BNB is once again capturing market attention as one of the most structurally strong large-cap tokens heading into the next crypto cycle. With deep liquidity, a massive global user base, and the expanding utility of the BNB Chain ecosystem, analysts increasingly believe BNB has a clear and achievable path toward the $1,400 region. Its long-term fundamentals, token burns, and exchange-driven demand provide a consistent base of support that many other altcoins cannot match.

Yet even with this compelling setup, analysts across multiple research desks agree that Ozak AI—a fast-rising AI-native token—offers far more explosive ROI potential. With early-stage affordability, real-time AI functionality, and accelerating presale demand, Ozak AI is emerging as one of the strongest high-growth contenders for 2025 and 2026.

BNB Shows Strong Structure as Demand Rebuilds

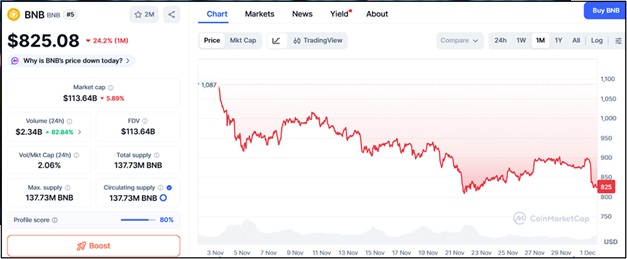

BNB, trading near $825, continues to maintain a healthy technical structure supported by strong accumulation zones at $802, $771, and $743, where long-term holders have repeatedly stepped in during corrections. These areas act as strong floors for BNB, reinforcing its reliability even during market volatility.

To trigger a broader upward expansion, BNB must break through resistance at $854, $892, and $930, each level representing a historically important point where momentum-driven rallies often begin. With stronger exchange activity, growing adoption across the BNB Chain ecosystem, and consistent burn mechanisms reducing supply, analysts project a long-term trajectory that could push BNB toward $1,400 in the upcoming cycle. However, as a large-cap asset, its ability to deliver extremely high multipliers is naturally limited.

Ozak AI Offers a Far Steeper ROI Curve Than Large-Cap Assets

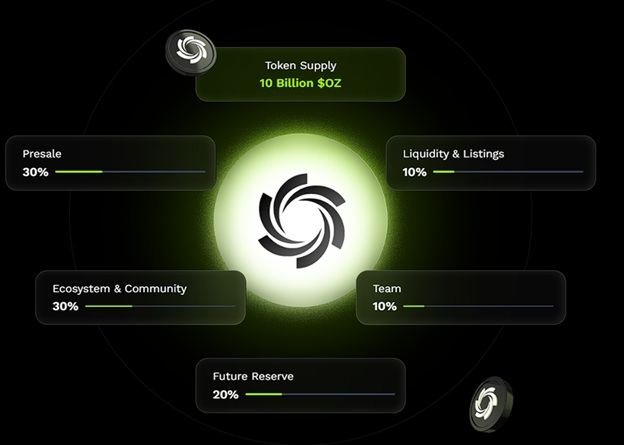

While BNB’s growth outlook remains strong, Ozak AI (OZ) presents a vastly different opportunity—one centered on early-stage pricing and deep AI-native utility. Ozak AI is not simply a token; it is a high-performance intelligence layer that integrates real-time market prediction, cross-chain data processing, and automated decision-making into Web3 systems.

Its millisecond-speed AI prediction engines can analyze live market behaviors across multiple chains simultaneously, while its partnership with HIVE enables lightning-fast 30 ms trading signals used to identify actionable trends instantly. From traders to developers, the use cases for Ozak AI’s technology extend far beyond speculation, making it a functional tool in the world of automated crypto intelligence.

The ecosystem goes further with SINT-powered autonomous AI agents capable of interpreting voice commands, running automated trading strategies, analyzing on-chain data, and executing workflows across decentralized applications. This places Ozak AI squarely at the intersection of two of the fastest-growing global sectors: artificial intelligence and blockchain automation.

Because Ozak AI is still in the OZ presale phase, its multiplier potential is significantly higher than that of mature large caps like BNB.

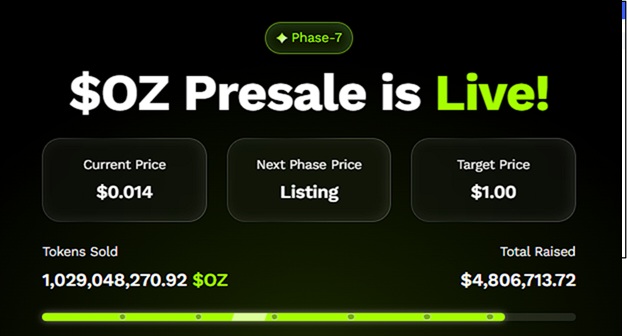

Presale Acceleration Strengthens Ozak AI’s 100x Outlook

The strongest indicator of Ozak AI’s explosive potential is its rapidly growing presale performance. With over $4.8 million raised and more than 1 million tokens sold, the project’s early momentum mirrors the beginnings of past cycle giants that later delivered massive 50x–100x returns.

Investors are increasingly prioritizing AI-powered cryptocurrencies due to the rising demand for real-time automation and intelligence. Ozak AI’s early stage, combined with its high-utility infrastructure, positions it as one of the most promising new entries in the AI-crypto sector—and one of the few with genuine technological depth.

BNB Could Hit $1,400, but Ozak AI Holds the Real 100x Potential

BNB’s path toward $1,400 looks clearer than ever, backed by strong tokenomics, global adoption, and a supportive ecosystem. It remains one of the most stable and reliable large-cap assets for the upcoming market cycle.

But Ozak AI offers something far more powerful—a combination of early-stage affordability, deep AI-native functionality, and fast-growing presale momentum that analysts say could generate 50x–100x returns if adoption continues at its current pace. While BNB may deliver strong growth, Ozak AI stands out as the project with the steepest trajectory, making it the most compelling high-ROI opportunity heading into 2025 and 2026.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a generation platform that specializes in predictive AI and superior information analytics for financial markets. Through machine learning algorithms and decentralized network technology, Ozak AI permits real-time, correct, and actionable insights to assist crypto enthusiasts and businesses in making the proper decision.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi