When news broke of the confrontation between Wasiu Ayinde, popularly known as KWAM 1 or K1 De Ultimate, and ValueJet at Nnamdi Azikiwe International Airport in Abuja, the story followed a predictable path in Nigeria’s digital information ecosystem. It began as a celebrity scandal, quickly became the subject of news reports, and then turned into a searchable commodity shaped by Google’s indexing logic and amplified by media framing.

In this piece, our analyst notes that at first, the incident appeared to be just another airport altercation involving a public figure. However, search data reveals a deeper process. Public interest was not simply recorded; it was actively shaped and packaged into thematic clusters that serve both the news industry and the search economy.

From Incident to Search Commodity

Direct incident terms such as “KWAM 1 Abuja airport” and “KWAM 1 ValueJet” recorded hundreds of thousands of indexed results. For instance, “KWAM 1 Abuja airport” generated about 279,000 search results, while “KWAM 1 ValueJet” had around 235,000. Yet these numbers were modest compared to thematic aviation-related terms. “Aviation safety Nigeria” returned over 65 million results, and “no-fly list Nigeria” appeared in almost 40 million results.

This difference shows that once the story entered Google’s ecosystem, it was no longer treated only as a celebrity dispute. Our analyst points out that algorithms began associating it with high-volume and evergreen aviation topics. This ensured that the content remained relevant to a much larger audience and could attract clicks long after the initial news cycle ended.

How the News Media Framed the Story

Media coverage did not limit itself to narrating the confrontation. Traditional and digital-first outlets linked the incident to governance and security, bringing in institutional actors such as the Federal Airports Authority of Nigeria (FAAN), which had over 1.58 million indexed results, and the Nigerian Civil Aviation Authority (NCAA).

This type of framing benefits both the media and the search engine. For media houses, connecting a celebrity incident to official agencies adds credibility and extends the story’s appeal to readers who may be more interested in aviation governance than entertainment gossip. For Google, these institutional references strengthen the semantic connections between the incident and ongoing public policy debates, which helps the story remain visible in search results for months or even years.

Themes and Issues as the Real Traffic Drivers

The search volume for aviation-related themes far surpassed that of the incident-specific keywords. Aviation safety, no-fly lists, and airport security dominate the search space. For example, “airport security Nigeria” generated more than 29 million results.

This shows that the incident was quickly absorbed into a wider conversation about aviation safety and passenger conduct. For Google’s algorithm, these thematic connections are valuable because they keep articles about the incident ranked highly for as long as those themes remain relevant. For the news media, it means that stories can be republished or reframed under broader aviation or security headlines, prolonging their commercial value.

The Underused Legal and Regulatory Angle

Legal references such as “Section 459A Criminal Code Nigeria” and “obstruction of aircraft Nigerian law” appeared far less frequently in searches, even though they were part of some reports. While “aviation regulation compliance Nigeria” had more than three million results, specific statutes remained niche and did not draw significant search traffic.

This suggests that although the media mentioned legal consequences, they did not succeed in making them central to the public conversation. For Google, the lower search interest in these legal terms meant they were deprioritised in ranking. For the media, it was a missed opportunity to connect the incident to deeper discussions about Nigeria’s aviation laws.

Co-occurrence Patterns and Search Economies

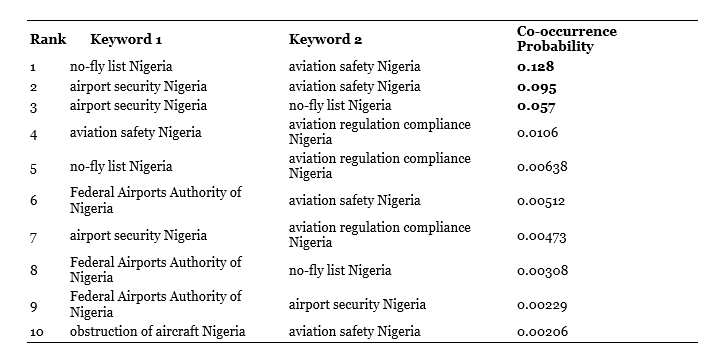

A co-occurrence probability analysis showed that the strongest connections were between “no-fly list Nigeria” and “aviation safety Nigeria,” “airport security Nigeria” and “aviation safety Nigeria,” and “airport security Nigeria” and “no-fly list Nigeria.” These are broad, structural themes that exist independently of KWAM 1’s celebrity status.

The data suggests that while the incident was the entry point for attention, the enduring search value lies in these generic themes. This is a key part of commoditisation: a transient event is repurposed into content that serves as an anchor for ongoing search interest.

Exhibit 1: Top 10 keyword pairs most likely to trend together based on search volume co-occurrence probabilities

The Algorithm as a Cultural Broker

Google does more than passively index events. It acts as a cultural broker by determining which parts of a story will continue to be searchable and which will fade away. Specific keywords like “KWAM 1 Abuja airport” may spike in the short term but will eventually decline. Broader terms such as “aviation safety Nigeria” will keep trending and will continue to pull in any content historically linked to them.

For the news media, understanding this means adapting their coverage. By pairing celebrity names with broader themes and institutional references, they can secure long-tail discoverability. This is why many reports blended the details of the incident with discussions of safety, security, and regulation. It was not just a matter of journalism; it was also search-engine optimisation.