In organizations around the world, resources are scarce. Firms have to optimize the factors of production as they create products and services while pursuing growth and profitability. The sustainability of any firm depends on the capacity to generate profit. Just as oases are very important in deserts for the survival of their inhabitants, products are vital for firms. Without products, firms die. Interestingly, the very essence of operating companies – fixing frictions in markets – rests on the notion that a company must create the right products to serve the needs of customers. Indeed, due to the imperfect nature of the relationship between demand (the buyer) and supply (the seller), companies exist as intermediaries to “remove” frictions between them.

In other words, if markets have been perfect, we would not need many industries and the companies that operate therein. There would not be a need for a bank, if a man that has $100, seeking 12% annual lending rate can seamlessly find another man that wants to borrow $100 at 12% interest rate. Suddenly, a bank emerges to “remove” the friction by collecting the $100, paying the depositor the 12% interest rate, and then lending it to the other man at 18%. The difference of the 6% is the market imperfection cost, which the bank earns for the services it has provided to remove the friction, primarily information paucity.

A company’s position in the largely imperfect market is determined by its products which help to remove market frictions. The best product in a firm anchors its survival, just as oasis does in a desert. And every business must discover its oasis, if it hopes to thrive. Discovering the oasis is very important because it would help the company to pursue optimal allocation of the factors of production.

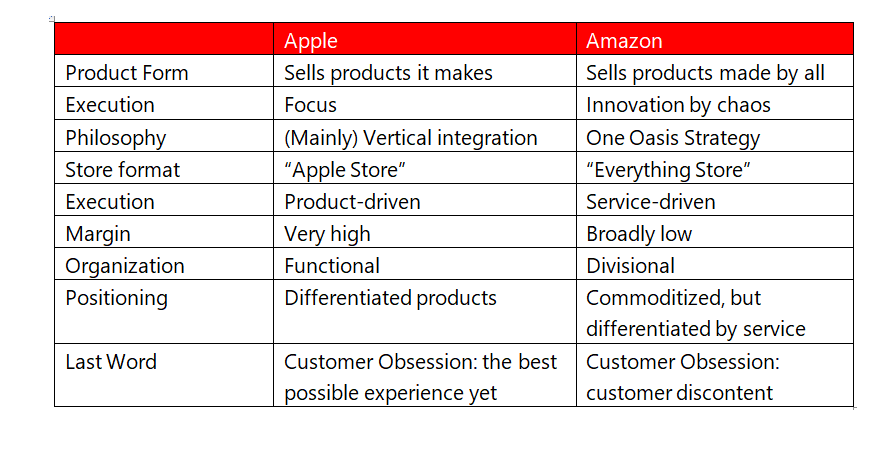

For competitiveness, a company can allocate resources to support its best product (the oasis), providing a pipeline where other internal products can feed from the success of that best product. Simply, in some sectors, if you build your investment around the best product, you will find success, because those investments will have a clear internal “customer”, reducing market risks. In other words, if your new investments are geared to support the best product, and the best product is doing well, it implies the risks on the new investments will be easily managed. Provided the best product continues to flourish, good return on the new investment is assured (i.e. the customer exists, irrespective of the external market). That is the One Oasis Strategy which I have formulated in my practice.

In the One Oasis Strategy, the key element is to align business investment to favour the best product in the company on value and financial return which over time would help the firm compete better externally. It is firstly an inward looking management system, and offers a firm an opportunity to test strategies, models, business systems and production processes, perfecting them before they are launched for outside customers. Yet, the best product is not static. Firms must renew the evaluation process from time to time to discover the present best product. That would help drive business level strategies as investments decisions are made.

The One Oasis Concept

The One Oasis Strategy is the proposition that if the best product drives key investments in a firm, it has the capacity to help other products in the business. Other products would feed from the best product, and on overall, the company would flourish. By removing the inherent risk of external markets, the best product becomes the first and the most important customer for that new investment and in the process eliminates investment risks. It makes firms move very fast because you do not have to even consider external customer opinion since the products are not made for them. Indeed, the time wasted on surveys, focus groups and market research works are eliminated because there is a customer right inside the firm.

This strategy develops marketing positioning not by looking at external market forces but by understanding what is happening in the business, and how it could grow by first improving its best product, even as that new investment could result, in future, a product for the external customers. Anchoring on the best product, the other products are now like the animals that return to the oasis for water, or the humans that depend on the oasis for habitat. Provided that the oasis is there, and doing well, their survivals are assured. Yet, as those new products do well, they could find new customers, beyond the first customer (that best product). That means you can (later) introduce them to the external markets as independent products even when they are supporting the best product.

Finding the best product in a business would involve looking at many indicators like financials, market share and brand. In this age of hyper-competition, need to invest massively to have category-leading products. That requires deploying resources to make them the best.

Application Examples

Amazon: Amazon is an ecommerce company with a massive user base. It supports billions of transactions in a year and needs computing resources to keep its portal running. Amazon could have called IBM for cloud computing infrastructure for its ecommerce operation. Rather, Amazon decided to build one in-house. The ecommerce is the oasis and the cloud is like the animal (in a desert) that finds habitation from the oasis. Provided the ecommerce is growing, the investment in cloud has minimal risk. The first customer to the cloud business was ecommerce and that means Amazon does not have to worry if there is any external customer for the cloud services. Amazon does not need to check market dynamics to invest in cloud provided its ecommerce business is doing well.

But interestingly, after time, Amazon did find opportunities in the external market to sell its cloud services. Those services are now called Amazon Web Services (AWS). The oasis (the ecommerce) has been served by the new product (cloud) and now that new product is also serving external customers.

Samsung: In the global semiconductor business, Samsung is one of the most prominent companies. Others are Chartered, Intel, TSMC and GlobalFoundries. While Intel makes chips it sells to customers to be bundled in products, it does not have major direct customer-end products of itself. Others are largely pure foundries. But Samsung is different: it makes chips, fabricates them, and has products in the markets that use them. The Samsung Galaxy series is the best Samsung product, an oasis, which the semiconductor business is serving at the moment. Samsung can afford to invest in new semiconductor areas like memory chips and OLED display irrespective of what the market trajectories are. Why? The first customer to Samsung semiconductor business is Samsung mobile devices unit. This removes investment risks for the semiconductor as the major customer is in-house. And over time, those new semiconductor products are made available for external customers.

Application Cases

We have used the one oasis strategy in our works with many clients in Africa. For Lagos-based software company, ATB Techsoft Solution, we used the strategy to redesign its investments, pushing the company to focus on its best product (FinUltimate) by unifying developments and capital around it. The product has emerged as a category-king in the local software market. For Abuja-based asset leasing firm, Amaecom, we worked with the company to commit its services and future products to make its best product (BuyNow PayLater) the best possible. These companies have seen dramatic growths: Amaecom has grown to 30 branches with operations in two countries outside Nigeria while ATB Techsoft Solution has quadrupled revenue in two years.

In summary, as we work with our clients in Africa, we have found that a focused strategy to make the best product better is critical. Driving investment decisions to anchor solely on the best product positions a firm to have the necessary capabilities to compete and win even though possibilities to exit those investments into separate products remain in future.