COVID-19, the unexpected, rapid and worldwide spread virus, has changed the world drastically. We are in a crisis that has forced workplace closures, disrupted supply chains and lowered productivity. This crisis differs from others in many facets, and it brings significant uncertainty about its impact on people’s lives and livelihood. Infection, cut the supply of labour. Social distancing restricts mobility, with more severe effects on sectors that rely on human interaction (such as hospitality, tourism, entertainment, travel, and education). Emerging markets and developing economies, face more challenges, with reversals in capital flows, currency pressures, a plunge in commodity price, while coping with a weak health and social system.

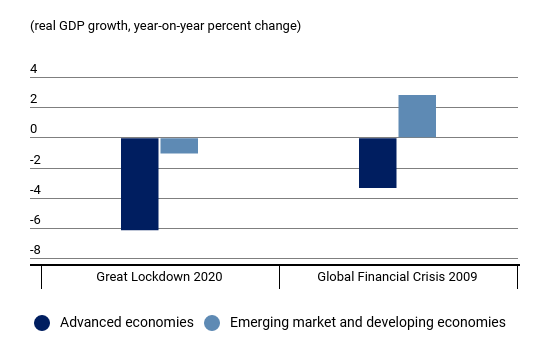

Based on the assumption that the pandemic and necessary containment, peaks in the second quarter for most countries, and recedes in the second half of the year, the International Monetary Fund (IMF) has projected the global economy will contract sharply by 3%. This is an outcome that is far worse than the 2009 Great Recession. Both the advanced economies and emerging market and developing economies are in recession. While global growth is expected to rebound to 5.8 percent in 2021, “the cumulative loss to global GDP over 2020 and 2021 from the pandemic crisis could be around 9 trillion dollars, greater than the economies of Japan and Germany, combined”.

Source: IMF

The impact of this would vary depending on the sector, financial capabilities, and management decisions of the company. As it is, with other recessions, certain businesses will permanently shut down, while some will struggle and some will come out as a winner. Also, some jobs will be lost, while there will be demand for certain talents and some sort of job reshuffling. Already, companies are responding with several restructuring and prudent measures, in order to remain in business. This includes compensation, restructuring, deferment of increment or promotion, axing temporary employees, furlough leave, retrenchment, shutdown of operations and many more. While these are pretty good measures, companies need to do more on competency mapping of their employees, and explore the possibility of reskilling and upskilling their workforce, in order for the company, to emerge stronger from the COVID-19 crisis. What is the risk profile of your workforce? Which roles are business-critical? And what skills/talents are needed to scale through?

No doubt, this crisis has forced many businesses to change the way they operate. There is a huge shift towards remote work, in order to reduce human-to-human contact and potential coronavirus infections. Even before the crisis, rapidly evolving technologies and modern ways of working were already disrupting jobs and reshaping the skills employees need to perform them. This crisis has further fast-tracked this journey. While you may expect remote work to fade, as the containment phase of the crisis increases, there is enough evidence to suggest that this trend will continue, as the use of technology, has never been felt more.

Thus, workers need to figure out how they can adapt rapidly to this dynamic landscape and the demands of the “distance economy”. Companies need to develop a talent strategy that develops employees’ digital capabilities, and well as their adaptability and resilience. Knowing fully well, it is difficult for companies to be resilient, if their employees are not, business leaders must pay special attention to this.

For example, the healthcare system in the UK has seen years of digital evolution, compressed into weeks by this crisis. In 2019, less than 1 percent of medical appointments took place remotely. Fast forward, to 2020, doctors now access 100 percent of patients through online and telephone, with only 7 percent proceeding to face-to-face consultations, according to BBC analysis. This massive shift implies that health workers must learn how to effectively and safely conduct remote diagnosis.

As mentioned earlier, companies need to conduct a workforce analysis and competency mapping, to identify critical value drivers and talents that are necessary for the survival of your business model. What are the roles of these value drivers and how will their daily operations change as a result of value shift? What shifts in activities, behaviour, and skills are needed?

Subsequently, you need to build employees’ skills that will be crucial to driving value in your adjusted business model and enable you to respond well to changes. Expand the ability of your employees to operate remotely, while strengthening their social and emotional skills, to ensure that professional engagement is kept, despite the distance. If transiting to a more tech and data driven model, then, there will be a need for your employees to understand how to employ digital tools such as data analytics, machine learning to improve their productivity.

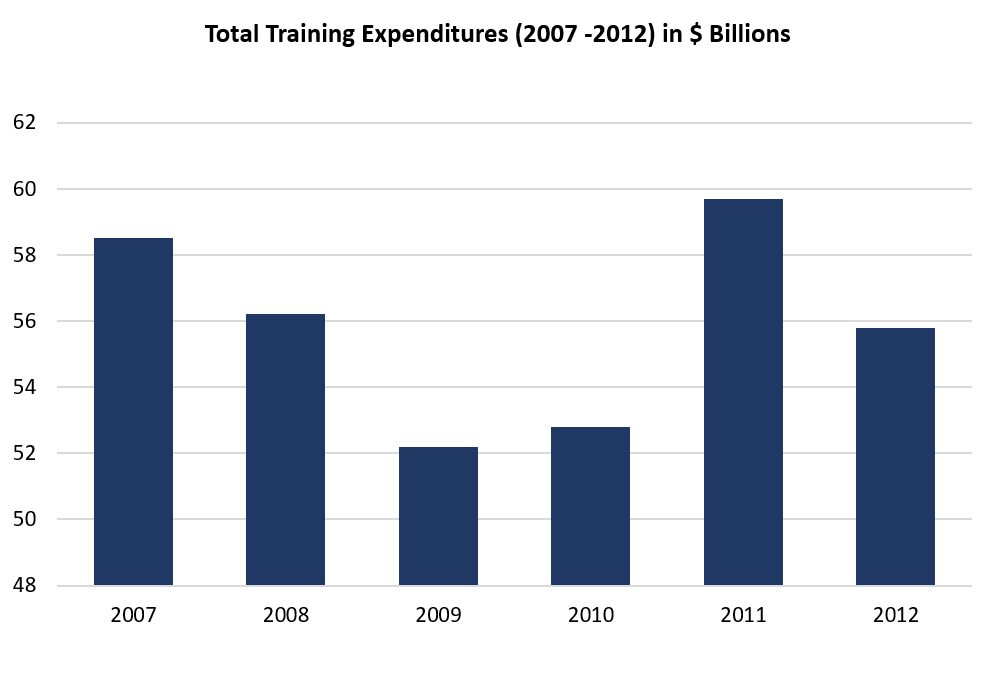

This is not the time to slash employee-training budgets. According to the U.S Training Report, before, during and after the Great Recession, revealed that there was a significant drop in the training expenditures in 2009 and 2010, followed by a boost in 2011 (surpassing the 2007 level), and then a drop to 2008 levels in 2012. This data tells us that if companies cut their investment in training now, it is only a delayed investment. And delay may be more costly, since the current crisis will require a substantial skill shift than the financial crisis of 2008.

Source: US Training report

We may not be able to control what is happening to our world today, but we can control how it will affect us. As I noted in this piece, the coronavirus pandemic is accelerating us towards a new normal, that was already on-going through automation, artificial intelligence and digitalization. And it is imperative that business leaders understand that the survival of their business hinges on the performance, resilience and adaptability of their workforce. Salary cuts and disengagements might be a good short-term response, but may not be sufficient alone, for companies to come out strong in the long term. Building your workforce to adapt must be your topmost priority, to ensure that your adjusted business model is successful. Don’t delay this. Start now, experiment quickly and iterate.