MultiChoice, the brand behind DStv, GOtv, etc, is being unbundled from the Naspers empire, for listing on the Johannesburg Stock Exchange. Naspers is the largest company in Africa by market capitalization.

According to www.iol.co.za, yesterday, Naspers has evolved in recent years into two distinct business lines, which are a high growth global Internet business with international focus and African video entertainment business.

Naspers noted that given their divergent paths, there was no longer a strategic rationale for keeping both business lines together and there are no synergies between them.

The unbundling and listing will result in Naspers’ shareholders holding a direct interest in MultiChoice rather than holding that interest through Naspers.

Meanwhile, in its pre-listing presentation, MultiChoice highlighted how it is the leading entertainment platform in Africa.

[…]

Netflix is a massive threat to DStv, and the South African company has said many times that the streaming service is biting into its Premium subscriber base.

While DStv subscribers in Africa have increased in recent years, its Premium package has lost subscribers. This has been attributed to its high prices and competition from Netflix.

Largely, the company is dividing its operations into two: the high growth global internet business and the Africa-focused entertainment business. Typically (but not always – eBay spurn out PayPal, a better business), when you break companies like that, you keep the high growth in-house and strategically kick the underperformer out. That is what Naspers has done here: the global internet business which includes Tencent investment stays under Naspers while the one we have come to know the company in Africa (yes, the MultiChoice) leaves. With that structure, investors can see value which Naspers is creating in the global internet business where it is clearly killing it.

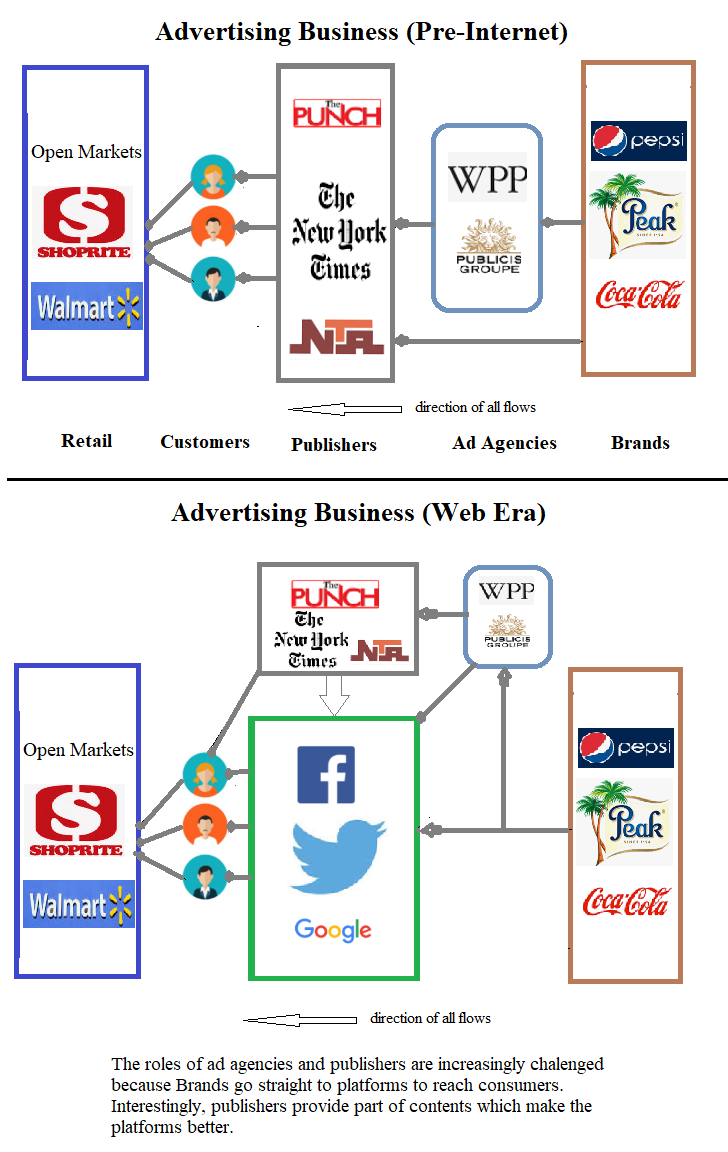

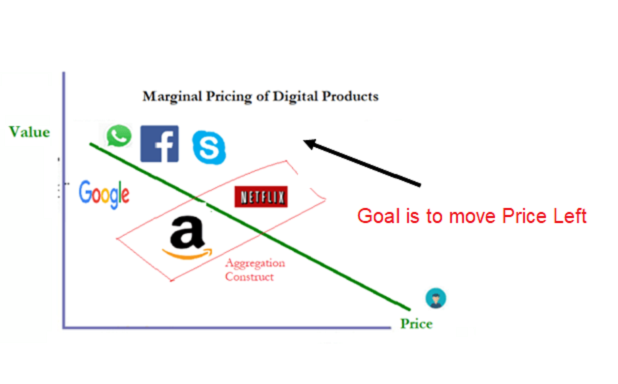

As Guardian noted in the quote above, the threat of Netflix is real, and to a large extent Naspers has given up. Yes, it does not want to fight because it cannot necessarily do much. In a piece in Harvard Business Review, I explained this dilemma (sure – MultiChoice is not a baby in this game). Simply, there is a global march to online streaming and cable and satellite TV providers are imperiled. Yes, they cannot do much because the world is going to converge on the web for entertainment. Naspers understood that and that is why MultiChoice with DStv and GOtv has to leave home, fast.

But the report also marks the final public disclosure we needed to assess the state of cord cutting at the end of 2018. Altice revealed a net loss of 15,000 cable TV customers in the fourth quarter. We already knew that Charter lost 36,000, Comcast shed 29,000, and Verizon 46,000 for the same period. AT&T lost 391,000 for both cable and satellite TV and satellite-only provider Dish Network shrank by 334,000. Net net, that’s 851,000 fewer paying customers for pay TV.

It looks like the legions of cord cutters set a new record for the quarter and are up significantly from a year ago, when one research firm calculated almost 500,000 departed, at the time a historic high.

And there’s more bad news for the industry. Unlike last year, the number of people signing up for cable-like bundles of channels over the Internet also may be shrinking now. Most of the services, such as Sony’s Playstation Vue TV and Google’s YouTube TV, don’t disclose their subscriber numbers regularly, if at all. But AT&T does, and it revealed a net loss of 267,000 DirecTV Now subscribers in the quarter. Dish, which also discloses for its Sling TV service, increased by just 47,000, about one-quarter the gain of a year earlier. Most of the Internet cable packages raised prices by $5 or more a month during the year, cutting into their appeal to cord cutters—most of whom, after all, are motivated by trying to save money. (Fortune Newsletters)

Sure – those numbers are U.S. numbers. Yet, the trend is global. It is just a matter of time for Africa to catch up at scale and that will happen as broadband becomes cheaper. My prediction has been that by 2022, we will have parity in that domain.

For Naspers, it wants to clean house fast to avoid deterioration of financial ratios on its high growth international internet business by this largely post-peak unit called MultiChoice.

LinkedIn Comment on Feed

There’s a popular line in product lines management, “when it’s not working, cut it off.” No one derives joy in losing money with reckless abandon, while growth trajectory looks gloomy.

There will always be admirers for Cable TV, but to keep pace with what goes on in the online version of the business, you have to invest heavily, more than your internet competitors, and yet there’s no guarantee for profits. A quandary of some sort.

Naspers doesn’t want its global internet business to be tainted by the conundrum going on in the cable tv space, so a separation became a good move. Maybe it would be a reverse of what GE did with its financial arm, and then became more ‘troubled’ afterwards, leading to countless restructuring and transformation undertakings.

By the time broadcasting rights for sports is dominated by streaming platforms, then we know that the paradigm shift has become palpable, at the moment, movie watchers are having their day.

Each movement brings with it a sizable loss of jobs, streaming platforms cannot have the kind of workforce DStv commands here, including technicians that install the dishes. May our innovations never increase hunger in the land!