With the less than a few hours to the year 2020, a new report from the Positive Agenda Nigeria seeks open culture of public engagement in Osun State. The report explores the public communication in the state in the last year using data-driven approach.

“Our expectation is that the messages communicated by the media team would reflect how the government and the governor solved various issues experienced during the one-year period. We also wanted to know how the government prioritised collective efforts seeking towards the state development and encouraged citizens to be cooperative, modest, care for themselves and strive for personal development.

Our analysis shows non-reflection of these in the messages that accompanied the government’s focus areas and activities reported in line with the governor’s personality. In terms of appearance (in images), government officials were more presented (42.1%) than the citizens (4.4%). In what appears as a disconnection with the citizens while discussing policies and issues, our analysis shows that citizens’ (99.1%) and community’s efforts (99.5%) towards the growth and development of the State were not emphasised in the messages. Government’s efforts were more stressed (26.2%),” the report reveals.

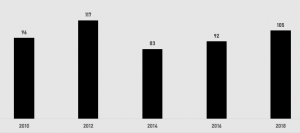

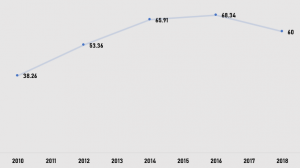

The report suggests that the close culture of interaction ensured spread of rumour about government and governor during the year. “It also contributes to less social credibility. We investigated this further by examining the number of comments and replies the posts and tweets had. A total of 2,405 comments and 4,285 replies were found on Facebook and Twitter respectively. On a monthly basis, we discovered low social proof for the government and the governor in November, 2018. The public started having interest in commenting and replying to the posts in December, 2018 and tweets in January, 2019. The proofs maintained irregular trends from May, 2019 till October, 2019.”

In his foreword to the report, Professor Ayobami Ojebode of the Department of Communication and Language Arts, University of Ibadan, notes that “anyone who would govern at this age needs a voice like the one we hear in this report, the voice of a credible interrogator of the specific aspects of our society and governance. It is my hope that the target audience of this report will take it seriously, and amend its communication strategies accordingly.”