Policy Development Process includes the following: Develop policies that you plan to implement: A policy that you are unable or unwilling to implement is useless. If your policy states that internet usage is strictly allowed to conduct office related work, but you do not block website access or have the competency to monitor internet activity […]

14.0 – Security Policy and Law

Security Policy is a set of high-level instructions. These instructions describe an organization’s entire security strategy. Policy is typically high level and strategic, and if it’s of high level; it seldom changes. With policy, you can have an appropriate security plan. Indeed, while your business may have lots of security controls, you may still not […]

The New Era: Money Transfer from New York to Lagos at Zero Fee Coming

If markets are perfect, there would not be companies. Yes, if buyers and sellers could transact businesses without frictions, we would not need companies. But since there are frictions in markets, we need companies. They provide services to “melt” those frictions. That is why we pay them, and they earn their fees.

In international remittance, there is a major friction. The friction here is that someone in New York has money to send another person in London (or Lagos) and doing that is hard. Typically, a bank exists to fix that friction. We pay the transaction/remittance fees. That is how Western Union, MoneyGram and banks make money.

But a startup thinks that technology has made it possible that the friction has gone, and that means there is no need to pay any company to “melt” that friction. That startup is Circle, a company funded by Goldman Sachs. It now allows entities to wire money from U.S. to Europe at zero fees. That is the new era. It has already arrived. They make the transfer without loss of exchange rate. It costs $0.

Blockchain-based payments startup Circle Internet Financial on Thursday launched an international online money transfer service that allows people in the United States and Europe to send money to each other instantly and at no cost as it seeks to tear down borders in the payments world.

The new service is part of a push by the “fintech” — or financial technology — sector to compete with established financial institutions, by using digital technologies to offer cheaper and more user-friendly services, often via smartphones.

Boston-based Circle Internet operates its app-based peer-to-peer payment network using blockchain, the technology which first emerged as the system underpinning cryptocurrency bitcoin.

One of the most well-funded blockchain startups, its investors include Goldman Sachs Group and Baidu.

[…]

“When’s the last time you sent a ‘cross-border email’?” Allaire said in an interview. “The idea of cross-border payments is going to completely go away. … Our vision is for there to be no distinction between international and domestic payments.”

Using Circle

On its website, Circle noted: “Finally. You can share money like everything else online — whether your friends are in the same room or a different country. Super easy and totally free. The way it should be. Free. We’re free to download and to use — wherever your friends are. Even between currencies, there are no exchange rate markups and no fees. (The rate we get is the rate you get.)”

How do you compete against zero? I am not sure, the new era is here. I do believe that within 7 years, we could move money from New York to Lagos at absolute zero transaction fees with no exchange rate markup. That is the real melting of friction, made possible by technology.

Overcome Your Teen’s Stress With The Parental Control App for Android Phones

Do you find it difficult to make your teen wakeup early in the morning for school? Do you have to call them at least 3 times and after 3 cycles of waking him up every 5 minutes, he is finally up and now rushing for school. Is this an everyday routine in your house? Do your teens always look irritated and complain of having a headache all the time? The reasons could be sleep deprivation, peer pressure, maintaining a body image and many more. Parents nowadays put so much pressure on their teens to ace studies and social life at the same time that they may not even find time to relax themselves.

Sure you’re thinking that everybody is stressed these days, and you push them for their own good, plus how stressed can teens be? But think again, because teens today are as stressed as adults! A recent report by Los Angeles Times shows that on a scale of 1-10 (1 being the least stressed and 10 being the most), stress in teenagers was reported 5.8 while average stress in adults was reported 5.1. That is even slightly higher than grownups! Even without the worries of having a job, taking care of family, mortgage and other adult worries they are as stressed as you. Imagine how stressful would their adult life be at this rate. After this it is no shock that 1/3 of US teens have considered suicide!

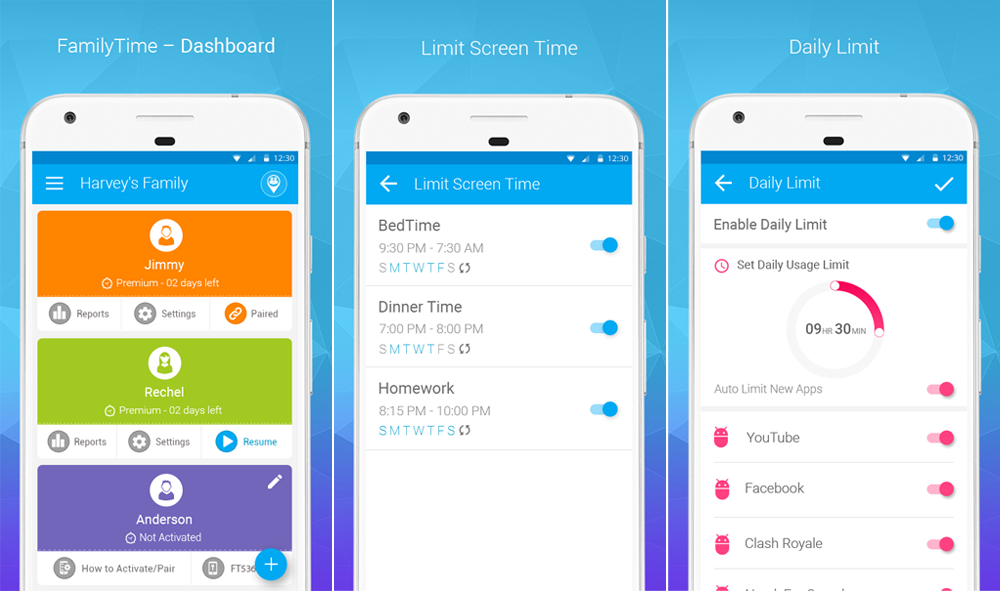

This can be very concerning for parents, not only are teens sleep deprived and stressed due to studies, but also because they are up all night on their cell phones. Teens tend to spend all their spare time scrolling them, it is important that they spend less time on their phones and more time sleeping at night. You can use many ways to reduce the time they spend on their smartphones, but a smart way would be use parental control app for Android to reduce their phone usage and counter technology with technology.

But first have a look at these symptoms to determine whether your teen is stressed or not:

Symptoms of teen stress:

- Irritability

- Frequent headaches

- Queasiness

- Weariness

- Increase in heart rate

- Bad temper

- Pessimistic views

You can also ask your teen to take this stress test to find out their level of stress. If the results indicate that your teen is even moderately stressed; it is important that you take steps to ensure that your teen is safe from further problems. As too much stress can lead to depression and has many adverse health effects. So what can you do to ensure to relieve your teen of stress?

Parental controls are here to help:

Keeping your teens up-to-date with the latest technology is important but teens tend to get addicted to their smartphones or iPhones which is not healthy. But taking away their phones or repeatedly telling them to leave their phones will only increase their stress and damage the bond between you two. So why not join the smart parenting group and turn to parental control apps for help? There are many apps in the market but the most popular one with parents these days is FamilyTime. FamilyTime not only lets you monitor your teens online and offline, but also lets you control the time your teens spend on their phones. You can download this app for free from iTunes and from your Google Play Store.

FamilyTime lets you remotely lock your teen phone from your online Dashboard and disable their phone. You can use this feature to lock their phones during study and sleep hours as they tend to easily get distracted or are just addicted to their phones. Also when you lock their phone you will receive an activation code, and your teens cannot use their phones until that code is entered on their child app. This means no out smarting you!

Fintech’s Asymmetric Warfare in Africa

I wrote this week in the Harvard Business Review that African startups may struggle to compete with ICT utilities like Google and Facebook. Interestingly, the new landscape goes beyond startups: everyone is going to be affected.

Google has a peer-to-peer payment in India called Tez. It has been doing well. Facebook has a messaging app called WhatsApp which we all use in Nigeria. Until recently, Google was doing its payment while WhatsApp was anchoring chat. Then the war began.

Google has added chat in Tez. It did that because WhatsApp has also included in-payment capability. With excess of 200 million users and practically anyone with smartphone in India, WhatsApp has a solid positioning. Google had to add that chat to at least keep its customers.

The biggest loser and increasingly vulnerable is the local payment company, Paytm. Paytm had added a chat option also but it is losing steam. Everyone is doing the same thing for that final moment of glory, even coming from opposite trajectories.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/58934079/tez_pay.0.gif)

Both Google and WhatsApp have built their services atop the Indian government’s Unified Payments Interface (UPI) system for transferring money by tapping into bank accounts directly rather than maintaining a virtual wallet. However, it’s clear that they’re going about the design from opposite directions — one company is adding payments to a chat app, and now the other is adding chat to a payments app.

Look carefully in these solutions, you would see one feature: platform. Yes, everyone wants to drive that consolidation where its platform is the place everyone comes. In coming weeks, I expect them in Nigeria. They are experimenting in India but Nigeria is not far. GTBank would be waiting because as the CEO noted, it wants to be a platform also:

To “create a platform and partner anybody who has a service to offer. So that if as a customer, one comes into our ecosystem, you can do just anything. You could do your banking business, buy your tickets, insurance, travel; if you wanted a 10-day pay day loan, you can do it. So, really we want you to come into our ecosystem, maybe five times a day to do different things other than banking.”

If you are a fintech, there is an asymmetric warfare looming. If payment becomes a chat conversation, I am not sure the value of even opening another app to make payment.

Yet, there is no reason to lose hope as Transsion (makers of Tecno) plans to go public. The phone maker defeated Apple and Samsung in Africa. Yes, our fintech can repeat same against the likes of Google and Facebook as they converge.

Led by founder Zhu Zhaojiang, Transsion shipped nearly

12 million[see comment below on this number] smartphones to Africa in the first three quarters of last year, helping it leapfrog Samsung Electronics Co.and Apple Inc. to become the largest player on the continent, according to researcher Canalys. The Chinese company has become the biggest seller in countries from Kenya and Nigeria to Senegal.

But fintechs should remember the untapped opportunity: intra-African remittance.

Ahmed sees this as an important opportunity for his company to fix a multi-billion dollar money transfer problem between neighboring African countries. This wouldn’t just have a significant impact on the hundreds of thousands of Africans moving between countries in search of a decent living, but also even those traveling on short business trips. Not only does technology add a convenience to the process but in Africa it brings a layer of transparency to things like exchange rates which should have significant impact and encourage more economically beneficial movement between countries

We cannot forget that. Yes, someone has to fix the problem of moving money across Africa.