By Nnamdi Odumody

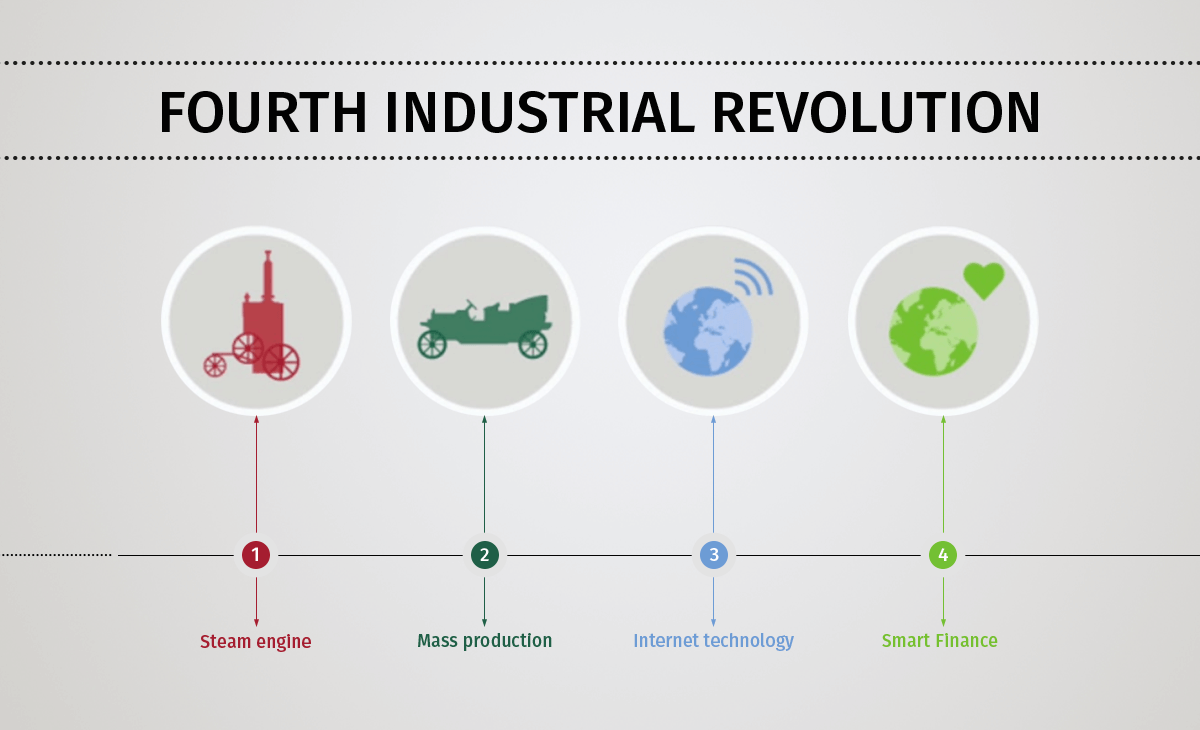

In this Fourth Industrial Age, talent has become a highly sought after factor as it has emerged as the major determinant of where capital which is scarce is moving to. As innovation is a prerequisite for the global competitiveness of countries, it is the investment in human capital development that will position nations for leadership in this era.

The United States, which until recently, followed by Hong Kong, was the most globally competitive economy, is now third, exchanging positions with Singapore. Its Ivy League universities help it to attract global talent. The talent has been critical for America in creating innovative solutions. The talented people lead to the emergence of successful companies that boost America’s GDP. Of course, the new course on U.S. immigration could cause a dislocation as global talent moves to other nations where they can work freely.

Singapore has a Skillsfuture Programme which is to prepare Singaporean citizens with future ready skills like Agility, Adaptability, Collaboration, Critical Thinking, Emotional Intelligence, Deep Learning and Machine Learning. Other skills included are Blockchain, Cybersecurity, Cloud, Robotics, Precision Engineering, Biotech skills, Additive Manufacturing, Embedded Systems and Mixed Reality. They have done this to position the nation as Asia’s Innovation and Talent Hub. It has Singapore University of Technology and Design (first of its kind) where students are taught how to apply design thinking in their programme of study, and area of specialization, to solve problems common to Asia and the rest of the world. Some of these problem include climate change, and environmental sustainability.

Singapore’s National University of Singapore is among the top-rated in Quantum Computing while the world’s most cited scientist in 3D Printing, Prof Chua Chee Kai, of the Singapore Centre for 3D Printing, Nanyang University, Singapore is a Singaporean. Also, the leading Polytechnic Nanyang Polytechnic is not left out of the talent breeding ecosystem for its Smart Nation Initiative with a Digital Convergence & Mobile Innovation Centre with Samsung, IOT Open Innovation Centre with Intel, Big Data & Analytics Innovation Centre with IBM, Games Solution Centre with MDA & Sony, Additive Manufacturing Innovation Centre, Centre For Digital and Precision Engineering, Centre of Innovation for Electronics.

Singapore also has an Institute of Manufacturing Technology which is to come up with innovative solutions, aimed at achieving efficiency and making its highly rated industrial sector globally competitive. More so, it has a Centre of Innovation for Supply Chain Management. Most of the leading biotechnology, consumer goods and enterprise technology companies have Research and Development Offices in Singapore. Singapore’s public sector is also integrated into its skills development programmes which is why they are ranked the best worldwide in performance. For a nation of 270 sqkm and population of 5.6 million, the effect of all these is a Per Capita income of $52,960.7 and GDP of $297billion.

In Nigeria, some private initiatives are ongoing to prepare a Fourth Industrial Workforce which will help the country to compete globally. Data Science Nigeria is a nonprofit founded by Dr Bayo Adekambi which wants to raise 1 million talents with skills in Artificial intelligence and Data Science, after it was discovered that of the 300,000 Machine Learning Engineers globally, Africa hardly featured.

IBM’s Digital Nation initiative currently has a partnership with the Lagos State Government to train Lagos residents with Artificial Intelligence, Data Science and other skills which will make them competitive while Google is also running a similar initiative for Nigerians. Microsoft’s recent African Development Centre in Lagos will help develop talents with skills in Artificial Intelligence and Mixed Reality who will develop innovative solutions leveraging its Azure Platform for the country and rest of the world, while Curators University in conjunction with Edo Jobs is training Edo youths in future ready skills like AI, Cloud and Data Science. Also, Andela is helping to develop software engineers who will compete on the global stage while getting them jobs to practice their skills. Cisco has unveiled a programme to train young Nigerians to become Networking and IOT Experts similar to Huawei’s Open Innovation Centre for IOT which it established at University of Lagos.

Judith Okonkwo of Imisi 3D is developing a community of Mixed Reality developers who will create solutions to some of the common problems in the country. 3D Africa founded by Njideka Harry and GE’s Lagos Garage is training Nigerians with skills in 3D printing and how to build businesses using it. TDP4AI founded by Dr Agu Collins Agu is helping in developing skills in embedded systems.

The Federal Government can lift millions of Nigerians out of poverty by partnering with the private sector to up skill for future-ready skills, and create a smart workforce, which will make Nigeria globally competitive.