When Geopoll noted that Facebook has become the second largest ecommerce platform in Africa, after Jumia, many were surprised. But in reality, it should not be that hard to see: Facebook is a planet and any ecommerce company can only get a subset of that planet. In other words, most ecommerce players are only going to lure a small segment of the Facebook users to its platform. And that would require a lot of work. So, if Facebook makes it easier for people to buy and sell, it would dominate the category without a lot of efforts.

That explains why the news that WhatsApp has added payment in its services in India should concern many fintech players (and banks) in Nigeria. India is always a test ecosystem for the developing market. Once perfected, in India, I expect WhatsApp to launch the product in other places including Africa.

WhatsApp has begun testing a new payments feature in India that will allow people to send money to other WhatsApp users, excluding merchant accounts. The feature is currently in beta, according to sources familiar with the company’s plans, but hasn’t been publicly announced because it’s not widely available at this time.

The company has been working on support for a payments feature for some time, which would take advantage of UPI (Unified Payments Interface) and include support by a number of Indian banks, including State Bank of India, ICICI Bank, HDFC Bank, and Axis Bank.

Now, add banks to the list of entities which would be worried about WhatsApp. The telcos have hated the global messaging app; now the banks join the fray. The risk to banks is clear: if WhatsApp becomes very successful in payments, it may become a small bank of itself. In other words, if people decide to be leaving money in their wallets without moving them to their bank accounts, most banks would struggle [liquidity issues].

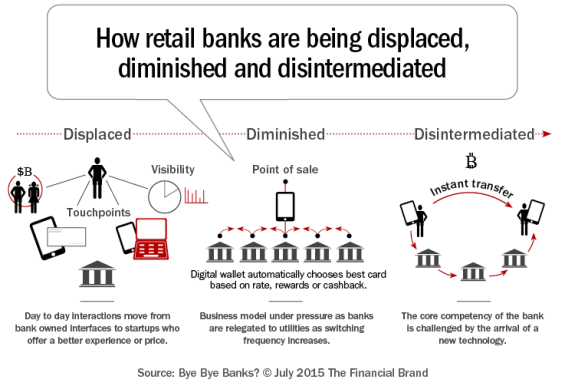

In other words, you can leave N100k in your WhatsApp account to handle basic things, and only move the money to the bank when you need hard cash. Under this scenario, the bank is merely serving as a dumb terminal which is good when you need to withdraw cash or pay in money. Once the money is in the wallet, you have no need of your bank. Think of what MPESA did to banks in Kenya: disintermediation which means the “removal of intermediaries in economics from a supply chain, or cutting out the middlemen in connection with a transaction or a series of transactions”.

Most Nigerian banks are enjoying growing transaction-based fees with ATM charges and all kinds of charges including stamp duty on digital transfer. WhatsApp could help Nigerians to handle their financial transactions without hitting any bank server, and in the process avoid most of those fees. The excessive fees would push many people to adopt WhatsApp. Just load your WhatsApp wallet, and from there handle basic things of your life. Provided the money is leaving the wallet, banks would not access the stamp duty, SMS fees, etc.

And this would explain why bank apps may not add much value in coming years: they would be totally disintermediated. Who needs to leave WhatsApp to launch a bank app before he or she can send money to a friend chatting on WhatsApp? None, if WhatsApp supports payment and transfer. As that happens, watch out for Western Union, MoneyGram and other global remittance entities to begin to struggle as they experience a new level of competition in the market.

Some Comments from LinkedIn

-

Another very insightful article from Ndubuisi Ekekwe I remember, about 13yrs ago, hinting Interswitch on the reality of disintermediation as they made type approval of POS terminals seem like a journey to space. Today payment aggregators have taken a chunk of their market share creating opportunities for agile companies like eTranzact International PLC AppZone Parkway Projects Ltd. Flutterwave Paystack to mention just a few. Similarly, mobile operators are stiffling a huge economic potential in the sector by failing to fully open their APIs for development of value added services that would generate new revenue streams and create wealth. Meanwhile, they are lobbying for the NCCto restrict use of WhatsApp and other OTT for eroding their revenues. Banks on the other hand are reluctant to evolve into the global trend #OpenBanking. They don’t seem to understand the importance of collaboration with FinTechs but see them as competition. We requested for mobile recharge API from a leading bank 5 weeks ago we’re still pushing emails back and forth today. I read few days ago PiggybankNG reached a milestone of mobilizing N1 billion savings. SureRemit raised ICO of $7m – the stories are endless. I hope banks would be smart & act swiftly

-

Ndubuisi Ekekwe Online payments in China: In 2016, 500+ million Chinese used mobile payments and transacted 97 billion times on non-bank mobile apps valued more than US$8.51 trillion with Alibaba and WePay chalking 54% and 40% market share respectively. What the government has done to regulate online payment system is to have them route all transactions through a newly created Internet Clearing and Settlement Platform. A shift from current direct connection model which bypasses the Central Bank’s clearing system which makes it difficult for regulators to track and monitor the capital flow of those payments.