The first financial results of first-quarter earnings season is out. Aside from the earnings declaration, the company’s performance tells the story of the of what the world is going through and how companies can thrive despite the pandemic. See highlights below:

Negative impact of the pandemic: 52% decline in revenue from contracts with customers

“Revenue from contracts with customers reduced by 52% year-on-year on the back of the drop in retainership fee during the first quarter coupled with a significant reduction in fee from corporate actions as a result of the postponement of clients’ AGMs and dividend payment in response to the spread of the novel coronavirus in Nigeria”

The Company’s response: 900% growth in revenue from digital consultancy

“The company was however able to increase its revenue from digital consultancy by more than 900%, thereby emphasizing the positive result from the company’s diversification strategy into digital technology”

Financial Highlights:

Income Statement:

• Revenue from contracts with customers: N0.13 Billion, compared to N0.27Billion in Q1 2019 (52% YoY Decline);

• Interest Income: N0.61 Billion, compared to N0.60 Billion in Q1 2019 (3% YoY Increase);

• Gross Earnings: N0.74 Billion, compared to N0.87 Billion in Q1 2019 (14% YoY Decline);

• Profit Before Tax: N0.41 Billion, compared to N0.45 Billion in Q1 2019 (9% YoY Decline);

• Profit After Tax: N0.34 Billion, compared to N0.38 Billion in Q1 2019 (10% YoY Decline);

• Earnings Per Share: 17 Kobo.

Balance Sheet:

• Total Assets: N18.09 Billion, compared to N18.65Billion as at FY 2019 (3% YTD Decline);

• Total Liabilities: N9.52 Billion, compared to N10.37 Billion as at FY 2019 (8% YTD Decline);

• Shareholders’ Fund stood at N8.57 Billion, surging by 3% YoY from N8.28 Billion as at FY 2019.

Read more…

Earnings Flash: Africa Prudential Plc, 52% decline in revenue, 900% growth in revenue from digital consultancy

Nigerian Economy, Finance, Business News Headlines & Insights: 17th April 2020

Oil Market Update: When the once sweet oil starts to taste bitter – the story of Nigeria’s Bonny Light…

Since 31st December 2019, Bonny light has now lost over 70% of its value. That’s not the news actually, all oil prices have lost about the same or more.

Here is the news, Bonny light is currently trading at $21.43, that is about $6.31 discount to dated Brent which is currently trading at $27.74, what’s the big deal? As at 31st December 2019, Bonny light ($67.42) was trading at a premium of over $1.4 to the Brent ($66).

Apparently, the Coronavirus pandemic has crashed all prices but why is Bonny suffering more?

No Buyers! We still cannot find buyers for our crude oil, unlike Saudi that is ‘sweetening their oil’ with heavy discounts and credit to refiners.

Remember Mele Kyari’s statement of 12th March 2020 “Today, I can share with you that there are over 12 stranded LNG cargoes in the market globally. It has never happened before. LNG cargoes that are stranded with no hope of being purchased because there is abrupt collapse in demand associated with the outbreak of coronavirus,”

Those cargoes are still stranded.

In its article dated 16th April 2020, S&P Global Platts confirmed that Nigerian crude is in dire straits, gasping for buyers.

“Trading sources said more than 50 million barrels of Nigerian crude for late-April and May loading has still not been sold to end-users. Sellers are resorting to holding some of this oil on inland or floating storage, to hope to sell at a later date, when demand recovers”

Stock Market Update:

Nigeria’s equity market is off to an early gain, currently up by 1.47%. FTSE (UK) – up by 3.31%, DAX (Germany) – up by 4.07%, CAC 40 (France) – up by 4.21% and Nikkei 25 (Japan) – up by 3.15%.

Click on the link https://bit.ly/2XrvIf9 to open a stockbroking/share purchase account and trade within 24 hours.

Money Market Update:

At the conclusion of T-Bills Primary Market Auction (“PMA”) yesterday, 15th April 2020, yields hit a new year low of 1.93%, 2.74% and 4.00% for 91-day, 182-day and 364-day tenors respectively.

Across tenors, the average return on T-bills is now 2.89%, if you take inflation into consideration, every kobo you invest in T-Bills will come back with a negative yield of -8.30%. That’s a No! No!. You need more than 1.93%, 2.74%, 4.00% or the average of 2.89% to grow your wealth, and we are willing to give more.

Our money market fund is still open and yield is currently over 11.5%, reach out to our team to grow your cash. We are digital, we are working from home, we are online and we are active. You can also do deposits with us at a starting rate of 10%.

See below for news headlines.

Corporate Disclosures:

Zenith Bank Plc – Notice of Board Meeting and Closed Period for Q1 2020

In line with listing regulations of the Nigerian Stock Exchange for quoted companies, Zenith Bank Plc hereby informs its shareholders, the NSE and the investing public that the Board of Directors of the bank is scheduled to meet on Wednesday, April 29, 2020 to consider the Group’s unaudited Financial Statement for the quarter ended March 31, 2020. Read more

e-Tranzact International Plc – Notice of Board Meeting and closed to Consider 2019 AFS

We hereby give Notice that a meeting of the Board of Directors of eTranzact International PLC (the Company) will now hold on Friday, April 24, 2020, via teleconference to consider the Company’s Audited Financial Statements for the Year ended December 31, 2019 (2019 AFS). Please note that the earlier scheduled meeting for March 26, 2020 was suspended in response to the COVID-19 Pandemic and was unable to hold. Read more

Africa Prudential Plc – Financial Highlights for Q1 2020- See detailsFCMB Group Plc – Notice of change of AGM Venue

Be Honoured, for Excellence. Begin Here.

Registration continues for Tekedia Mini-MBA. Classes begin exclusively online on June 22, 2020 to end Oct 22 (four months). Program is self-paced which means your work would not be affected as you can consume our academic materials (class notes, cases, videos, etc) anytime. On Mondays, contents are pushed to the digital board, and you can study them at your time and pace.

Invest $140 or local equivalent for a top-grade professional development. Our program has elevated people. Our faculty are business leaders from BUA Group, Deloitte, Schlumberger, Access Bank, Queen’s University, Nigerian Breweries, St. Mary’s University, Polaris Bank, Infoprive, esure Group Plc, and other leading global organizations. The theme is simple: Growth, Innovation and Execution.

Join us by registering today – and ADVANCE. In edition 1, co-learners from 16 countries joined us (not sure many universities can write that). Learn the mechanics of business, and REACH higher. Be honoured, for excellence! Begin here – https://www.tekedia.com/mini-mba-2/

https://www.tekedia.com/mini-mba-2/

The Destination – A $300 iPhone

Let me celebrate a call: as Apple was ramping up prices on the iPhone, I predicted in August 2017 that “Apple must have a phone with a price range in the neighborhood of $300-$450”. (The new iPhone SE begins at $399.) The debate on LinkedIn was intense as many dismissed any strategy of Apple going downwards on pricing. My prediction was based on finite hardware improvement. Yes, there is a ceiling on how far you can improve the value and quality on hardware to command more non-marginal dollars. What can you do to double the price of an electric iron? With other devices advancing, Apple’s moat of exclusive hardware packaged on proprietary software will crack for entrance into the castle. Simply, phones will have largely marginal value improvements for years!

More so, as I have noted, I maintain that we would see the iPhone being priced at $300 soon. Why? Apple is pushing a services-driven strategy, and that means the more people who are using the hardware, the better. It is a better business to have ten people on Apple Music, Apple Pay, etc than just one person who can afford an expensive hardware. The lifetime value of those ten customers from a revenue perspective would be superior to the money made from the one expensive buyer. With ten users, retailers will open their systems for partnerships. In short, across all metrics, you win with more users of iPhone.

On average, these trends are negative for Apple: anything that declines the absolute number of iPhone sold is bad because even the services which are supporting higher revenue cannot grow without more people using iPhones since Apple services are exclusive to the hardware.

[…]

Apple will be fine and investors will align. Simply, the company is making it clear that its future is going to include services. So, if you hold Apple stocks because of iPhones and iPads, you may have to reconsider. By dropping the disclosure, Apple wants investors to focus on its revenue bottomline and not the number of devices sold. As far as the company is concerned, if it can grow revenue through payment, apps, licensing, etc, investors should not overly care what is happening on hardware as the company transmutes into making services a key part of its future. Simply, Apple has gone Services.

So, the base of my call – $300 – remains possible for the iPhone.

TrustBanc Daily Stock Market Scorecard, 16th April 2020

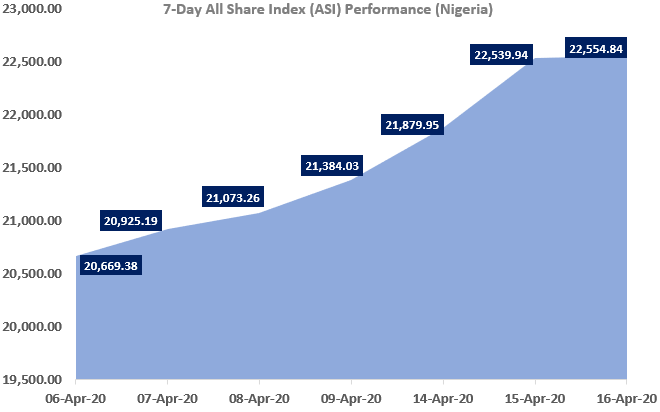

Tracking from 6th April 2020, the market has now gained over 9% in 6 consecutive trading days and recovered over N980 billion for Investors. The last time the market enjoyed this bullish run was an 8-day streak between 2nd and 13th January 2020.

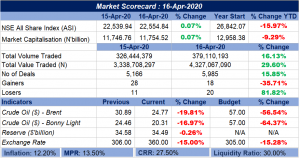

Today, the Bulls held on to their winning run with a marginal gain of 0.07% to close the All-Share Index (ASI) at 22,554.84 and abate the year-to-date loss of the Market to 15.97%.

See the image below for a complete snapshot of market performance.

Click on the link https://bit.ly/2XrvIf9 to open a stockbroking/share purchase account and trade within 24 hours.

Market Breadth: Profit-taking activities on the shares of Banks weakened the breadth of the market as it recorded 18 gainers compared to 28 recorded yesterday. Bargain hunters pushed the price of NESTLE to the top of the gainers list along with NB and CONOIL. STERLING and ACCESS top the table of 20 losers, this is the first time the losers have dominated the gainers in 7 trading days. See the list of top gainers or losers below:

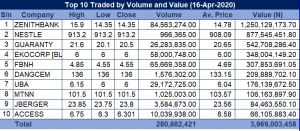

Market Turnover: Heavy profit-taking on the shares of ZENITH and bargain exchange in the shares of blue-chips like NESTLE and DANGCEM increased the volume of the market by 16.13% and value by 29.60%. See top 10 traded stocks below:

It’s a wrap.