Ethereum’s rally is showing signs of exhaustion, stalling near resistance at $4,318, while OKB has drawn fresh attention with billions in whale transfers moving in and out of exchanges. These developments highlight how quickly momentum can shift, leaving traders uncertain about near-term direction. Amid this noise, BlockDAG is charting a very different course. Its presale has already raised more than $383 million and sold over 25 billion coins across 29 batches, with pricing now at $0.0276.

The final goal is a $600M cap, funding liquidity, listings, and ecosystem growth. What sets BDAG apart is its layered momentum strategy, global visibility through Inter Milan, local engagement with the Seattle Seawolves and Orcas, and a confirmed U.S. sponsorship deal that adds credibility. Combined with its hybrid DAG + PoW architecture and 2.5 million mobile miners, BlockDAG is positioning itself as one of the top crypto to buy heading into 2025.

BlockDAG’s Triple Momentum Strategy Toward $600M

BlockDAG is building its foundation on multiple levels. Globally, its partnership with Inter Milan puts the project in front of millions of fans. Locally, partnerships with the Seattle Seawolves and Seattle Orcas foster grassroots trust in the U.S. and adding even more weight, a yet-to-be-revealed U.S. sponsorship deal brings national credibility. Each layer is designed to move beyond visibility and drive real adoption, fueling its reputation as a top crypto to buy.

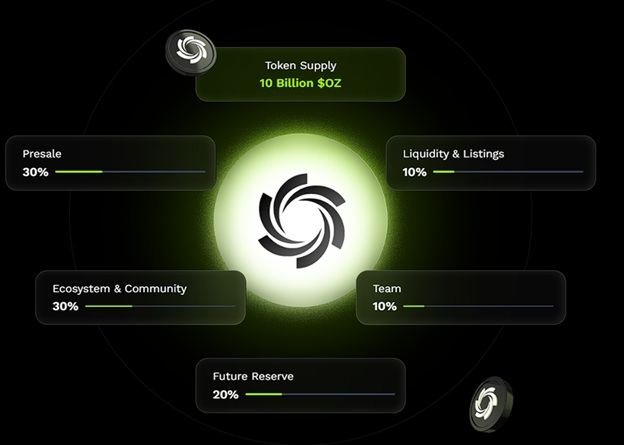

The presale numbers highlight this momentum. More than 25 billion coins have already been sold across 29 batches, with prices climbing from $0.001 at launch to $0.0276 in Batch 29. Early participants are already up over 2,660% on paper. The $600M cap will fund liquidity, listings, and ecosystem expansion, with confirmed exchange support from MEXC, LBank, and BitMart, plus ongoing discussions with Coinbase and Gemini.

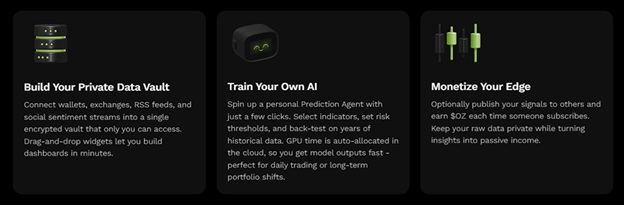

With its hybrid DAG + Proof-of-Work model supporting up to 15,000 TPS and an EVM-compatible design for seamless Ethereum migration, BlockDAG isn’t just a presale, it’s a network built for scale. Add in 2.5M+ users mining through the X1 mobile app, and the adoption case becomes undeniable. This layered approach is why BDAG is increasingly recognized as one of the top cryptos to buy this year.

OKB Whale Transfers Signal Uncertainty

OKB has been in the spotlight after a surge in whale transfer activity. The largest saw 19.7 million OKB, worth $2.25 billion, move from OKX to an unknown wallet, followed by a reverse flow of 17.1 million (~$2.06B) back to OKX. Additional transfers worth $1 billion, $302 million, and $573 million only heightened speculation.

Price action currently hovers around $217, with whale movements dictating volatility. Netflows suggest accumulation rather than dumping, but the scale of transfers has traders alert. The uncertainty surrounding these moves has kept OKB in focus, though it lacks the structured growth strategy that makes BDAG one of the top crypto to buy.

Ethereum Technical Analysis: Resistance at $4,318

Ethereum has been consolidating near $4,265–$4,318, with short-term indicators showing mixed momentum. StochRSI is oversold, hinting at a bounce, while RSI remains neutral. ETH continues to trade above major moving averages, including EMA25 at $4,086 and EMA99 at $3,275, supporting its broader bullish case.

Still, ETH needs a decisive breakout above $4,320 to unlock targets near $4,500. A drop below $4,000, however, could expose support around $3,600. Institutional flows and ETF demand are helping provide support, but uncertainty keeps traders cautious. While ETH holds long-term promise, BlockDAG’s presale-driven adoption push positions it more clearly among the top crypto to buy in 2025.

Final Word

Ethereum continues to wrestle with resistance at $4,318, and OKB’s billion-dollar whale moves are raising speculation. Both assets remain important, but neither has the structured, adoption-focused momentum that BlockDAG is building.

With over $383M raised, 25B+ coins sold, millions of miners, and a layered sponsorship strategy, BlockDAG is aligning technical strength with mass visibility. Its scarcity-driven presale has already delivered paper gains of 2,660% for early participants, and projections toward $1–$5 in the coming years reinforce its potential. For those seeking the top crypto to buy right now, BDAG combines scarcity, adoption, and growth like few others in the market.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu