These videos are troubling! A serving senator in a bus stop looking like a thug? I am not a fan of Dino Melaye but just for his office as a senator, it does not have to be this way. But hey, that is Nigeria. It is very painful to watch these videos.

The Aggregation-Integration Construct

Here, I explained the Aggregation Construct using many case studies. I am expanding it by adding the integration element in this video. Integration is a very important component of aggregation and without it, no one can achieve aggregation capabilities. Aggregation drives scalable advantage because of the relative low marginal cost it anchors.

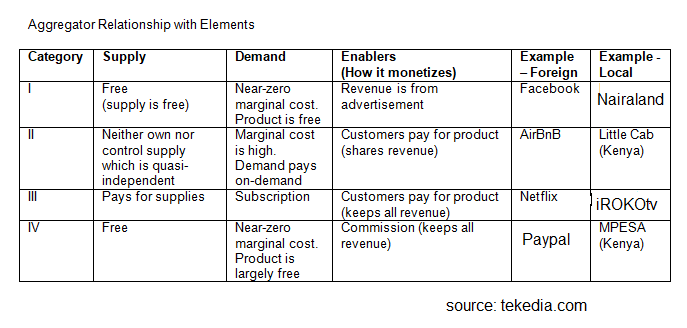

I identify four types of elements in the aggregation construct system: demand, supply, platform and enabler. The platform is very catalytic to make these elements work seamlessly.

Looking at the construct, it is the unbounded and unconstrained internet that makes it possible, primarily because of immersive connectivity. By examining the relationships among demand, supply, platforms and enablers, I identify four categories of aggregators as shown in the table below.

Looking at the integration part, I make a case that only the integration of customer relationship at scale within platforms can enable new basis of competition. And when new basis of competition is created, the outcome is typically disruptive at scale. The video is below.

Business Idea #3: Pan-African Aggregator for Mobile Money & Payment Networks

This daily series focuses on business ideas for those looking to launch new ventures in Nigeria (and Africa in general). The short ideas are archived here.

The Problem

There are many mobile money systems in Africa. These systems are supported by banks, telcos, money transfer organizations, mobile money operators and broad financial institutions. Largely, these systems are disparate and disconnected from one another across Africa. Indeed, a system like Kenya’s M-Pesa is not connected to another mobile money system like Ghana’s Airtel Money at end-customer level.

The Opportunity

There is a clear need to link these mobile money ecosystems across Africa. In other words, there is a need for an aggregator that can integrate and link all these systems together. That way, someone with Airtel Money in Ghana can seamlessly remit and transfer money to someone using M-Pesa in Kenya in a way that location is eliminated with all compliance issues automatically handled by software.

Action Roadmap

Develop an API that will enable mobile money systems to become members of the aggregator system. Once connected, all their customers can then remit and transfer money across regional and national boundaries and borders while complying with all local regulations at receiver end. The aggregator system should support banks, mobile money operators, mobile transfer institutions, and companies with end-users in mind.

[Video] Different Business Models to run Energy (Solar) Venture in Nigeria

In this video, I explain the different business models to run energy (solar) small venture in Nigeria. I have also provided examples of companies using the models. The full text is here.

Business Idea #2 – Location Agnostic Pan-African Remittance /Money Transfer

This daily series focuses on business ideas for those looking to launch new ventures in Nigeria (and Africa in general). The short ideas are archived here.

Problem

Over the years, sending money from Europe/US into Africa has advanced. The transaction cost continues to drop as innovations and more players enter the sector. However, remittance/money transfer within Africa (i.e. from one African country to another) continues to be expensive and non-optimal.

In this videocast, I discuss the need to build a truly pan-African digital remittance/transfer banking product which is agnostic of location or currency in Africa. None of the products we have today meets that standard. Largely, I envisage a situation where all you need to buy and sell across Africa is one bank account in just one African Union country. With that, you do not have to even think about the specific currency of that account as technology will seamlessly make it possible to access other African markets for payments, transfer etc. The banks or fintech companies must still comply with all regulations related to inter-national transfers, forex etc. The only difference is that customers will not see them as they will be hidden with technology

Opportunity

African intra-trade is low partly because sending and receiving money within Africa is hard. Just as many airlines will need to take you to Europe [for a trip originating within Africa] before taking you to another African capital, most money going from one African capital to another does require passing through London or New York. There is a huge market opportunity to fix that business friction by improving efficiency, speed and cost.

Action Roadmap

Build a payment system and settlement networks using modern technologies like blockchain, mobile money, etc with capabilities to serve broad spectrum of customers across Africa.