Cardano (ADA) continues to trade within a narrow range as market participants assess whether recent network activity can translate into sustained price momentum. Despite periods of whale accumulation and rising active addresses, ADA remains constrained below key resistance levels, with price hovering near the $0.39–$0.42 zone.

Meanwhile, Zero Knowledge Proof (ZKP) is drawing attention for structural reasons. Instead of competing on throughput metrics or short-term narratives, ZKP is being evaluated based on the design of its built-in marketplace.

This marketplace introduces a new revenue model focused on privacy-first data and computation services. This contrast is shaping how participants define the best crypto to buy now in 2026.

Cardano’s On-Chain Activity and Market Position

Cardano’s on-chain metrics present a mixed picture. Network usage remains relatively strong, with active addresses reaching around 2.5 million and daily transaction volumes approaching $10 billion during peak periods. Whale wallets have also accumulated roughly 100 million ADA in recent weeks, suggesting some degree of long-term positioning.

However, these positive signals are offset by structural constraints:

- ADA price remains below major resistance near $0.43–$0.47.

- Short-term holder activity has surged, indicating potential supply pressure.

- Total value locked (TVL) has declined compared to 2025 highs.

- Fee generation and capital efficiency remain limited.

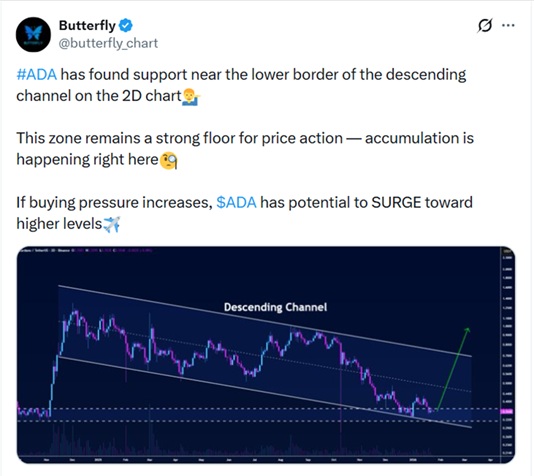

From a market structure perspective, Cardano appears to be in a compression phase. Price behaviour reflects cautious positioning rather than directional conviction.

Unpacking Cardano’s Competitive Landscape

Cardano’s long-term differentiation lies in its research-driven development model and formal verification approach. Technologies such as Hydra and the upcoming Ouroboros Leios upgrade aim to significantly improve scalability and transaction throughput. The Midnight sidechain, focused on privacy and zero-knowledge systems, has also expanded Cardano’s technical footprint.

Cardano’s slower development cadence, while improving system reliability, has limited its ability to capture market share in fast-moving application sectors. In practical terms, without stronger capital inflows and application-layer growth, price behaviour is likely to remain range-bound.

What Is Zero Knowledge Proof (ZKP)?

ZKP functions as a blockchain framework for trustless system coordination, where network behaviour is governed by cryptographic proofs rather than intermediaries. Instead of focusing on transaction throughput, ZKP is built to support environments where correctness, privacy, and execution integrity are the core primitives.

ZKP’s Built-In Marketplace: A New Revenue Stream for Holders?

One of ZKP’s most distinctive features is its built-in marketplace, which enables participants to exchange data, computation, and verification services within a privacy-preserving environment.

Unlike traditional token models that rely primarily on transaction fees or speculative demand, ZKP’s marketplace introduces a functional revenue layer. Participants can earn value by contributing computational resources, datasets, or verification services, all enforced through zero-knowledge cryptography.

The marketplace enables:

- Data providers to monetise datasets without disclosing raw information.

- Developers to access verified computation services.

- Enterprises to outsource privacy-sensitive workloads.

- Network participants earn from the real system utility.

Instead of transferring data directly, the marketplace operates through cryptographic proofs, where only results are shared while ownership and privacy remain intact.

How the Marketplace Drives Demand and Utility

ZKP’s marketplace model creates a direct link between network usage and economic value. As more participants rely on the system for data processing and verification, demand for marketplace services increases, driving activity at the infrastructure level.

This has several implications for token utility:

- Demand is tied to real service consumption, not speculation.

- Token usage reflects participation in computation markets.

- Revenue scales with network adoption.

- Value capture aligns with system utility.

This positions ZKP as a platform where token demand emerges from functional workflows.

The Bottom Line

Cardano’s current market structure reflects cautious positioning under macro pressure, with strong network usage but limited capital efficiency and price momentum. While its technical roadmap remains ambitious, near-term valuation continues to be shaped more by external conditions than by internal ecosystem growth.

In contrast, Zero Knowledge Proof (ZKP) reflects a different signal. Through its built-in marketplace, ZKP introduces a utility-driven economic model where demand is generated by real data and computation services.

As investors search for the best crypto to buy now, platforms that align token value with functional revenue and privacy-first infrastructure are increasingly shaping how long-term crypto relevance is defined.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Auction: http://buy.zkp.com/

Telegram: https://t.me/ZKPofficial

FAQs

- Why is Cardano’s price still range-bound?

Because capital inflows remain limited, and market positioning is cautious.

- What is ZKP’s built-in marketplace?

A privacy-first platform for exchanging data and computation services.

- How does the marketplace benefit token holders?

By linking token demand to real network usage and service consumption.