Whether on physical or online sphere, Nigerians are one of the people in the world who usually express their feelings on issues and needs of national importance. Since the country returned to democratic system of governance in 1999, social and public analysts, including politicians have continued to discuss varied socioeconomic needs and challenges.

Topics of the Discourse

For some days now, the Nigerian society has been discussing the possible exit of Shoprite on different platforms. Our check reveals that the discussion remains intense on Twitter than Facebook. According to many sources, Twitter is a social networking community that enables people and organisations to interact, reflecting a diverse and rapidly growing global social networking community.

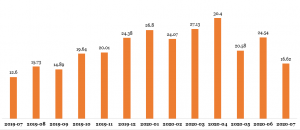

In his description of the Nigerian Twitter community, Jack Dorsey, co-founder and Chief Executive Officer, says “in recent years, there has been barely any social media platform contesting with Twitter in hosting Nigerian conversations — whether protests, rants or energising social movements.” Looking at the yearly percent increase in the number of Twitter users, our analyst believes that the Twitter CEO is right. From 12.6% in the use of the social networking site in July, 2019 to July, 2020, the Nigerian community is indeed growing.

Exhibit 1: Monthly Percent Increase/Decrease in Twitter Users

Explicating the Discourse

Adding to the discourse through article publications on Tekedia, Professor Ndubuisi Ekekwe has made us understand why the company is leaving Nigeria. For instance, he credited the possible exit to the country’s currency weakness in the global economy not to the physical or online competitors but open markets. These factors are not quite different from what Nigerians in the Twitter community discussed between August 4, 2020 and August 5, 2020 (Time: 9:03am on August 4, 2020 to 9:49am on August 5, 2020).

From a total of 1,163 tweets mined and analysed by our analyst, it emerged that within the market factor, Nigerians [including businesses] believed that the company’s failure to understand the Nigerian market dynamics adequately before entering is the main reason for the exit. Tthey also pointed out the fact that most Nigerians, especially those at the bottom of the pyramid prefer buying goods at the open markets to going varied outlets of the company.

In their conversation, they did not spare the effects of high prices, currency devaluation and corruption. According to them, Shoprite’s price tag on majority of goods is outrageous considering what is obtainable in the open markets. For example, one of the members of the community hinted that it is out of the Nigerian context to set a price of N500 or N1000 for two or three corns that can be bought from the open markets at N100 or less than N200.

In our engagement with the Tweets, our analyst also found that the discussion was also on the dwindling place of the country’s currency in the global market and many years of corruption in public and private life that make some people at the upper-class income category having access to money freely. The accessibility, according to the people in the community, largely helped Shoprite in its early days in Nigeria.

Once again, the conversation on the exit afforded the studied 1,163 users opportunity of discussing leadership issues using different perspectives. Some of them believed that the leadership style and capability of President Muhammadu Buhari should be questioned while some were of the view that President Buhari’s stance on fighting against corruption could be attributed to the reduction in patronage and revenue of Shoprite across its outlets. According to our data, we found occurrence of discussion on open markets, Naira devaluation, competition, corruption, price and Buhari [linking to good and bad leadership] 376 times during the two days.

Exhibit 2: Topics of the Discourse

The Extracts

Price: @cchukudebelu Why shop in ShopRite when u can shop rightly at Igbudu market at reduced price

RT@LadiSpeaks: Local supermarkets Local supermarkets How many Nigerians can buy Shoprite? How many Nigerians are willing to take the risk? Maybe only 10 and all of them are in the APC so… Nobody cares

Naira Devaluation: RT @kinmoju: @OkporEmeka with the devaluation of the naira, imported items from SA which ShopRite sells will be too expensive compared with local alternatives thereby impacting their sales figures economy it bites seriously

Corruption: RT @oloye__: Everyone that goes to ShopRite is corrupt and benefited from the 16 years of corruption under PDP. Go to the kiosk on your street. We must kill corruption before it kills our indigenous businesses.

Market: RT @AyoBankole: Again, I have always said most investors overestimate the Nigerian market. Even most analysis on Shoprite exit are emphasizing on Nigeria being the most populous African country. We often forget that over 70% of us live in poverty. And only Lagos holds a real economic promise.

Buhari: RT @keljykz2: Nigeria has been destroyed by this man…Muhammadu ‘destroyer’ Buhari. Same as in 1986…Shoprite is leaving. Air peace is firing pilots and insecurity is at its peak. Keep hailing Mr. Destroyer in chief. Fabrizio/ Willian/ bbnaijalockdown/ the nun/ Martinez/ MUFC https://t.co/6iUxZxWbMb

RT @fattylincorn01: Even those thieves that went on a looting spree @Shoprite_NG are now blaming @MBuhari for @Shoprite_NG woes. SMH

Clustering, Networking and Interaction

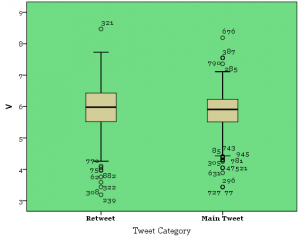

Beyond the topics of the discourse, our analyst explored classification and the kinds of network relationship and interaction that existed during the two days. From the analysis, we discovered that 696 citizens were in Cluster A [the cluster that vehemently pursued the topics in their conversation with others]. In the Cluster B [the less active group in terms of discussing the topics] had 467 citizens.

In our analysis, we discovered that people who fell to the Cluster A (Main Tweets) had influence over those who fell to Cluster B (Retweets) [see Exhibit 4]. In Cluster A, a citizen with the National Identity Number 676 had superior ability of interacting with others within the Cluster. Further analysis indicates this citizen retweeted @ekomiamiblog’s tweet, which says “ShopRite Denies Leaving Nigeria https://t.co/RG46QIhEAh Willian#bbnaijalockdown2020 Buhari Spar.

Exhibit 3: Dominant Words in the Community

Exhibit 4: Citizens’ Categorisation in the Context of Ability to Interact

Exhibit 5: Distance among the Users based on Ability to Interact