Since I wrote the piece on moving startups including fintechs to northern part of Nigeria where BVN penetration rates are about a factor of 10 below what Lagos has, many have commented explaining why the move would be a bad strategy. Of course, no one said it would be easy, and without any risk. As I explained in the free-range chicken analogy, opportunities come in uncontested markets for pioneers who have the visions and capacities to unlock them.

Let me quote this comment which largely summarizes most of the points

I don’t agree with you. The most important consideration for any business is the market need for it’s products or services. First off, is there a considerable need for my products/services in a particular market? Is the market ready and sophisticated enough for my kind of business offerings? Who are the people that make up my potential customer base? Are they willing and able to buy or afford my products/services? Will my products be too advanced or simplistic for them? When it comes to Fintech, not sure northern Nigeria qualifies as a viable market (at least not for now). That region is still struggling to embrace basic financial & banking services not to talk of more advanced digital financial services like that which fintech offers. How many of the FG & CBNs financial inclusion initiatives have succeed in northern Nigeria till date? $mart businessmen and investors follow the money and the viable markets when it comes to locating or building their business structures and models. Northern Nigeria doesn’t present such an attractive offer or potential worth all the inherent risks (security & socio-economic) therein. Just several days ago, over 100 persons were killed in Kaduna out of nowhere without any warning. That’s a disaster. (edited)

My response: The commenter is right on all the points noted. Yet, he is making this comment based on the present technology he is aware. If we do believe that innovation can bring disruption through a new basis of competition, it is fair to expect that one can build a financial service technology company in Northern Nigeria at scale. That we have text-based payment system does not mean that is the final state, and what is desirable in Nigeria. Even literacy should not be a barrier if we make that product to be delivered via voice. Our challenge here is the limitation of what we read on Silicon Valley which defines what we expect to deliver to customers in Nigeria. Provided one does not need a high level of literacy to use a mobile phone, it is fair game that one can do banking via voice while being an illiterate. MPESA has not been slowed down because people are not literate. Typically, within weeks, non-educated people pick some key enablers to do their MPESA without any help – how to send money and how to receive money. Then, know the amount!

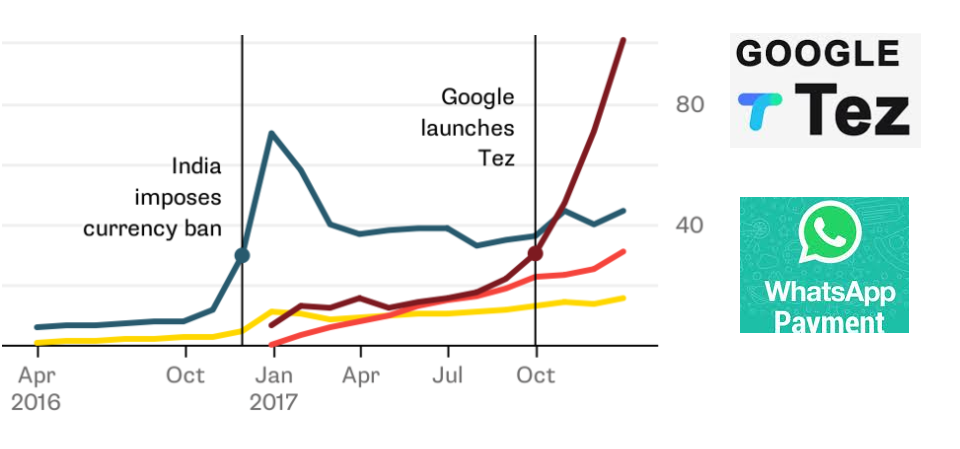

I had noted that Google Tez would also cause disruption with its potential voice banking capabilities. Possibly, Google Tez would come first to Northern Nigeria before our entrepreneurs.

Voice banking will be key in places like Northern NigeriaVoice banking will be presented as secure and convenient and will open new vistas for a really brilliant startup to set a new basis of competition in the fintech world. 2018 is the year of Voice Banking in Nigeria, and Africa. If you have the capabilities, go for it.

—

Simply, I told him “Voice Banking” but it may not be a bank product, but likely from a fintech. We have experienced ecommerce, journeying on mobile commerce, and right now, this is the age of voice-commerce. For Africa, there is no emerging financial technology that is coming in 2018 that will be bigger than voice, and banking (not necessarily banks) is going to be the clear beneficiary in Africa

On security, provided you have MTN and Glo in those areas, you do not need to be in villages to deliver your services. At the end, everything comes down to how you create that product. Yet, no one said it is going to be easy but I am very confident that Northern Nigeria is ready if the right products arrive for the citizens in ways they can use them.

LinkedIn Comment On this Piece

There’s really no argument/misunderstanding on what needs to be done or how it should be done; the only thing remaining is having the capacity to deliver, the market is already there in the north.

Some people are still stuck in the traditional way of product design, whereby a business entity comes up with what it likes, or what it thinks the consumers would like, and then force it on them. But the construct of digital platform has changed all of that. Now, you need to go out and find out what the people want, and how best to deliver it, in order to suit their limitations and other challenges they may have. When you learn to develop products with this kind of mindset, obviously the things you highlight as impediments will vanish.

As for security issues, I am sure many who worry much about security have not travelled to the north before, they rely mostly on what they read and hear. The way you hear about boko haram and bombing, you might be tempted to believe that Maiduguri is a deserted town by now, interestingly there’s still over a million people within the city. If you travel to Kano or Kaduna and spend some time, you will appreciate that there’s so much economic activities happening, with billions of naira exchanging hands.