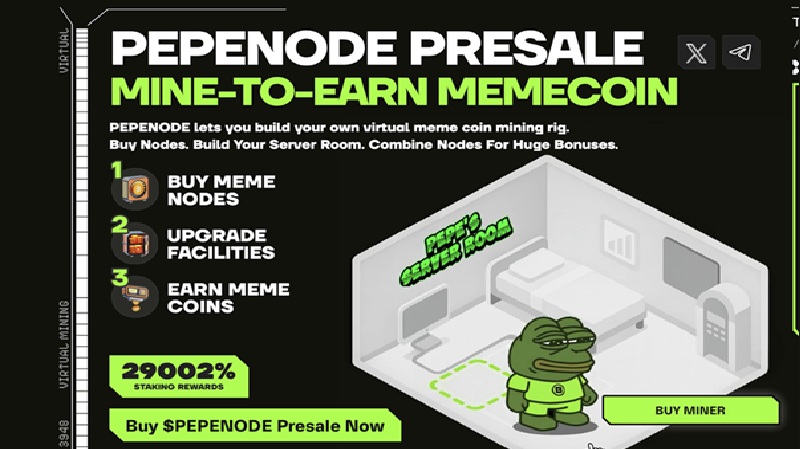

Most presales ask investors to throw in funds and sit back, hoping something magical will happen post-launch. Not PEPENODE.

This new meme coin invites early supporters to step into a virtual mining dashboard where they can build and earn long before the token even hits a DEX.

With thousands of percent in passive income potential and a mining game that is both fun and accessible, PEPENODE ($PEPENODE) is one of the more peculiar (and promising) meme coins to enter the market this year.

Build Virtual Rigs and Start Mining Before Launch

The PEPENODE ecosystem is built around a mine-to-earn concept. However, here everything happens inside a virtual dashboard.

Using $PEPENODE tokens, users can buy digital mining nodes, design their virtual server rooms, and start mining without physical hardware or graphics cards. Since it uses Ethereum’s proof-of-stake mechanism, there is no worry of leaving behind a large carbon footprint, either.

Each node contributes hash rate, energy stats, and reward output. As the mining setup is entirely simulated, there’s no electricity cost or noise. The clean UI tracks the rig’s performance without giving any hassles common to physical mining.

More importantly, presale participants don’t have to wait for listings or the launch day to start earning. The off-chain version of the game is live during the presale phase, allowing early users to rack up rewards and level up their infrastructure much before the Token Generation Event (TGE).

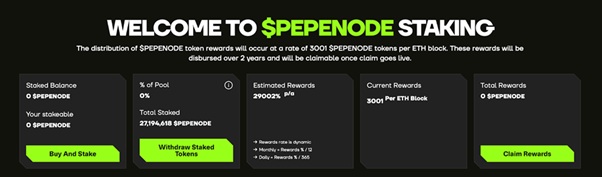

Passive Rewards Stack Up Fast

Mining is not the only way to earn rewards from PEPENODE.

Early adopters who lock their tokens in the system can also earn annual rewards as high as 20,000%, making it one of the most aggressive passive income models in the current cycle.

Thanks to the “Buy & Stake” option, it only takes a few clicks to start earning.

But here is the catch. Those staking from the first round unlock the highest rewards, and the rate dynamically adjusts as more investors join the pool. The earlier the entry, the better the reward rate.

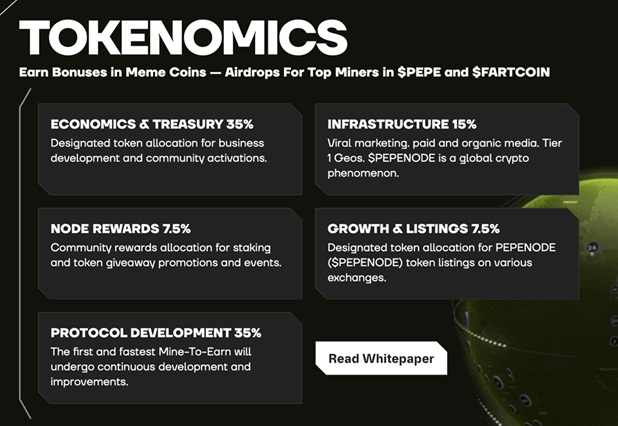

Scarcity Baked in Through Token Burns

Unlike many meme coins that inflate the supply to fuel gameplay, PEPENODE opts for quite the opposite. Every time someone upgrades a node or expands their facility, 70% of the spent tokens get burned forever.

This constant burn reduces the total supply over time, tightening circulation as more players upgrade and compete for leaderboard spots.

This way, the deflationary system actively supports the long-term price appreciation of remaining $PEPENODE tokens. The more users build, the scarcer their tokens become.

When the platform transitions on-chain in Phase 3, all Miner Nodes and upgraded Facilities will be converted into NFTs, giving players full asset ownership and preserving their progress from the presale.

Airdrops, Referrals, and Node Strategy

In addition to staking and burning, PEPENODE’s gamified setup includes layers of strategic engagement. For example, users who refer others earn 2% of their referrals’ mined rewards. It’s a great organic mechanism to drive growth.

There’s also airdrop potential integrated into the roadmap, with meme coin giveaways like $PEPE and $FARTCOIN reserved for top-performing miners. Tiered node systems ensure early players enjoy higher efficiency than late joiners. That’s why timing matters.

Your setup, your invites, and every upgrade decision play a role in what you take home.

Presale is Now Open with Tiered Pricing and Dynamic Rewards

Crypto launches often get hijacked by bots or gobbled up by whales. To tackle this, PEPENODE takes a more grassroots approach. This means all purchases require a brief manual confirmation step. It’s not too complicated to annoy real users, but just enough to trip up automation.

There are no private rounds or VC carve-outs either. Everyone joins from the same starting line, and the team has passed a third-party audit by Coinsult, reducing the risks of hidden vulnerabilities and rug pulls.

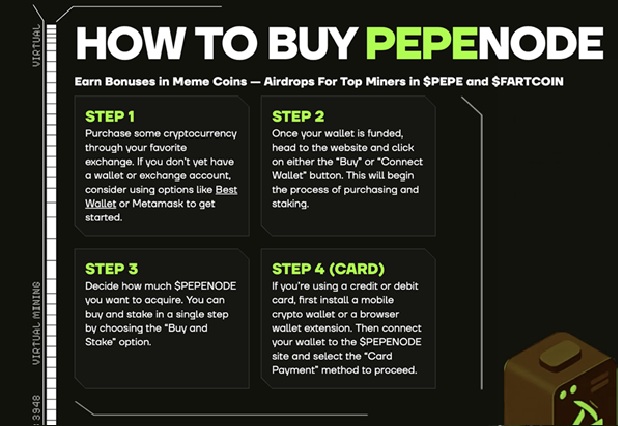

Joining the PEPENODE presale hardly takes a few minutes. You can also use a debit or credit card to join the presale if you’re short on crypto.

Once connected to the PEPENODE site, just select the amount you want to invest and hit the “Buy” button. For those who wish to earn straight away, the “Buy & Stake” option handles both in one go without extra steps.

The presale started at a base price of $0.001 per token, and the price ticks up with each round. So the earlier you join, the cheaper your entry, and the more mining power you’ll lock in when the full platform launches.