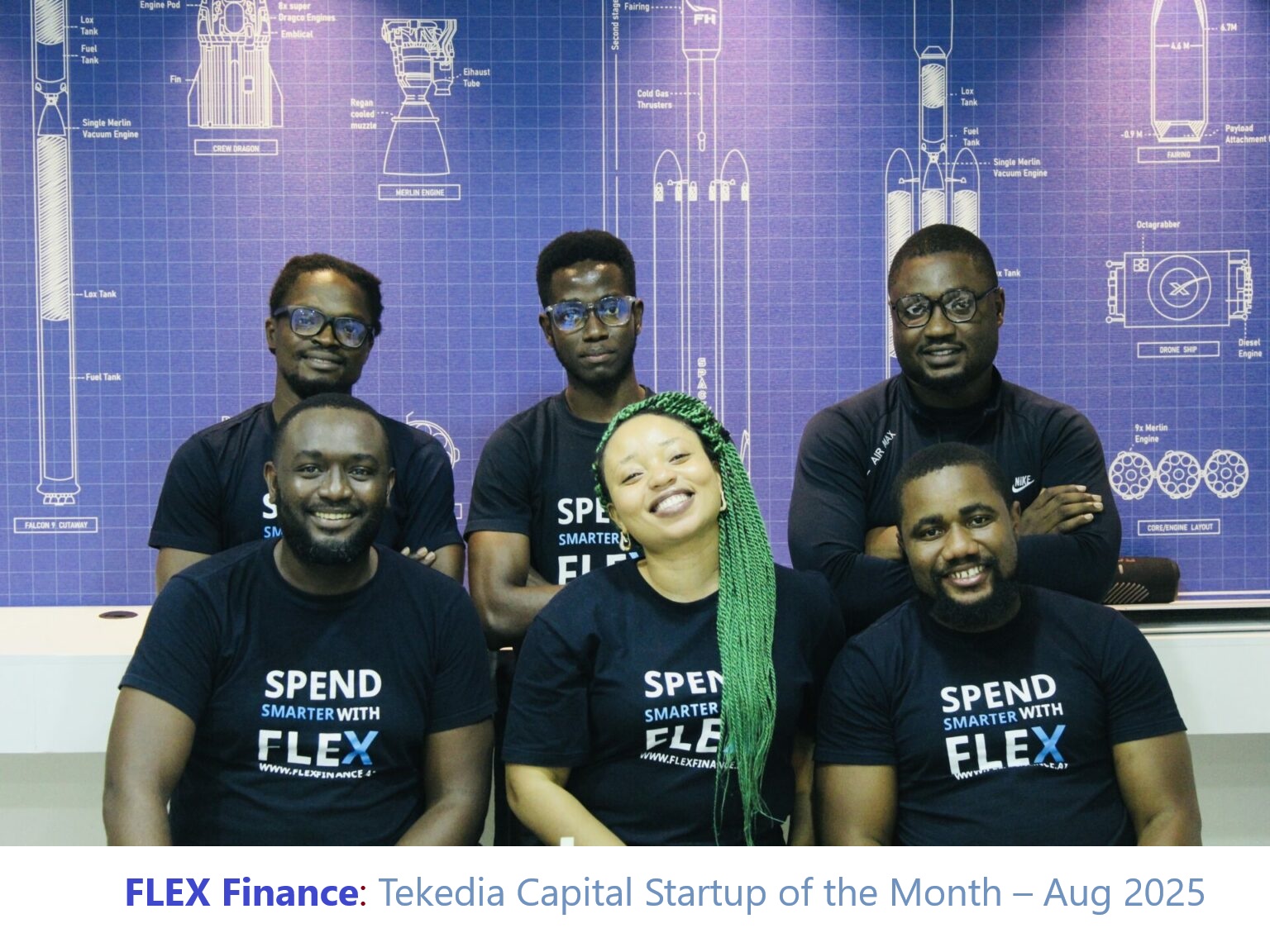

Flex Finance is revolutionizing business finances in Africa, and has just raised a significant amount of capital, one of the largest in this business sector in Nigeria. Tekedia Capital congratulates the team led by Yemi Olulana. They will announce the fundraise later.

For their executional excellence which qualified them before foreign investors to raise this growth capital, Tekedia Capital recognizes Flex Finance as “Tekedia Capital Startup of the Month – Aug 2025” in our portfolio of companies. Well done Flex Team; win more markets as expansion begins.

In many emerging markets, particularly across Africa, the management of business finances remains a significant challenge. The reliance on manual, fragmented processes for tasks such as expense tracking, vendor payments, and budget control often leads to inefficiencies, errors, and a lack of real-time financial visibility.

Flex Finance, a Nigerian-based fintech startup, has emerged as a crucial player in addressing this issue. By providing a comprehensive, all-in-one spend management platform, the company is empowering businesses across the continent to digitize their financial operations, enhance control, and ultimately, drive growth.

Flex Finance’s core value proposition lies in its ability to centralize and automate a company’s non-payroll spending. The platform moves beyond the traditional, time-consuming methods of manual data entry and paper-based approvals. Through its suite of digital tools, Flex Finance enables businesses to create and manage expense accounts, track all transactions in real-time, and automate approval workflows.

This not only significantly reduces the time and resources spent on administrative tasks but also provides finance teams and business owners with instant, accurate insights into their cash flow. The ability to issue virtual and physical corporate cards with predetermined spending limits is a particularly valuable feature, as it allows for greater control and transparency over employee and departmental expenses.

The company’s mission is particularly relevant within the African context, where the business-to-business spending market is projected to reach trillions of dollars. As the African economy digitizes, companies need financial solutions that can keep pace with their growth. Flex Finance provides this by offering a platform that is not only secure—with bank-grade security and regulated partnerships—but also scalable.

By catering to formal SMEs, startups, and mid-level enterprises, Flex Finance positions itself as a partner in their digital transformation journey. The platform’s ability to help businesses uncover hidden costs and make informed decisions on budget allocation demonstrates its role as a strategic tool for profitability and sustainability.

In conclusion, Flex Finance is a compelling example of how targeted fintech solutions can address specific regional challenges. By digitizing and streamlining the complexities of spend management, the company is providing African businesses with the tools they need to operate more efficiently and effectively.

Flex Finance is more than just a financial tool; it’s a catalyst for business maturity, allowing entrepreneurs to shift their focus from the tedious and error-prone process of managing finances to the strategic work of scaling their operations and contributing to the continent’s economic development.

Flex Finance is a Tekedia Capital portfolio company.