Every second a significant number of data is being churned out by man and machine. The data are either released vertically or horizontally from one object to another object. In the last decade, this has been more pronounced as big data. With the high level of leveraging big data in the last 5 years throughout the world, the revolution of processes, people and decision making remain unabated.

From manufacturing to service industries, insights from big data are being explored to improve human and infrastructure performance in the matured Facilities Management markets. The emerged big data from facilities and occupant behaviour are being used for short, medium and long term plans development for quality and sustainable experience that do not left attainment of productivity objectives and targets behind.

There is no doubt the emergence of big data through the network of devices that collect, share data as well as talk to each other is a “golden egg” for Facilities Management providers and practitioners to be more proactive rather than reactive in their processes towards the efficient management of short and hard facilities, and workforce management.

From 2006, the narrative has been that the Nigerian Facilities Management is in the infant stage, growing slowly due to many factors such as low recognition by the public sector and poor maintenance culture across the country. Despite these issues, this article believes that the industry cannot continue to play second fiddle in the midst of big data mantra within the global FM industry.

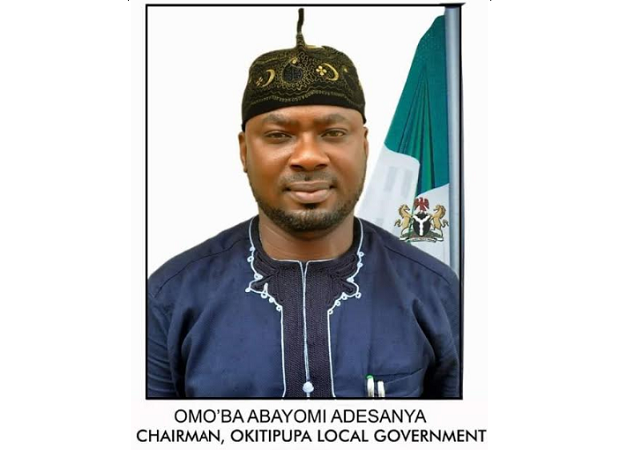

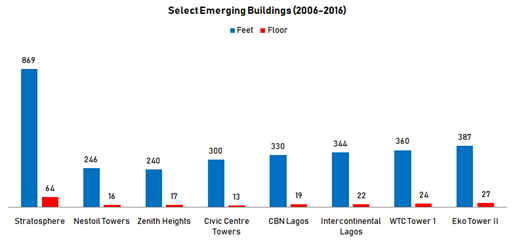

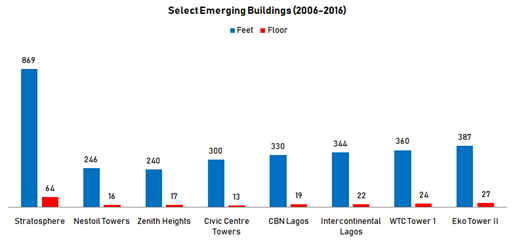

This position has been reinforced by the emergence of the new buildings and infrastructure since 2006 in cities such as Lagos, Port-Harcourt, Abuja and Kano. These main cities have experienced rapid growth. Available statistics indicate that Lagos has over 150 million buildings with the average age of 40. The figure is not expected to dip soon as there are plans to add more building. Oban, Orun and Zuna Towers are expected to come up by 2020. Like what would happen in the Lagos Smart Cities, these Towers would largely be equipped with sensors and other real time monitoring systems, making consistent maintenance of critical and non-critical facilities a must.

Already, there are uncertainties among the professionals in the built environment. Fears are being exhibited on the basis that a city such as Lagos, which constantly undergoes rapid and dynamic transformation needs new approaches to real estate development and management, particularly the high density high-rise buildings. Failure to build effective big data structure within Marketing and Communications, and Information Technology Departments will make decisions making on the buildings more difficult. In these buildings and existing ones with the Internet of Things devices, energy cost cannot be reduced without collecting data in real time. Answering questions such as what is being wasted will remain entangle in the absence of data metrics pertaining to it.

Source, Multiple, Infoprations Analysis, 2019

How More Big Data Will Be Generated by 2020?

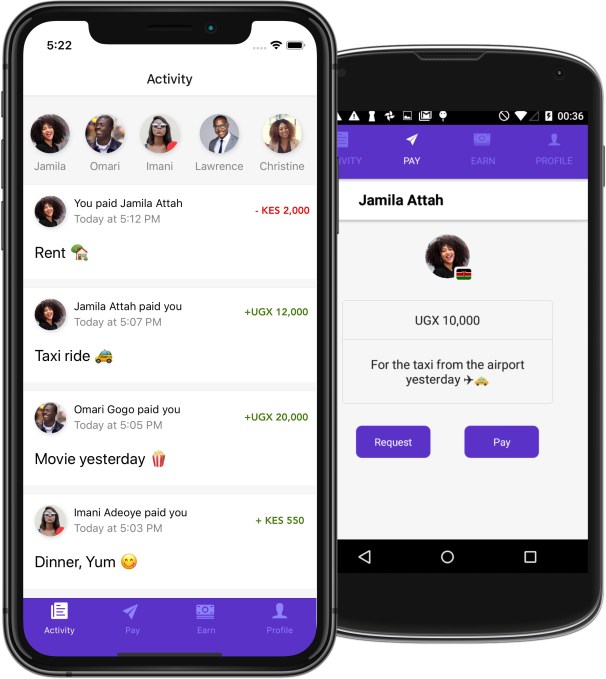

The changes in demographics, psychographics and lifestyle would largely force building owners to incorporate IoT devices in their buildings to enable quality experience. By 2020, Lagos and other cities are expected to receive more ‘net-generation’ Nigerians. This generation is expected to increase their prioritisation of seeking information through the Internet-Enabled devices such as Google Map, Body Exercise Tracking among others by 2020.

Apart from this generation, the growing public interest in the big data through hyper-personalised searched is a pointer that FM companies and professionals cannot do without leveraging big data for maintenance. With the current consideration of specific building characteristics that align with their needs, they are most likely to create real time data at a microscopic level which must be tapped by FM providers.

For instance, analysis shows 80.5% connection of public interest in big data and facilities maintenance between 2014 and 2019. During the period, the interest in facilities maintenance was mainly facilitated by the interest in big data, analysis reveals. Analysis further reveals 88.7% linkage of big data and building maintenance. This indicates that building as a whole has a high possibility of generating big data than individual facility. Like the facilities maintenance, analysis equally suggests big data as a factor for the interest in building maintenance. Whether in facilities or building, “The goal is to turn data into information, and information into insight,” that makes preventive maintenance much more effective, Carly Fiorina, former chief executive of Hewlett-Packard said.

Unlocking Big Data Potential for FM Practice in Nigeria

How can Nigerian FM companies benefit from the big data? Abdullah Oladipo, former Operations Manager, Savvy Capire, appears to have provided the right answers during a recent interview. According to him, “to achieve this, FM companies in Nigeria must move beyond appropriating analogue technologies and conventional processes to smart devices and processes that linked with people on-site and off-site digitally.”

In addition to smart technologies adoption, employees within FM companies need to change the culture and attitude towards sharing structured data. The idea of hoarding vital data when the business value has been established would continue to make the integration of big data with the solution delivery processes difficult. To make the data sharing easy, companies need to provide talents capable of working with large datasets and explore significant insights for the employees at the business and functional levels.

Nigerian companies and practitioners need to learn from the developed markets such as the United Kingdom, where Computer-Aided Facilities Management (CAFM), Building Management System (BMS), Environmental Management System (EMS) and Building Information Modeling (BIM) have been confirmed as the key sources of big data. Most big players in the industry are the early adopters of these operational systems. Deriving full benefits from big data will remain myths if players continue struggling with the digitalisation of operations and failed to utilize emerging data for any evaluation or real time analysis.

Like this:

Like Loading...