (CBN).

The milestone, announced on Thursday, signals not just the end of a transaction that began with a Share Sale Agreement in 2021 but also the beginning of a new era for Nigeria’s banking industry.

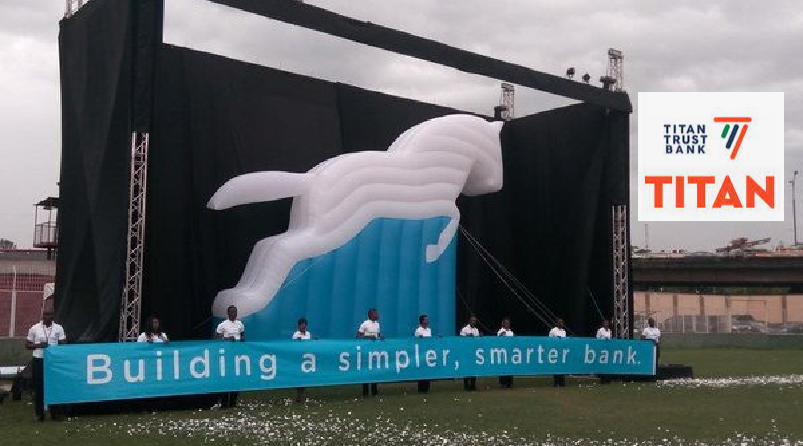

According to Mrs. Olufunmilola Aluko, Union Bank’s Head of Brand and Marketing, the merger consolidates Titan Trust’s agility and innovative strength with Union Bank’s 108-year legacy of stability and trust. Under the arrangement, Union Bank fully absorbs Titan Trust’s operations and assets, with the Union Bank brand continuing as the sole identity. Titan Trust Bank ceases to exist as a separate entity.

With an expanded footprint that now includes more than 293 service centers and 937 ATMs across Nigeria, as well as strengthened digital platforms, the combined bank is positioning itself to deliver greater value across retail, SME, and corporate markets.

Union Bank’s Managing Director and Chief Executive Officer, Mrs. Yetunde Oni, described the transaction as “a pivotal moment in our 108-year journey, and a launchpad for delivering greater value to our customers. By blending stability with innovation, we are better positioned to meet the evolving needs of Nigerians and to be their most trusted financial partner.”

Echoing this, the Chairman of the Board of Directors, Mr. Bayo Adeleke, framed the consolidation as “a new era of growth, collaboration, and shared prosperity. By bringing together the strengths of both institutions, we are committed to creating lasting value for our customers, shareholders, and communities while advancing Nigeria’s financial inclusion agenda.”

The bank emphasized that customers will not experience disruptions, assuring that account details remain unchanged and services will continue seamlessly. An accelerated focus on enhanced digital solutions is also underway, reflecting the wider shift in Nigeria’s banking landscape toward technology-driven service delivery.

A Backstory of Transformation in Nigeria’s Banking Sector

The Union Bank–Titan Trust merger is part of a broader restructuring trend that has shaped Nigeria’s financial industry for decades. Union Bank itself has undergone waves of transformation. Founded in 1917 as Colonial Bank, it became Barclays Bank of Nigeria in the 1920s before assuming its present name in 1979, following indigenization. For much of the 20th century, Union Bank was regarded as one of Nigeria’s “big four” banks, symbolizing stability and reach.

However, in the wake of Nigeria’s banking consolidation under the Central Bank’s reforms in the mid-2000s and rising competition from newer, tech-savvy institutions, Union Bank began to lose ground. By 2012, a recapitalization plan saw a consortium of investors led by African Capital Alliance inject funds to rescue the bank. Since then, Union Bank has fought to reposition itself in a highly competitive market dominated by GTBank, Zenith Bank, Access Bank, and others.

The entry of Titan Trust Bank in 2019—one of the youngest commercial banks in Nigeria—marked a new disruption. Despite its short history, Titan Trust quickly became a challenger, leveraging innovation, speed, and strategic capital backing to make inroads where older banks were struggling.

In December 2021, Titan Trust Bank signed a Share Sale and Purchase Agreement (SPA) with Union Global Partners Limited, Atlas Mara Limited, Standard Chartered Bank, and other core shareholders, who collectively held 93.41 percent of Union Bank’s issued share capital. The agreement paved the way for TTB to acquire 89.39 percent of Union Bank’s shares in the first tranche, with subsequent regulatory clearances confirming its majority ownership.

Its 2021 acquisition of a majority stake in Union Bank was widely seen as a bold statement of intent, signaling how younger, well-capitalized players could reshape the industry.

Implications of the Consolidation

Analysts note that the merger underscores a global trend in banking where older, legacy institutions consolidate with newer, more agile entrants to remain relevant in a fast-changing environment. For Union Bank, absorbing Titan Trust’s operational model and digital culture could accelerate its push into tech-driven banking solutions, a necessity given Nigeria’s booming fintech ecosystem and the growing demand for mobile-first services.

As the dust settles, the completion of this merger may well determine whether Union Bank can regain its stature as a leading force in Nigerian banking—this time not just by heritage but by innovation and resilience in an increasingly digital age.

Like this:

Like Loading...