A website is very critical for any kind of business nowadays. A good website helps your businesses in increasing your global footprints, improving customer outreach, and increasing the business bottom lines. A professional level website involves back-end, front-end, and database management system. PHP is one of the most popular server-side programming languages.

There are many popular PHP frameworks that are extensively used for server-side programming in PHP language. Laravel framework is the leading PHP framework with 25.85% share of PHP back-end market share. To have a deeper perspective and more helpful hints on how to use Laravel framework check out this page. It is very important to note that PHP is the leader server-side programming language globally with over 78.8% of all websites live on the internet.

This article will help you figure out the very critical questions that you should consider before you start building a professional grade website. You also have deeper knowledge about back-end technologies and web development trends.

The popularity of Web Development

The total number of websites and web applications at the time of writing this article was over 1.9 billion, according to the Internet Live Stats website. The number of websites grows very fast. Every passing single second adds more than 1 website in the overall number of websites in the world.

Still, in 2018, there are more than 36% small businesses in even the US that don’t have a website, and they want to have one to get the key advantages a website for their businesses. This means, still there is a huge demand of websites across the globe. It is very important to note that the ratio of business failure is very high in the modern world. So, the old businesses continuously fail and new ones emerge on the marketplace. Those new businesses also need new websites. Thus, the popularity of the website will continuously remain in the marketplace.

More than 65% people believe that a company having branded email and website is more credible to purchase products. According to the Statista information, there are 1.79 billion digital buyers in 2018. This number is expected to cross 2.14 billion by 2021.

It is a proven fact that a good website with good website speed increases the credibility, reliability, business sales, and customer reputation in the marketplace. Thus, the demand for a web development company dealing with web development projects will continue to grow all over the world.

Why Build a Website?

If we look at the web development market, both the demand and the cost of building a website are increasing continuously. There was more than 3.9% change in the median salary of web developers in the UK according to the IT JOB Watch information. Similarly, the demand of web developers is increasing at over 25% in the USA, Germany, India, Brazil and other countries.

There are numerous great reasons to build a website for a business. The main reasons for having a professional website with great UI design include:

There are numerous great reasons to build a website for a business. The main reasons for having a professional website with great UI design include:

- A website offers global opportunities to expand the business footprints

- A website helps improve the customer outreach and increase the sales

- A good website improves user experience and customer loyalty

- A website helps you use different ways of digital marketing to make your brand bigger and more attractive

- Websites offer the fastest return on investment ROI

- A good website helps you develop a competitive edge to survive in the competitive marketplace

What Top 5 Questions to Ask Before Building a Website?

Building a website is not as simple as some naive may consider. It is so simple if you want to show static content on a page without any modern features and capabilities. But building a website with all modern features and capabilities required to professionally compete in the competitive business ecosystem is very complex.

You need to consider tens of things before building a website. Let’s have a look at the top 5 questions that you should ask before building a website for your business.

#1 What Is the Best Domain Name?

For any good website, the domain name is the very first interface to connect with the desired audience. A good domain name leaves a great impression on the users. It should be simple, attractive, memorable, and meaningful. The examples of great domain names include Google.com, Ask.com, intel.com, and many others.

#2 What Technologies to Use?

A professional website needs front-end, back-end, and database technologies to be integrated smoothly. There are many great back-end technologies that are very popular in the modern marketplace. Using PHP as a back-end technology is very popular in modern website development. You can use numerous PHP frameworks to accomplish the back-end development. The Laravel PHP framework is the most popular PHP framework for server-side programming. So, choose the right combination of technologies for the back-end as well as for the front-end website development.

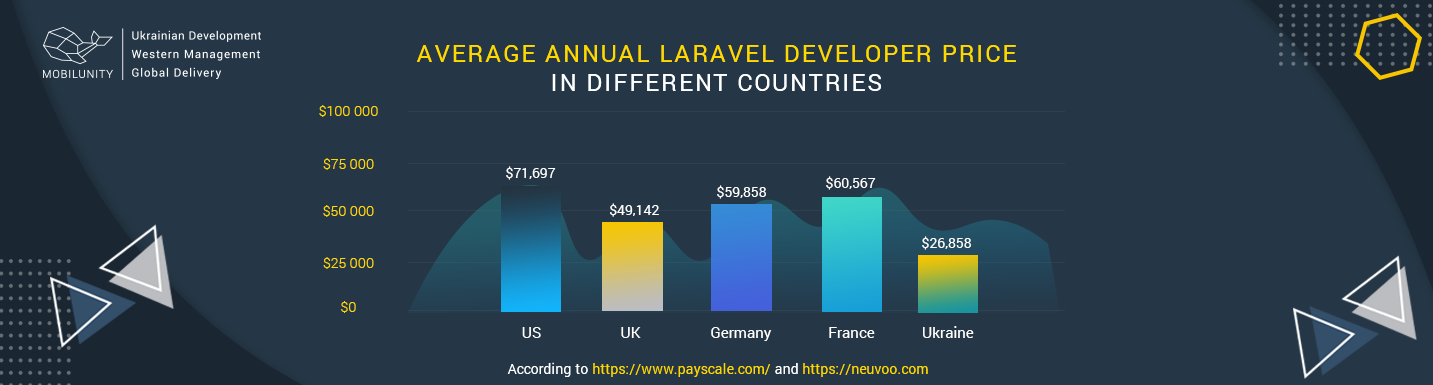

#3 What Is the Cost of Web Design and Development?

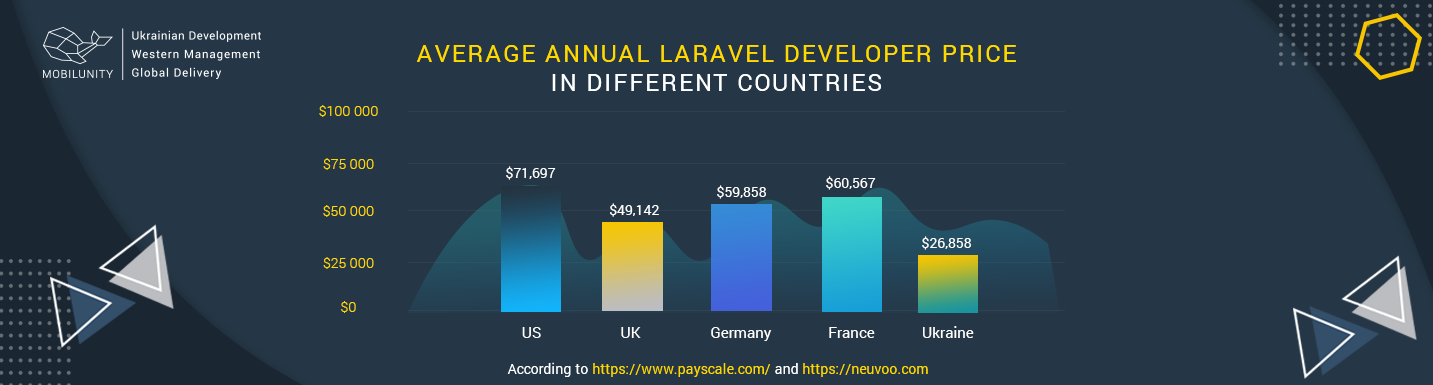

Building a website may cost you in the range of just $500 to hundreds of thousands of dollars. The cost of a website depends on the features and capabilities of the website and the website development cost. The web developer salary depends on the availability, geographical location, and the web development technology that you use. How to hire developers will also play an important role in the overall cost of the web development project.

#4 How to Make It SEO and User-Friendly?

Modern websites should be SEO and user-friendly because search engines and mobile users play a very critical role in the success of a business website. If your website is not search-engine optimized your ranking will go down and you would be lost in the heaps of websites. Similarly, always great user experience on mobile devices by creating good UI design of the website.

#5 How to Integrate Social Media and Other Features?

You should ask your web development team on the integration of social media, payments, comments, user analytics and other options on your website. So make sure to get all those required featured implemented on your website.

Modern Web Development Trends

The web development trends change consistently. Newer styles of website UI designs catch eyes and become trends of the year. In 2018, the following website trends are in use:

- Big and bold typography

- Custom depiction

- Mobile friendly browsing

- Integrated animation

- And many others

The popularity of Laravel Framework & PHP Development

PHP is a very powerful multi-purpose programming language. It is extensively used in connection with the WordPress, which powers more than 25% of the websites across the world. PHP is the second top language on TWM ranking. More than 80% of the websites use PHP scripting language at back-end development.

According to Medium job portal information, PHP is among top 5 highly demanded languages. In the PYPL popularity ranking, PHP stands at the 5th position. Laravel is the top PHP framework in the marketplace. It occupies more than 25% PHP market share in the world. So, both the PHP and Laravel are the top technologies in their respective fields.

Final Takeaway

After having read this article, it is very clear that PHP is the top server-side scripting language and Laravel is the top PHP framework. The demand for the websites will remain for a long time to come. You should consider many questions before building a website, but questions regarding technology, cost, responsiveness, social media integration, SEO, and domain name are very critical.

Like this:

Like Loading...