Softbank experiences another bad timing as Germany’s Wirecard crashes. Wireacrd had attracted a $1 billion investment from SoftBank in April 2019 to finance Wirecard’s expansion into Asian markets. Today, Wirecard, after revelation that the $2.1 billion the company had reported on its balance sheet did not exist, has dropped to less than $2 billion in valuation from the high of $27 billion. This is another poor run for Japan’s Softbank. Maybe it is time for Softbank to try a mega investment in Africa. We could make it whole.

In a deepening fintech industry scandal, the former Wirecard CEO was arrested Tuesday on charges of inflating the company’s balance sheet, said German prosecutors. The payments firm, which saw boss Markus Braun step down last week, has been unable to locate $2.1 billion in cash that was missing from its balance sheet — which the company said Monday probably doesn’t exist. Wirecard has withdrawn its most recent financial results and is now weighing “a full scale restructuring” to survive, Bloomberg reports.

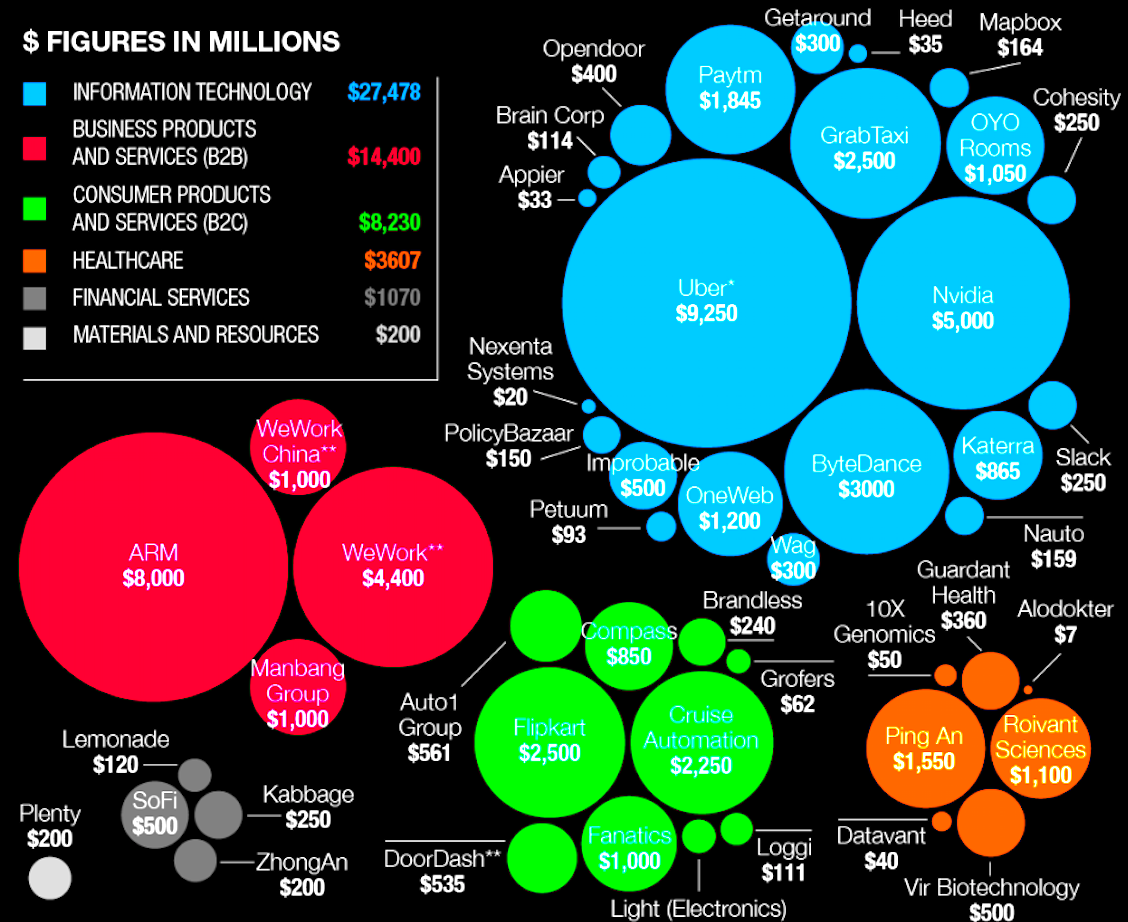

To show how bad things are in Softbank, the company is cutting “15 per cent of jobs at the investment arm which manages its $100 billion Vision Fund, following a series of misplaced bets which damaged its overall value. The Vision Fund, which is responsible for taking major stakes on behalf of Softbank in tech startups such Wework and Uber, has a global staff of approximately 500 people”. This Vision Fund certainly has bad luck with the Wirecard scandal developing. Yet, it is important to note that the company has some wins; companies like Nvidia and Ping An are good bets.