Oil Market Update: When the once sweet oil starts to taste bitter – the story of Nigeria’s Bonny Light…

Since 31st December 2019, Bonny light has now lost over 70% of its value. That’s not the news actually, all oil prices have lost about the same or more.

Here is the news, Bonny light is currently trading at $21.43, that is about $6.31 discount to dated Brent which is currently trading at $27.74, what’s the big deal? As at 31st December 2019, Bonny light ($67.42) was trading at a premium of over $1.4 to the Brent ($66).

Apparently, the Coronavirus pandemic has crashed all prices but why is Bonny suffering more?

No Buyers! We still cannot find buyers for our crude oil, unlike Saudi that is ‘sweetening their oil’ with heavy discounts and credit to refiners.

Remember Mele Kyari’s statement of 12th March 2020 “Today, I can share with you that there are over 12 stranded LNG cargoes in the market globally. It has never happened before. LNG cargoes that are stranded with no hope of being purchased because there is abrupt collapse in demand associated with the outbreak of coronavirus,”

Those cargoes are still stranded.

In its article dated 16th April 2020, S&P Global Platts confirmed that Nigerian crude is in dire straits, gasping for buyers.

“Trading sources said more than 50 million barrels of Nigerian crude for late-April and May loading has still not been sold to end-users. Sellers are resorting to holding some of this oil on inland or floating storage, to hope to sell at a later date, when demand recovers”

“This overhang of Nigerian crude, is possibly the largest ever in recent trading cycles, according to traders”

“This has pushed Nigerian crude values to record-lows and is weighing down on the already-depressed Atlantic Basin crude market” S&P Global Platts

In our opinion, until the new production cut agreement becomes effective in May, we may not find buyers for our crude as Saudi is bent on increasing production, giving heavy discounts and extending credit to Refiners.

We expect the increased activities in the fixed income and equities market to persist since foreign investors cannot find their way out.

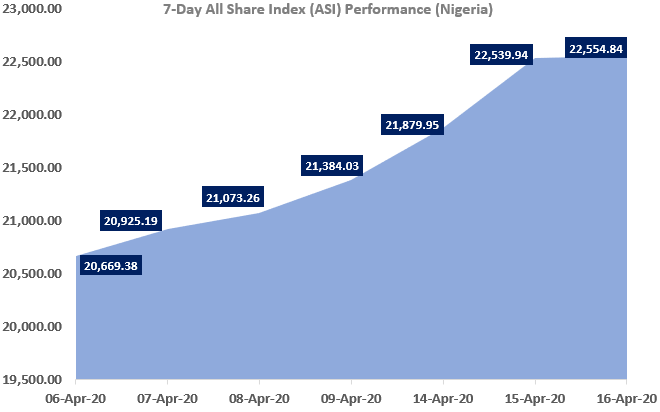

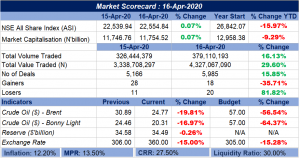

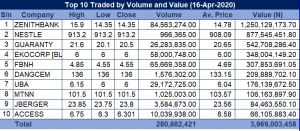

Stock Market Update:

Nigeria’s equity market is off to an early gain, currently up by 1.47%. FTSE (UK) – up by 3.31%, DAX (Germany) – up by 4.07%, CAC 40 (France) – up by 4.21% and Nikkei 25 (Japan) – up by 3.15%.

Click on the link https://bit.ly/2XrvIf9 to open a stockbroking/share purchase account and trade within 24 hours.

Money Market Update:

At the conclusion of T-Bills Primary Market Auction (“PMA”) yesterday, 15th April 2020, yields hit a new year low of 1.93%, 2.74% and 4.00% for 91-day, 182-day and 364-day tenors respectively.

Across tenors, the average return on T-bills is now 2.89%, if you take inflation into consideration, every kobo you invest in T-Bills will come back with a negative yield of -8.30%. That’s a No! No!. You need more than 1.93%, 2.74%, 4.00% or the average of 2.89% to grow your wealth, and we are willing to give more.

Our money market fund is still open and yield is currently over 11.5%, reach out to our team to grow your cash. We are digital, we are working from home, we are online and we are active. You can also do deposits with us at a starting rate of 10%.

See below for news headlines.

35 New Cases Of COVID-19 Confirmed By The NCDC

Thirty-five new cases of COVID-19 have been confirmed by the NCDC, taking Nigeria’s total infections to 442. The NCDC confirmed this on Thursday evening via a statement on Twitter. According to the agency, of the 35 cases, 19 were found in Lagos, 9 in the FCT, 5 in Kano and 2 in Oyo state. Read more

Why Nigeria Is Not Among Beneficiaries Of Recent IMF Debt Relief – Finance Minister

The Minister of Finance, Budget and National Development Zainab Ahmed, explained on Thursday why Nigeria was not among 25 countries recently granted debt relief by the International Monetary Fund (IMF). Quoting the IMF, she said the relief was for the “poorest and most vulnerable” IMF members. And “since Nigeria is not indebted to the IMF, there is no outstanding debt obligation to be forgiven,” Ahmed said on her official Twitter page. Read more

Don’t expect crude demand recovery before July, says OPEC

The demand for crude oil will not recover till the second half the year, the Organisation of Petroleum Exporting Countries has said. OPEC, however, forecast that global oil demand would fall by over six million barrels per day as a result of the effect of the coronavirus pandemic on the oil industry in the first half of this year. Read more

Gencos, Discos deny knowledge of FG’s N200bn payment

Power generation and distribution companies on Thursday said they were unaware of any N200bn that was paid to the power sector by the Federal Government in the past three days. Group Managing Director, Nigerian National Petroleum Corporation, Mele Kyari, had announced on Wednesday that the Federal Government paid over N200bn for power supply in Nigeria. Read more

Banks recorded N11.44tn online payments in March

Bank customers carried out a total of N11.44tn worth of financial transactions on the Point of Sales and Instant payment and electronic bills platforms in March, the latest data from the Nigeria Inter-Bank Settlement System have shown. This shows a 34 per cent growth from the NIP, PoS and e-Bills figures of N8.54tn recorded in 2019. Analysis of the data indicated that the customers carried out a total of N10.97tn worth of financial transactions on the instant payment platform in March 2020. Read more

European shares gain as Trump plans to reopen U.S. economy

European shares jumped on Friday, clawing back weekly declines as financial markets globally drew comfort from U.S. President Donald Trump’s plans for a gradual re-opening of the U.S. economy and reports of a potential drug to treat COVID-19. The pan-European STOXX 600 index was up 2.5% at 0712 GMT, shrugging off data showing China suffered its worst economic contraction in almost three decades as the pandemic crushed business activity. Read more

Dollar steadies as overnight sentiment boost eases off

The dollar steadied in early London trading on Friday after its rally was cut short by an overnight boost to risk sentiment from news of apparent success in a Covid-19 treatment drug trial and early plans to reopen the U.S. economy. The dollar, which has closely tracked risk sentiment through the coronavirus crisis, was broadly flat against a basket of currencies, up less than 0.1%. Read more

Super-charged stocks race toward second-best week ever

World stock markets made a super-charged sprint towards an 11% weekly gain on Friday – their second best of all time – after President Donald Trump laid out plans to gradually reopen the coronavirus-hit U.S. economy following similar moves elsewhere. Europe’s main markets (FTSE) (GDAXI) and Wall Street futures made 3% gains in early European trading too, putting the pan-regional STOXX 600 (STOXX) up more than 7% for the week and MSCI’s 49-country world index <. MIWD00000PUS.> up 10.5% already. Read more

Stocks – Dow Cuts Losses as Traders Eye Trump Update on Reopening Economy

The Dow cut its losses and ended higher Thursday, shrugging off a surge in jobless claims as investors awaited an update from President Donald Trump on the prospect of reopening the economy, even as several states extended lockdown measures. The Dow rose 0.14%, or 33 points, theS&P 500 was up 0.58% and the Nasdaq Composite rose 1.66%. Read more.

Africa Prudential Plc – Q1 Unaudited Financial Statements for the Period ended 31 March 2020- See details

Zenith Bank Plc – Notice of Board Meeting and Closed Period for Q1 2020

In line with listing regulations of the Nigerian Stock Exchange for quoted companies, Zenith Bank Plc hereby informs its shareholders, the NSE and the investing public that the Board of Directors of the bank is scheduled to meet on Wednesday, April 29, 2020 to consider the Group’s unaudited Financial Statement for the quarter ended March 31, 2020. Read more

e-Tranzact International Plc – Notice of Board Meeting and closed to Consider 2019 AFS

We hereby give Notice that a meeting of the Board of Directors of eTranzact International PLC (the Company) will now hold on Friday, April 24, 2020, via teleconference to consider the Company’s Audited Financial Statements for the Year ended December 31, 2019 (2019 AFS). Please note that the earlier scheduled meeting for March 26, 2020 was suspended in response to the COVID-19 Pandemic and was unable to hold. Read more

Africa Prudential Plc – Financial Highlights for Q1 2020- See detailsFCMB Group Plc – Notice of change of AGM Venue

In view of the Covid-19 pandemic and the federal government restriction on public gatherings, the 7th Annual General Meeting of FCMB Plc scheduled to hold at the shell Hall Muson Center, Onikan Lagos will now hold at the registered address of the company, First City Plaza, 44 Marina, Lagos. Read more

Wapic Insurance Plc – Notice of Board Meeting and Closed Period for Q1 2020 Accounts

Wapic Insurance wishes to inform the Nigerian Stock Exchange and the Investing Public that a meeting of the Board of Directors of Wapic Insurance Plc (“The Company”) has been scheduled to hold virtually on Monday, the 27th day of April, 2020 to amongst other things review the Company’s performance for the first quarter of the 2020 Financial Year as well as consider and approve the Q1, 2020 Unaudited Financial Statement of the Company. Read more

Sterling Bank Plc – Notice Annual General Meeting

NOTICE IS HEREBY GIVEN that the 58th Annual General Meeting of Sterling Bank Plc will be held at the MUSON Centre, Onikan, Lagos, on Wednesday, the 20th day of May, 2020 at 10.00 a.m to transact the following business read more

SFS Real Investment Trust – Unaudited FIRS Results for the Period ended 31 March 2020

See details here

SFS Real Estate Investment Trust – Key Performance Metrics for the Month Ended 31 March 2020

See details here

Like this:

Like Loading...