In order to carry out their responsibilities, managers require the permissions to perform tasks such as system configuration, software installation, resource allocation, user permission management and more. With this privileged access, managers practically always also have access to the services and data that run on the systems they handle. Further, manager’s teams have usually shared […]

26.0 – Attacks, Tools for Defending Against

Cyber attacks can be poisonous for your online presence. It can damage it in minutes and seize your online functions to your irritation. It’s very important that you become familiar with what risks are creeping in in the cyber world that can damage your existence. Here are some of the common cyber attacks which will […]

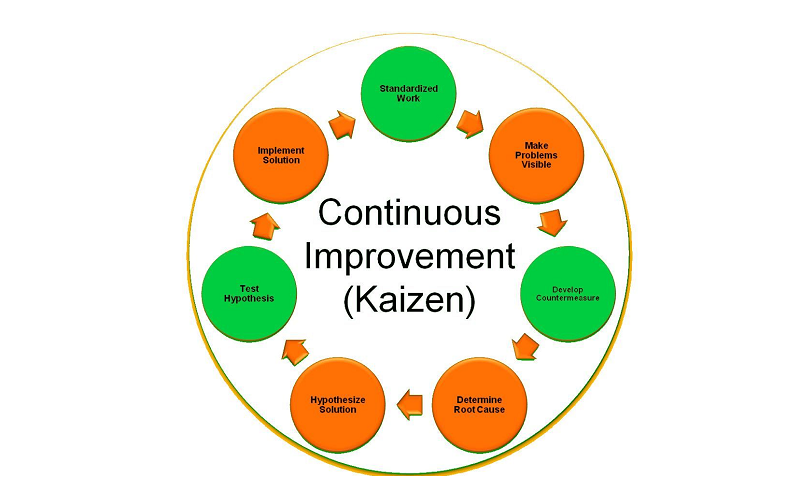

Kaizen Business Model: A Leeway for Companies and Entrepreneurs in Post Covid-19

“Thrift is poetic because it is creative; waste is unpoetic because it is waste.”- G. K. Chesterton in his essay titled “What’s Wrong with the World.”

Tellingly unpleasant as the situation is now, it is certainly not a better time for the world and its habitants much less the world economy. The world economy is ravaged, devastated and plummeted like the Oloibiri Oil Groove in Niger Delta, South-South, Nigeria. The Nigerian economy nay any other is not insulated to the eerie but now novel coronavirus better known as COVID-19; this period can now be likened to the “Great Depression” of the 1930s when the world economy was brought to its very knees.

Even the great Nostradamus with his prognostication prowess of a flu or epidemic from Far East China, and that would ravage the world in a twin year (2020) never in his wildest imagination thought the pandemic would be this cataclysmic and seismic. Alas, it is even more. Companies, NGOs, Government offices, all Education Offices, Small and Medium Scale Enterprises, and all forms of self-owned businesses have closed operations owing to global lockdown and fear of the pandemic; and some are at shut-down point because of COVID-19. The level of global unemployment as we have it now was last seen in the 1930s. Inflation rate has doubled and businesses are already filing for bankruptcy. In sane countries of Europe and America, governments are supporting businesses with various packages like tax cuts or exemption for a period; packaging financial lifelines through their various central banks as a way to keep them afloat or at least, not sack their employees. In spite of all of these, many businesses and corporate organisations that are profit-centred are struggling to survive.

It is therefore imperative to pen down internal panacea that are practicable for entrepreneurs, companies and other profit-centred organisations to stay operationally efficient or at least healthy as a leeway out of this Post COVID-19 consequences. And this internalized model is the Kaizen Model of Optimality which is geared towards cutting wastes. Kaizen has its etiology from Japanese language of two words which are Kai, meaning change; the other part: Zen means good. Contextually, however, the Kaizen Model of Optimality has found its way into global business and has won the hearts of business and tech gurus because of its benefits to business space. Kaizen is in fact a philosophy of its own. Kaizen aims at continuous improvement in operations, and involves all employees with respect to enhancing productivity.

An organisation that is fat in budget should prune itself of bourgeoisie’s remuneration which is largely self-inflicted. It is in the bourgeoisie’s perquisites that most companies and profit-centred organisations burn a good percentage of running cost which adds up to operations cost. The stakeholders and Board should as a matter of exigency come to a round table and agree on what is moderately acceptable for their superordinate or top echelon staff. This is the number one cost saving technique.

Another Kaizen principle that should be embraced is the Principle of Agility. Agility which obviously has its etymology from Agile is a business terminological exactitude associated with high speed coupled with output delivery. Agile thrives on adaptive culture where team members are quick to change if expectations are more benefitting and productive. So, every organisation needs to introspect on its business ideation, and determine which it should use the arsenal of its financial muscles to pursue and add to the bottom line. Here, flagship or the main product of the company should be examined vis-à-vis its contribution to total revenue.

More important and breviloquent is the issue of corporate culture and belief system which is enshrined in the organisation’s corporate governance. The corporate governance requires that checks and balances should be adequately put in place in order to block any resource conduit pipes of leakages. No company engaged in manufacturing or any other thing that has to do with material management should look away from its waste products. For companies which do not have effective waste disposal management would continually lose millions of naira because of smart-roguery employees, who are mendaciously pilfering and profiting from the negligence of management under the pretense that it is waste they move away.

The concept of Kaizen, according to Marshakk Hargrave, encompasses a wide range of ideas. It involves making the work environment more efficient and effective by creating a team atmosphere, improving everyday procedures, ensuring employee satisfaction, and making a job more fulfilling, less tiring and safer. Positive change can come from any employee anytime and Kaizen recognises that small changes now can have big future impacts (source: Investopedia).

Again every organisation should redefine its culture of efficiency and uniformity to all stakeholders. Many employees have lost focus of their core competencies and the reason for continuous earning of their paycheck. It is therefore pertinent to have their personal goals and aspirations aligned with the goals, cultural beliefs and value system of the company or organisation they work for. This will to a very large extent avoid conflict or clash of interests.

Lastly, every organisation should carry out the 360 degree evaluation of their staff with the use of technology where respondents are anonymous and their responses cannot be subjected to witch-hunting by their superiors. A lot will be discovered and then, proactive management will be armed with the right information and can block loopholes of financial rascality, thievery, gangster corruption or organised corruption, and many other corporate abuses.

Conclusively, COVID-19 will not be a thing of the past too soon. The effects are likely to last another two years and above. No profit-centred company should avoid or exit because of COVID-19 effects. Great things are born out of adversity. I will leave you with the words of great Aristotle “the beauty of the soul shines out when a man bears with composure one heavy mischance after another, not because it does not feel them but because he is a man of high and heroic temper”.

Why Nigerians Did Not Feel the Impact of the Covid-19 Palliatives

The call for palliatives during this pandemic was too loud. Every decision made by the government to extend the lockdown reminds people that the government is not providing the citizens with what they need to manage the bite of the partial economic inactivity. At a stage, the lockdown actually looked more like a punishment than a preventive measure.

The calls for providing palliatives were answered from different quarters. The federal, state and local governments did the best they could to provide food and other necessities for the citizens. Private individuals, organisations and associations also did their best. Many rural communities received one form of palliatives or another from well-meaning Nigerians and organisations. But all in all, these kind gestures did not stop the loud cry for palliation from Nigerians.

The fact that people complained about being neglected by the government during this lockdown shows that the impact of the palliatives was not felt. It is either these outcries came from people who have not received any kind gestures during this pandemic or from those who received “little”. These complaints are actually signs that Oliver wants some more.

But then, it should be understood that palliatives can never solve the hunger situation in Nigeria, especially during this pandemic. The reasons for this are noted below:

- Many Dependents

An average Nigerian home is made up of 5 biological children. When you add up the number of cousins, nieces, nephews, helpers, brothers, sisters, grandmothers, and other extended family members, you may find about ten people in a household and they are all taken care of by one man. Note that I didn’t include wife to the number of dependents because I’m assuming that wives also work and contribute towards the upkeep of homes. So, if you look at all these people in one man’s house and you now give him one painter of garri, one painter of rice, five super-pack Indomie, and things like that, how will he care for his family with them? Of course, the palliative will only serve as a snack while the family waits for the main course.

- Inflation

When the federal government shared 20k to some households in Nigeria, people were more interested in identifying the beneficiaries of this palliative. One thing a lot of people didn’t consider is the purchasing power of twenty thousand naira in today’s Nigerian open market. A 25kg (it is not even up to that) bag of Abakaliki Rice sells currently at #8,500, and it is not even up to 100 cups of rice. Now, remove that amount from the 20k and tell me what remains. Believe me that money will disappear immediately when it finds its way into the market and its impact will be forgotten almost as fast as the money disappears.

- Inconsistency with Palliative Distribution

The irregular way palliatives are distributed will not help people that much. If the distribution is done in such a way that the beneficiaries receive something say every two weeks, it will be better. But here, once something is shared, that is it. People don’t know if another one will come from that same quarter or if they should turn to another direction and expect help from there. The effect of this inconsistency is that it creates anxiety in the minds of those that depended on palliatives.

- Population Explosion

I think part of the reasons the quantity of things shared are so small is that the number of beneficiaries are much. The population of the country is actually going up but the problem isn’t just the increasing population. The problem here is that the few palliative providers are overwhelmed by the huge number of beneficiaries. For instance, in my hometown, private individuals and associations send in tens of trailers of food stuff to be shared in their different clans. These food stuff, when still in the trailers, appear so massive. But when they are shared amongst the available families within the clan or village, the food items seem so small because these people will go home with half “Bagco” bags or the “noise-maker” poly bags of food stuff.

- Corruption

Although this has not been proven, it is possible that corruption is part of the reason palliatives are not reaching the people that need them. It is possible that some of the people that benefit from this exercise are not those it is meant for. And it is also possible that funds and food stuff are diverted during this practice. One thing that is so certain here is that there was no transparency with how palliatives were shared.

It is good that the lockdown is gradually coming to an end. It is also good that many Nigerians survived the period. Hopefully, in a few weeks time nobody will depend on palliatives to survive (except the very poor in our midst). However, it is hoped that Nigerians have learnt not to depend on others for all their needs because they may get disappointed. It is also time for the concerned authorities to put in place measures and facilities that will help Nigerians to save for a rainy day.

The Economics of Covid-19: An Unprecedented Threat To Nigerians Development

Gideon Dunioh Publisher and Editor-In-Chief At Econs Media and Economics Correspondent At TrueNewsNG

As it stands now no one in the world is safe because of the COVID-19, it is a virus that we have never seen before there have been other coronaviruses but this one particularly seems to be different as very little is known about it and it spreads rapidly.

We are dealing with fear and uncertainty, a menace we cannot see, in this circumstances it means that the entire world should be interested in making sure that economies do not suffer economically as the economic impact is already being felt.

In Nigeria the COVID-19 has presented an unprecedented threat to national development as well as presenting a huge opportunity.

This paper seeks to highlight what is perhaps known as the most profound, global and domestic challenge especially in health and economy in the whole of human history.

In Nigeria alone there are over 182 number coronavirus related deaths and the figures are predicted to rise (as at Sunday, 17th May 2020).

From an economist point of view, managing the COVID-19 crisis will not be easy ‘’Coronavirus pandemic economic fallout ‘way worse than the global financial crisis,’ IMF chief says the Coronavirus pandemic has created an economic crisis “like no other,” the top IMF official said. “It is way worse than the global financial crisis “ of 2008 – 09, Gergieva said during a World Health Organization news conference’’

Nigeria will go into recession if COVID-19 continues beyond six months – Finance Minister

“If it is an average of three months, we should be able to close the year with positive growth. But if it goes longer than that – six months, one year – we will go into recession.”

Hence the need to identify the opportunities herein, by answering the following questions of the unseen COVID-19 danger

Some Questions Of The Unseen COVID-19 Danger In Nigeria

- How long will the covid-19 crisis last in order for us to envisage the impact ?

- What sector in the economy needs critical attention ?

- How does the Covid-19 affect our most pressing business needs in terms of laying off staff and salary cuts ?

- How does the government influence your decision on savings, investment and consumption ?

- How can the private sector compliment the government in the covid fight?

Until these questions can be answered and a better coordination of govt policy responses and measure put in place to curb the effect of the covid crisis then can we begin to tap into the opportunities

Here Are Some Of Nigerians Fiscal And Monetary Policy Responses

| FISCAL POLICY RESPONSE | MONETARY POLICY RESPONSE |

COVID-19 CRISIS INTERVENTION FUND

|

Reduction of interest rates on all applicable CBN interventions from 9% to 5% |

SUB-NATIONAL SUPPORT

|

Liquidity injection of ?3.6 trillion (stimulus package in the form of loans) into the banking system |

| BUDGET REVISION AND FUNDING

Benchmark oil price revised to US$30/b from $57/b and production to 1.7mbpd from 2.18mbpd. • Concessional funding from WB, ADB, IDB and IMF’s COVID-19 Rapid Credit Facility • No intention to negotiate or enter into a formal programme with the IMF • Downwards adjustment of non-oil revenue projections, customs receipts and proceeds of privatisation exercises • Budget Office to revise 2020-2022 MTEF / FSP • Amended Appropriation Act will provide for COVID-19 Crisis Intervention Fund |

Provision of ?100 billion to support the health sector, ?2 trillion to the manufacturing sector, and ?1.5 trillion to impacted industries in the real sector |

| TAX RELIEFS AND ALLOWANCES

2019 Finance Act already grants tax exemptions to small businesses while the tax rate for medium-sized companies has been reduced from 30% to 20% • VAT exemption for expanded list of basic food items plus medical and pharmaceutical products • Ministerial Orders for charitable donations to fight COVID-19 to be tax deductible • Release and (where necessary) enhance the hazard allowances of federal health sector workers • Affected States are enjoined to take similar measures. |

Creation of ?50 billion targeted credit facility through NIRSAL Microfinance Bank for households and MSMEs |

| The CBN granted all DMBs leave to consider temporary restructuring of loan terms for businesses/ households affected by COVID | |

| Strengthening of the CBN Loan to Deposit ratio (LDR) policy. | |

| Suspension of the sale of foreign currency to members of the Association of Bureau De Change Operators of Nigeria (ABCON). |

Nigerians should expect some more unprecedented economic shock even though a comprehensive structural policy reforms can reduce the impact

Further impact of the Covid-19 in Nigeria

Massive spike in employment

- Massive number of people in informal sector not earning daily wage between lockdown and recession

- Huge food security challenge

- Fiscal crisis at both Federal (FG) and State level

- Depletion of external reserves

Note that : Nigeria entered the crisis with pre-existing vulnerabilities such as low growth, low private investment and severely constrained fiscal policy which was only compounded by the Covid-19 pandemic which are

Very low tax to GDP ratio (less than 6%)

- High debt service to revenue ratio

- Low level of tax compliance

- Significant fiscal risks due to COVID-19 economic disruption

- Exposure to the risks of a sustained decline in oil prices

- Dated Brent oil prices as low as US$18.49/barrel as at Friday 1 May 2020

- Compared to 2020 Budget benchmark of US$57/barrel

- Oil production in 2020 year-to-date is 2.0mbpd vs Budget projection of 2.18mbpd.

- Little fiscal buffers compared to 2008/2009 or 2015/2016