Businesses exist to serve a purpose. Businesses exist to ensure profit that commensurate with the efforts expended by the owners and their employees. In a just society, businesses are not expected to be resolute in their pursuit of profitability at the expense of clients or customers, especially those at the bottom of the pyramid.

In any sector or industry, it is the core responsibility of businesses to ensure equality in terms of customer engagement and attention to issues. Out of over 15 industries and sectors in Nigeria, financial or banking and consumer good industries are critical to the survival of other industries and sectors. These industries are the backbone of operational activities of entities and individuals at household level. When it becomes practically impossible to fulfil financial obligations, activities would be grounded. The consequences would be enormous and devastating.

In my earlier open letter to Herbert Wigwe, the Chief Executive Officer, Access Bank Plc, and his staff, I detailed how the bank has failed to resolve blacklisting of my accounts over the last 3 months. The blacklisting has led to the inability to receive and make payments. As I noted during conversation with two staff of the bank, the suggestion that I should go to the nearest branch cannot solve the issue because of the past experience with the employees at the branch. Besides, going to branch at this period (Coronavirus outbreak) is uncalled-for if truly Access Bank is transforming the Nigerian banking industry with “digital transactions and discourage branch banking until the world is completely out of the pandemic times,” according to Victor Etuokwu, Executive Director, Retail Banking. Apart from this, it is imperative for the Chief Executive Officer to revisit his position about how the bank should be an intelligent one. An intelligent bank is expected to know the right approaches to the effective use of technologies to resolve customers’ complaints in a challenging time. As he said during an event on 16 May, 2019, “becoming an intelligent bank is no longer an option in today’s financial services, but a necessity. Today, we are experiencing the fourth industrial revolution which uses the Internet of Things, and Cloud Technology to automate processes. This has enabled financial service providers to increase their digital offerings for customers so they can conduct banking transactions on mobile phones, the internet, and at the ATM.”

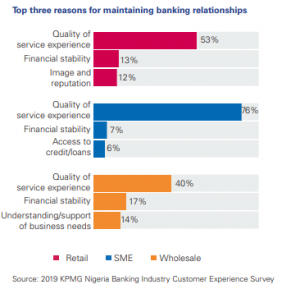

May I refer the CEO and staff to the Central Bank of Nigeria’s legal framework for customer complaint management, which stresses timely complaints handling and dispute resolution. According to the apex bank, “the 2008 global financial crisis re-emphasized the need for concerted efforts among regulators in various jurisdictions to establish robust policies and structures aimed at regulating the conduct of operators, with a view to protecting consumer’s assets.” Access Bank and staff also need to realise that quality of service experience is the main factor for sustainable banking relationships.

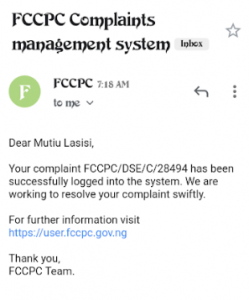

As a citizen and consumer, who believes in justice and fair play, I have logged my complaint with the Federal Competition and Consumer Protection Commission in line with the apex bank’s legal framework for consumer protection in the bank industry. The response of the agency will determine how true, we embrace justice and equality as a nation.

Update One

In my efforts of getting my accounts whitelist, I sent a message to Access Bank’s Ombudsman Desk on May 10, 2020. A few hours later, I received an email message from one Gloria Okungbowa, saying “Kindly send us a clearer written instruction (also signed) and a valid means of identification to reactivate your USSD profile. We apologize for requesting for another instruction, the initial one you sent is blurred and we could not work with it. We hope to hear from you soon to resolve the issue.”

I do not believe a scanned copy of National Identity Card I sent is blurred. This morning I have replied to her with a repositioned card and asked for urgent solution to the issue.

In 2018, the bank says “the aim and objective of the Ombudsman initiative was to resolve all customer complaints and issues on the same day irrespective of where the complaint is issued from or the officer responsible for resolution.”

Update Two

The Federal Competition and Consumer Protection Commission has sent a message, confirming my complaint. It would be recalled that I logged the complaint with the commission on May 8, 2020. The commission has asked for the details of the accounts blacklisted by Access Bank. I hope the commission will leave up to its constitutional responsibility and promise it gave in the message.

Update Three

While waiting for the response of the Federal Competition and Consumer Protection Comission, a staff of Access Bank (Gloria) reached me via email asking for the resend of the written instruction earlier gave to the bank to whitelist my accounts. I have informed her that doing that is like playing upon my intelligent. It is should not be difficult to retrieve the previous one. Apart from this, I do not know the reason Access Bank cannot assign only one person to resolve the issue. Why four people treating the same issue? This is creating back and forth, which is bad for customer engagement. Access Bank should do the needful!