Samsung is winning the dollar wars on mobile devices in Africa, despite the supremacy of Transsion (makers of Itel, Tecno and Infinix) on total number of units sold. This battle is just starting as more Chinese brands arrive in Africa. I just hope for one thing: great value for customers.

Shenzhen, China-based Transsion is still the top-selling phone maker in Africa, according to market data from IDC. Transsion’s brands, including Itel, Tecno and Infinix, jointly dominate the feature phone space with 64% of unit shipments in the third quarter of this year. The company’s brands also maintain the lead for smartphones accounting for 36.2% of shipments, keeping with the trend since it first overtook Samsung as the continent’s top phone maker in 2017.

But Samsung isn’t going away quietly. The Korean phone giant leads the continent’s phone market in dollar terms suggesting its phones sell at higher prices on average. In addition, it has also now stepped up competition with Transsion in the market segment for lower-priced smartphones.

Samsung recorded a 61.4% growth year-on-year with phones priced between $100 and $200 in the third quarter of the year, a move which IDC says has “pushed Chinese brands to offer more affordable devices.”

The sector did well in Q3 2019, according to IDC.

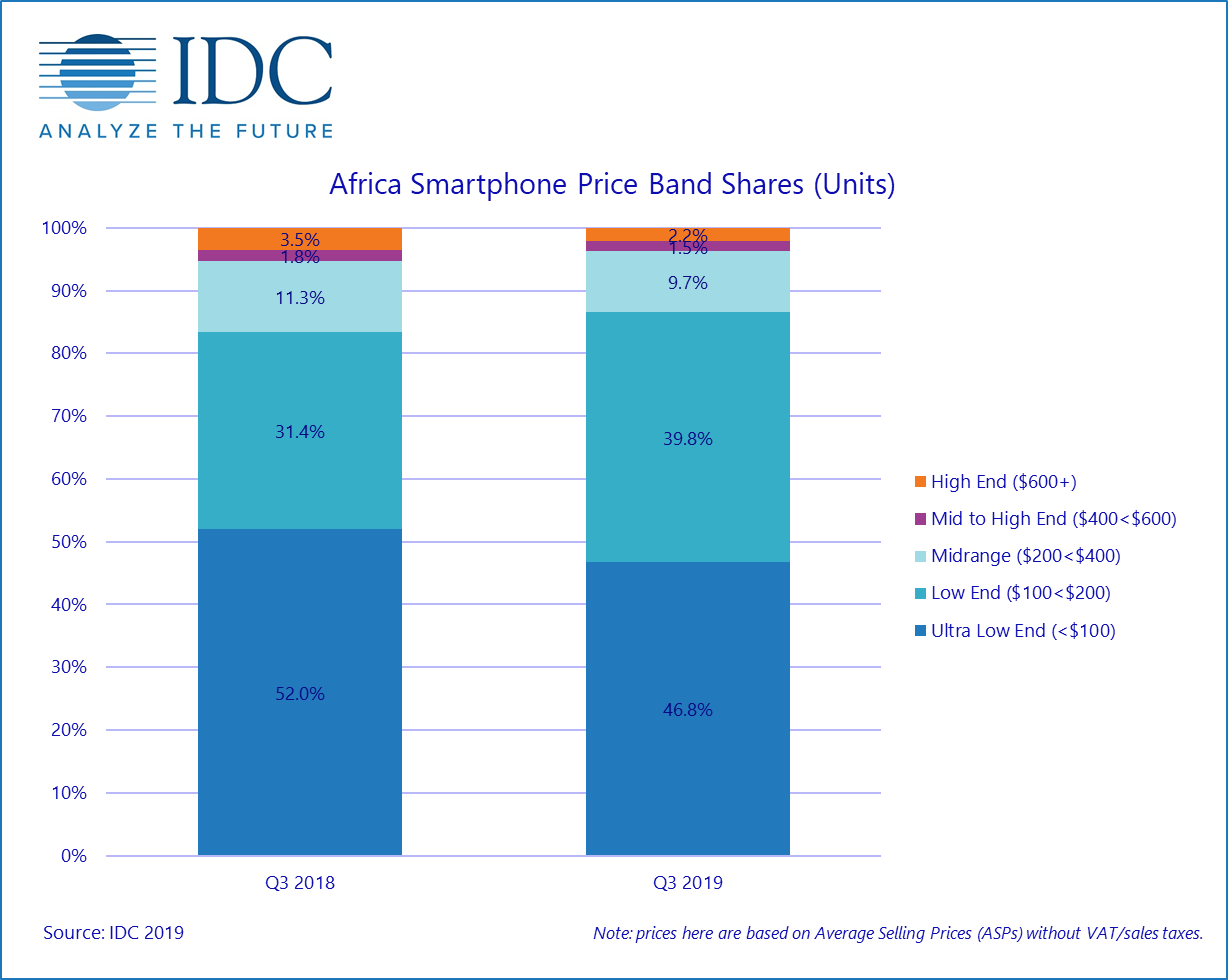

Africa’s smartphone market is also changing from a price band perspective, with the $100-$200 category seeing its share of shipments increase from 31.4% in Q3 2018 to 39.8% in Q3 2019. This growth was largely driven by the launch of new Samsung and Transsion models. The ultra-low-end band (below $100) has been declining in recent quarters and losing share to the low-end price band as brands move their device portfolios towards larger screen sizes and 4G capabilities.