After the formation of the Nigeria Police Force in 1820, what could be termed as regional police sprung up in 1879 and 1896. Over 1,000 members armed paramilitary Hausa Constabulary was formed in 1979, while the Lagos Police, serving Lagos colony, was established in 1896.

Historical information indicates that the establishments of the units became necessary because of the need to protect ever expanding population and reduce crime rates in the hard to reach hinterlands. The information further adds that members of the national and regional police departments were well coordinated towards solving various crime issues without harming non-criminals and committed to the protect and save life’s tasks.

However, the Nigeria Police known for approaching every security issue with the due diligence started derailing at the beginning of 20th and 21st centuries. The influx of personnel with bad antecedents, poor welfare programmes and the use of the Police to the individual’s advantage have been cited as the main factors by the concerned stakeholders, most especially the citizens and public affairs analysts.

The outcomes have largely been legitimacy crisis and the growing distrust for the police by the public. In these centuries, scholars and public affairs analysts have documented a number of reasons for the continuous police brutality. Undemocratic political structures, and the quest by rulers to suppress opposition to dictatorship, involve the use of police to coerce or repress citizens, lack of political accountability by the rulers, which encourage lawlessness by government agents, encourage police to act beyond the law, the inequitable economic system, the deployment of the police by economic and political power-holders for the suppression of some segments of society remain the key reasons.

These have largely encouraged the ‘kill and go’ syndrome among the personnel of Police Mobile Force established to cater for special crimes containment. The Special Anti-Robbery Squad is one of the special units and remains the unit Nigerians on several occasions have noted for dismantling by the Police authority and the Federal government. Anytime members of the unit brutalized citizens or involved in extrajudicial killing, people’s interest in ending the unit usually increases. In 2018, the public outcry in online and offline spheres promoted the Nigerian government to act.

Dilemmas in the face of the Staggering Statistics

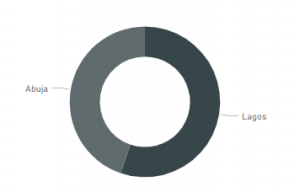

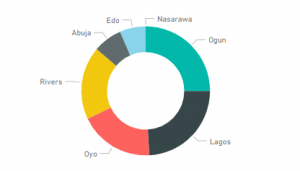

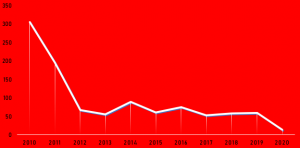

In their efforts of curbing crimes, the SARS has been reported on a number of times of carrying out ‘unauthorised’ inspection of young citizens and other nationals’ personal belongings. One of the affected persons says “It seems in the eyes of Nigeria’s police, any young man with a laptop, smartphone and an internet connection is likely a fraudster.” Our check shows that Nigerian media have significantly reported a series of police brutality between 2010 and 2020, which were equally sought by the citizens for better understanding of the reasons for the brutality and how it could be curbed [see Exhibit 1].

A recent study has also established that “between June 2006 and May 2014 the security forces caused fatalities in 59% of the lethal incidents where they intervened. Secondly, the more the security forces intervene, the more people are killed. This explains why from an annual average of 59% between June 2006 and May 2007, killings by the security forces peaked at 80% between June 2013 and May 2014. Thirdly, 58% of police interventions cause fatalities compared with 60% in the case of the army, an indication that killings by the police are more prevalent, while the army cause more fatalities per incident.”

Exhibit 1: Public Interest in Police Brutality 2010-2020

In another study, a significant number of Nigerians interviewed revealed that police brutality on Nigerians is prevalent. Forty percent of the people interviewed have either been or know someone who has been brutalized by the Nigeria Police personnel. With the overwhelming statistics on the level of police brutality across the country, it seems that existing rules and laws are not enough to curb the act among the Police Officers. For instance, the newly passed Police Reform Bill “provides internal disciplinary mechanism for any police officer that maltreats or kills an innocent citizen.”

This has been predicated on the cases of policemen going out of control with their guns under the influence of alcohol. To address this, according to the bill, it is now criminal for a police officer to take alcohol while on duty, according to Clause 98. The punishment prescribed for such offence is a fine of ?20,000 or three-months imprisonment. Our analyst observes that the punishment is insipid when compare with what is stipulated for the citizen who assaults, obstructs or resists a police officer from performing his or her responsibility. According to clause 96, such person will pay a fine of ?100,000 or six months imprisonment. On several occasions, news reports and citizens engagement in online communities have shown that concerned police authorities and government have not done enough in punishing erring police officers.