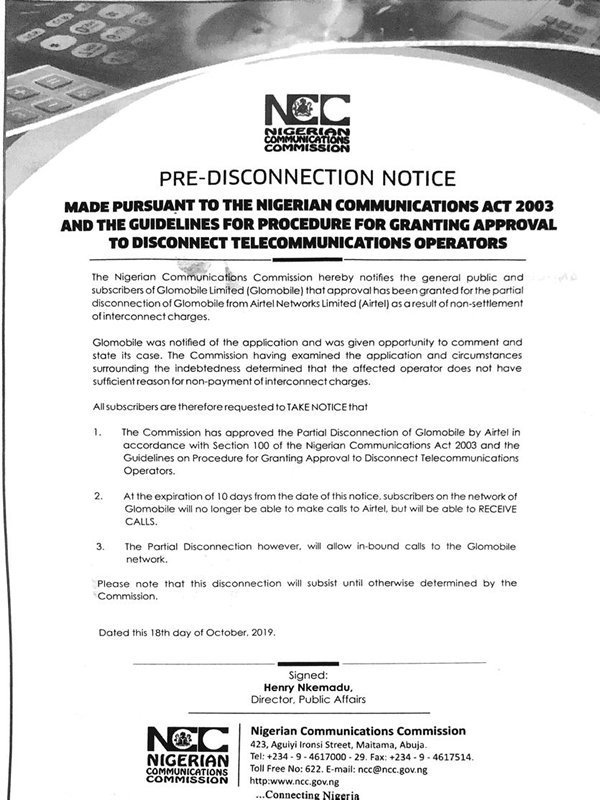

“The Nigerian Communication Commission hereby notifies the general public and subscribers of Globacom Limited (Glomobile) that approval has been granted for the partial disconnection of Glomobile from Airtel Networks Limited (Airtel) as a result of non-settlement of interconnect charges.

Glomobile was notified of the application and was given the opportunity to comment and state its case. The Commission, having examined the application and circumstances surrounding the indebtedness determined that the affected operator does not have sufficient reason for non-payment of interconnect charges.

All subscribers are requested to take notice that:

“The Commission has approved the partial Disconnection of Glomobile by Airtel in accordance with section 100 of the Nigerian Communication Act 2003 and the Guidelines on Procedure for Granting Approval to Disconnect Telecommunications Operators.

At the expiration of 10 days from the date of this notice, subscribers on the network of Glomobile will no longer be able to make calls to Airtel, but will be able to receive calls.

The partial disconnection however, will allow in-bound calls to the Glomobile network.

Please note that this disconnection will subsist until otherwise is determined by the Commission.”

This is a statement signed by the Director of Public Affairs, Nigerian Communication Commission (NCC), Henry Nkemadu. And it is telling an unpleasant story that network subscribers have heard and experienced before, and it didn’t sound or taste pleasant.

In July, Glomobile got into the same fight of non-interconnect charges with MTN Nigeria, putting subscribers in a situation of non-communication. MTN partially restricted calls from Glo, and the dispute lingered until August when Glo paid the N2.6 billion interconnection charges.

People thought they have learned their lessons and it’s never going to happen again. But they were wrong, and this time it even got messier. The intervention of the NCC here, as in other occasions, has been to recover the money for Airtel at the expense of subscribers.

Subscribers have to bear the brunt of the fight between Glomobile and Airtel, and the only alternative is switching to some other networks. Business lines will not be reachable from certain customers, and so it will be with every other thing powered by the interconnectivity of the two telcos.

The question everyone is asking is: Why do subscribers have to suffer the consequences of a telcos’ shortcomings? The NCC should find another means of debt recovery that will not penalize subscribers for offense they did not commit.

In the past, many of the operators had been caught up in one saga or the other with the regulator, and fines were levied against defaulters. For instance, in 2015, MTN was handed a record $2.5 billion fine for failing to disconnect unregistered SIMs, and the fine has kept them on their feet since then when it comes to SIM registration.

The Nigerian Communication Commission should have followed the same pattern and leave subscribers out of a squabble they have nothing to do with. If Glomobile knows that they are going to pay more than they owe in fines, they would not hesitate to pay their interconnectivity charges.