One of the most “elitist” technical jobs in America is mixed signal integrated circuit design. Why? There are just a handful of universities which are in the MOSIS program, funded by DARPA, the US military funding organization, which makes it possible for students to design chips and get them fabricated. If your university in not in the MOSIS program, that is it. And if you are in, you will have access to the most important CAD tool in the world: Cadence. Upon Cadence is the chips of nations designed.

When you finish the schematic design, you do the layout and then generate the files which are then sent to the foundry for manufacturing. (I explained the steps here . ) Trump understands that before the factories receive the files in Taiwan or anywhere, America’s Cadence has done the design job. One European company, ASML, makes the most important equipment (primarily in lithography) used in the manufacturing, and over time, the US does influence where ASML ships its products.

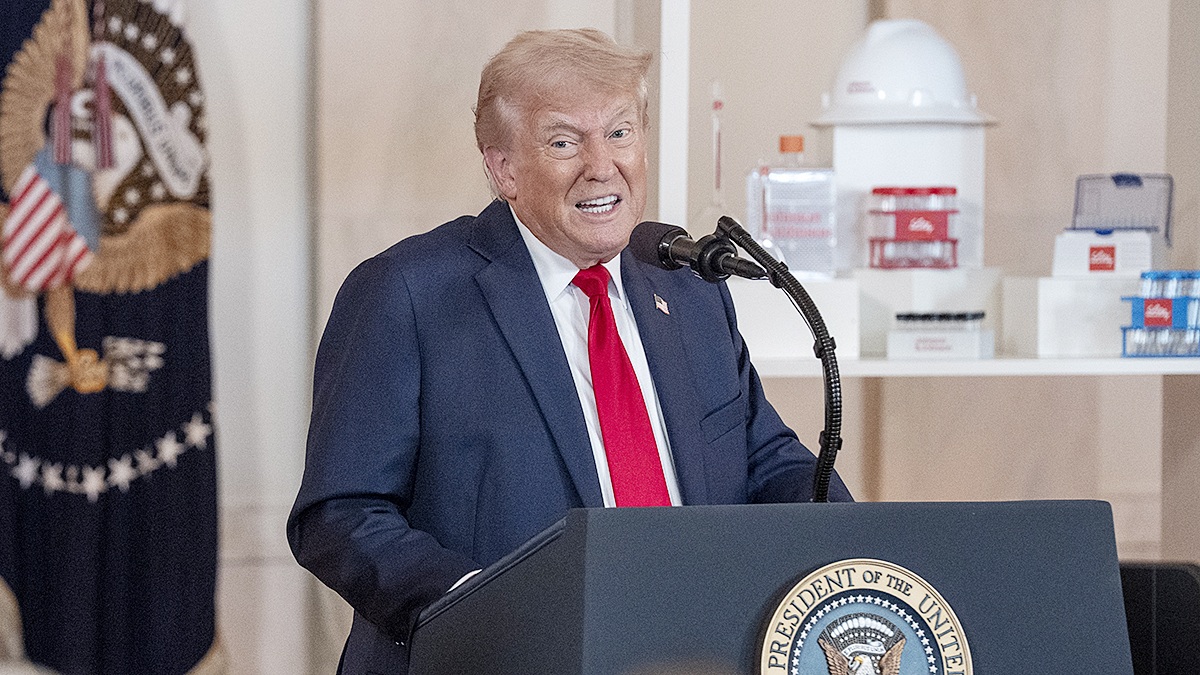

Looking at everything, the news that the US does not want South Korea’s Samsung to run chip manufacturing in China with US equipment is another way of saying Samsung get out of China chip manufacturing: “President Donald Trump’s administration has escalated its technology confrontation with China by revoking authorizations that allowed South Korean chip giants Samsung Electronics and SK Hynix to use American semiconductor equipment in their Chinese plants.”

But Samsung has an option – come to Abia State and build your plants! No restrictions because Nigeria is a friend of Trump’s America!

Comment on Feed

FB: Emeka… thanks for bringing my attention to this post.

Prof, this is a brilliant breakdown. You’re absolutely right that mixed-signal IC design is one of the most “gatekept” technical careers because of how access to tools, foundries, and training is controlled.

The MOSIS program, Cadence, and DARPA’s early investments created a pipeline where only a handful of universities (and their students) could get hands-on exposure. That exclusivity translates into both scarcity of talent and high strategic importance.

On the geopolitical side, it’s fascinating how design and manufacturing dependencies are structured. Cadence and Synopsys dominate EDA (design), ASML monopolises EUV lithography, TSMC/Samsung/Intel dominate advanced fabs, and the US wields leverage by controlling licensing of critical equipment.

That’s why the “chip war” isn’t just about fabs in Taiwan or Korea—it’s about who controls each link of the toolchain.

But the top priority for countries like Nigeria should be local capacity development in VLSI, chip design, and semiconductor engineering.

A hyper-skilled workforce is a major driver of outsourcing—companies take their design work to where the talent pool exists.

And while Cadence is the gold standard, it’s worth noting that there are also open-source EDA tools, especially within the RISC-V ecosystem, which is built on an open ISA. These tools are not yet at the scale of Cadence/Synopsys, but they lower the entry barrier for training and experimentation.

Your Abia State point is spot on as a provocation: why not think about building alternative hubs in friendlier, less geopolitically constrained regions?

Of course, fabs require billions in CAPEX, water, power, and highly skilled engineers, but Nigeria and other emerging economies could position themselves as strategic partners if they start small—say with packaging, assembly, or even specialised analog/mixed-signal fabs where the barriers to entry are lower.

Over time, building such capacity could break the monopoly of a few nations.

It’s a bold idea—and in this chip war era, the countries that prioritise skills and think outside the established power map may actually create new opportunities.