Facebook’s CEO Mark Zuckerberg has been vocally registering his dissatisfaction over the newly introduced changes Apple plans for its iOS 14 mobile operating system. The iOS 14 will prevent apps from tracking users using their unique device identifier without their explicit permission.

The advertising industry assigns a unique code to each device called Identification for Advertisers (IDFA). Advertisers use IDFAs to determine if their ads are effective, especially when the ad has been served in multiple places.

Facebook has been using IDFA to personalize ads in third-party apps, and Zuckerberg said the change in iOS 14 will halve his social media platform’s earnings.

“We expect these changes will disproportionately affect Audience Network given its heavy dependence on app advertising. Like all ad network on iOS 14, advertiser ability to accurately target and measure their campaigns on Audience Network will be impacted, and as a result publishers should expect their ability to effectively monetize on Audience Network to decrease,” Facebook said in a post on Wednesday.

“While it’s difficult to quantify the impact to publishers and developers at this point with so many unknowns, in testing we’ve seen more than a 50% drop in Audience Network publisher revenue when personalization was removed from mobile app ad install campaigns.”

Facebook said the change may even cause more revenue loss than it is anticipating and worry that the change will have crippling effects on small businesses.

“We understand that iOS 14 will hurt many of our developers and publishers at an already difficult time for businesses. We work with more than 19,000 developers and publishers from around the globe and in 2019 we paid out billions of dollars. Many of these are small businesses that depend on ads to support their livelihood,” Facebook said.

At the launch of iOS 14 next month, Facebook will be required to ask for users’ permission before it could be allowed to harvest personal data for targeted ads. Alternative to this procedure will require setting up a completely new advertising account to run campaigns for iOS users.

This development has limited Facebook’s ability to collect users’ data on Apple smartphones, and will have a serious impact on its campaigns. Though it can cope as the change does stop the collection of data from millions on its platform, ad-buying small businesses depending on the IDFA wouldn’t.

Over the last few weeks, Facebook has been in squabbles with Apple on two other issues. Adding this to them, the two tech giants appear to be out for a full blown discord.

Apple has had a gaming app (Instant Games) Facebook launched earlier in August blocked because the game app was offering alternative stores with content that it cannot vet. Facebook launched the app without gameplay functionality, and it can be used to watch streams of other people playing games.

Facebook had teamed up with Microsoft to criticize Apple’s game policies, as it has affected many other game apps launched on the Apple store. Apple kicked video game Fortnite out of its store, when Epic Games, the game’s creator, added a feature that allows players to buy virtual currency using their own credit cards, which denies Apple the opportunity to take its 30% cut.

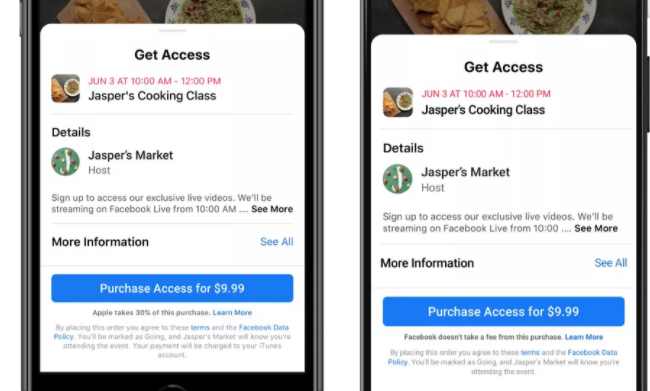

In another case, Apple refused to waive fees for Facebook on its paid Online Events feature. The Online Event feature is designed to allow small businesses and individuals to organize paid digital events that Facebook users can sign up for and sell tickets.

Mac rumors reported that Facebook had asked Apple to waive the 30 percent fee it charges from the in-app purchases for Online Events or allow Facebook process events payments using Facebook Pay. Apple turned the request down saying that it goes against its policy and App Store guidelines.

Nevertheless, the disagreement escalated when Facebook decided to add a note in the Online Events feature to notify users that “Apple takes 30% of this purchase.” Apple got infuriated and removed the note, saying it violated Apps Store policy that forbids apps from showing irrelevant information.

Following these incidents, Zuckerberg said Apple is becoming monopolistic and anti-competitive, and its practices are becoming harmful to customers.

“Apple has this unique stranglehold as a gatekeeper on what gets on phones. Zuckerberg told more than its 50,000 employees during a Q&A session. He added that California-based company’s app store “Cupertino blocks innovation, blocks competition and allows Apple to charge monopoly rents.”

Earlier in the month, Apple became the most valuable company in the world with a $2 trillion valuation. Interestingly, Apple and Facebook are among the companies indicted in antitrust investigations of US regulators. Their current disagreements and accusations may well help the investigators.