OPay has hit Nigeria’s legendary “long” gestation period before a business can turn a profit. Because you are your own electricity board (via your generator), your own waterboard (via your borehole), your own police (via your guards), etc, you have many inefficiencies in the utilization of your factors of production. Unlike in the U.S. or Europe, where your real challenge is growing the business, in Nigeria, you have to deal with orthogonal matters that may trip you the whole day. Yes, the generator man forgot to buy diesel and now there is no light to power the laptops!

So, for OPay, a platform fintech, which began life with the American startup playbook with the typical unlimited ocean of capital, it is looking like things are not working out. That explains why the company has become another “tax agency” in Nigeria by taxing its customers. But unlike the government tax agency where Senators can easily approve bills they have not seen, OPay does not even need Senate: it wakes up in the morning and changes its fees.

People, we have an OPay double clip (hello Ireland and Amsterdam double dips, sure for tax reduction techniques). It involves wasting N45 for first transfer of your money from OPay wallet to your bank, and then 1% flat fee subsequently. The 1% was after a revolt by the believers; the company had set it at 2%. At 1%, every bank in Nigeria at our regular N52 flat fee offers better value.

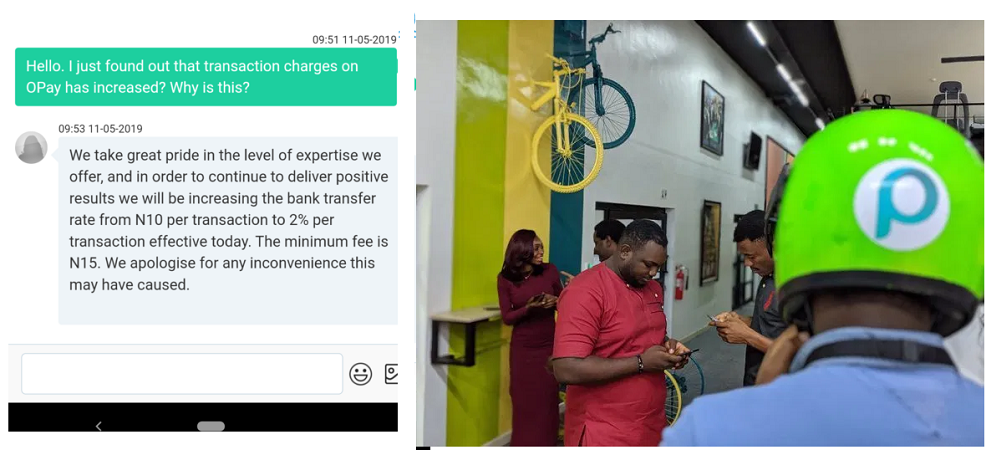

OPay is facing perhaps its first-ever backlash from customers. On Tuesday, users found out they had to pay a 2% charge for transferring money to other banks, at a minimum rate of N15 per transaction. OPay apologised for not communicating the increased fees to its customers. The company then revised the fee to N45 for the first transaction a user makes in a day, while subsequent transactions will incur a flat 1% processing fee. (TC Daily)

Let me say it here: if OPay’s playbook is to “tax” Nigerians this way, it has no future. It has been proven that Nigerians like FREE things. If you try to ask them to pay, they move in exodus. Yes, provided it is free, you are the best service provider. Any playbook that depends on attracting users with freebies and expecting a paid conversion without a new level of product evolution will fail in Nigeria. So, OPay, you can burn your $50 million war chest, and the day that money runs out, all the users will look for the next deal in town. There is nothing like lock-in in Nigeria because the hardest thing is to get a Nigerian to spend money!

Sure, OPay may be using these fees to deepen intra-Wallet transactions where everything stays in its ecosystems. In other words, provided no one is transferring outside the Wallet, no fees will be incurred by the users.

But this redesign is actually good news in the ecosystem: it validates one thing – OPay is not doing magic by making costs to disappear. With the subsidized rides on ORide, OBus and OTrike, one could have imagined that this company was not under the gravity of high cost of doing business in Nigeria. But hello – OPay is just typical. It is being normalized in the beautiful nation. If you think you can achieve what took Paga about ten years in 18 months, Lagos Lagoons will welcome your ideas and OLX, Efritin, etc may be like peers in the swimming rivers.