I giggle a lot and almost could see through anyone’s depth of interest at a glance by asking two simple questions.

- How long have you been interested?

- Since you are interested in this for this long period of time, what have you done regarding your interest?

By anyone’s answer to this question, I could almost tell whether such person’s interest is motivated by the tide of the wind or by dedication to leapfrog the tides.

Interests are fluid and multidimensional often flowing with the tide of the wind. It is never stable for a living and active being, it can even grow uncontrollably. I was there or say I am still there, that’s why I know.

Interest grows, but interest never gets anyone anywhere, obsession does. Now I agree things start out as interest but those things must grow to become an obsession for them to see the light of the day and possibly leapfrog. It took me time to be able to bring this to perspective. This tweet’s question and answer reveals that…

Replying to

@real_DavidALADEThere are interests And there are obsessions.

That was me on June 19, 2019, asking the respected and insightful man question about the multidimensional nature of interest and his answer changed everything.

Yes, there are interests and there are obsessions, the mistake a lot of us make is to think of both as one. However, it does not actually take long before it gets revealed that this thing is only a thing of interest to this fellow and not an obsession. For me, the two questions I mentioned earlier quickly help me to pinpoint the difference per time either for myself or for someone else.

Many interests flow with the tide of the wind. I have been there and maybe I am still there. I wish I still have my LinkedIn profile image of about 2 years ago. My profile would have been evidence to show that this guy flows with the wind. I had things like Fintech enthusiasts, Big Data enthusiasts, tech evangelist, tri-sector intelligentsia and so on my profile.

Now those things aren’t bad at all, in fact, it was my version of not seeking permission but following after forgiveness constantly. However, unsustainable.

And if I was to advise anyone, I would still say it’s fine to go through that process. Don’t seek permission always remember.

What usually makes the difference is not stopping at that point of interest. Today those things are ripped off my profile.

How do people move from interest more often than not motivated by the tide of the wind to the realm of obsession?

By dedication, people achieve this.

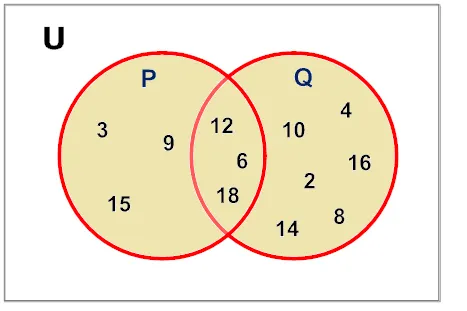

Till tomorrow, your interest will keep growing just like mine is constantly growing albeit with the tide of the wind. However, we get to work on (dedication) just a minute percentage of our interests (I may peg it at <5%).

Those interests that we dedicate our time to pursue end up either being an obsession or we realize oh, this can’t grow beyond this and we drop it. In technology development cycle we call it “the peak of inflated expectations.”

Only those interests that survive the peak of inflated expectations gets to become an obsession and they are usually very few.

I started by saying I giggle when I get asked some questions. That’s because I could tell that these things someone is asking me of are still in the realm of interest and no matter what I say, it might not be enough to move them to the realm of obsession. It is your sole responsibility to move yourself to the realm of obsession, interest is too multidimensional to invite anyone to navigate it for you. Move beyond interest.

When I see folks in the realm of obsession, something I rarely do, by the way, I can go all out to see them building upon their obsession. They are people worth 100% of my time.

Few of them I’ve met, I pay for online courses for them to learn, some I share my login details with to learn, some I go the extra length of being their accountability partner and some I benefit in different measure.

Yes, it is usually a worthy investment, some did it for me. They are ripping it now and will do later.

Why have I written this?

- To help you understand yourself and forces that are shaping you.

- To help you understand the interplay between interest and obsession.

- To help you understand that not all interest will turn into an obsession and only those who turn to obsession actually leapfrog you.

- To also help you understand that it is all normal to have a varying interest.

Above all to help you to move quickly from the realm of interest to the realm of obsession through dedication.

And lastly, to point out that not all interests will make it past the bridge of dedication. And that is 100% alright.

However, you need to be dedicated ASAP in order to root out those interests that are only occupying space in your mind but will never see the light of the day.

I have mastered the art of navigating the realm of interest and obsession for myself and have a mental playbook for this. Hopefully, I will be committed enough to share one day. For today, that’s all.

Invest in people’s obsession and you had reaped your investment one way or another.

Invest in people’s interest and you are almost guaranteed to lose your investment.

When you are making a choice between both, go for obsession.