Many have contacted me for some perspectives after I posted something on the stock market. I had noted that loss of value may happen, and suggested that people may need to leave instructions with their brokers, to pull the triggers, if the mayhem should continue. I am not sure what would happen. And no one is ever sure. Just as in politics, I like the stock market because there are always hard outcomes: elections come with winners and losers, and stock prices rise and fall. So, any statement can be tested and benchmarked with real results, unlike say approval rating and popularity of leaders which provide no definite outcomes to validate them.

Now, are you on alert in case this sell-off continues? If you have equity anywhere, please do not be far from your broker. Have an outstanding instruction to pull the trigger if the mayhem continues. We may be in for market correction, but it is too early to talk that.

I explained to the people that checked that it would be premature to start making decisions because of few isolated bumps. The key is making sure that it is not yet a negative pattern that is sustained. At this point, nothing has happened to trigger that tsunami of fear which can move markets at unprecedented level within a very short time.

Yes, I explained that I had personally gotten out of stocks few days after President Trump passed his tax law in the United States. I was a banker; I continue to work with leading bank clients on strategies. As an entrepreneur, I practice what I teach.

One thing I know is that inflation is always fought vigorously by any government. If Trump Tax Law makes U.S. firms to bring money home, they would pay dividends to shareholders. Also, they would give out a lot of money to their workers. Possibly, they would invest here and there. Those are all great stuff. The economy would horn and people would have great Christmas, and Black Friday would become Spend Friday. The consumer confidence would be huge and general business sentiment would accelerate.

However, as government begins to fight inflation, many things would happen. The Federal Reserve of U.S. would hike interest rates. When it hikes rates to curtail inflation, the cost of capital would go high. Then, immediately, many companies would start watching their shoulders. So, borrowing would become a little more expensive and spending would become more managed. Stock market traditionally does not always perform well in that domain as bond market would become more attractive since high rates would favor it for investors. Besides, if rates are high, savers would have alternatives as they can make money by saving. Right now, there is no value in saving because rates are artificially low. But if rates go high, saving would improve. That means, saving becomes an option besides investing in stock markets.

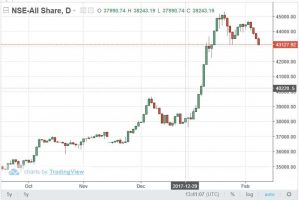

In Nigeria, specifically, I do not expect a lot of contagion from foreign markets to affect us, since at the moment, most of the funds in the Nigerian Stock Exchange (NSE), are indigenous. So, anything that happens in countries like U.S. would have marginal impacts in our stock market. Sure, there would be impacts, but only minimal. It is unlike 2008 when foreign investors were heavily invested in the NSE, and when they pulled money to cover losses in their home countries, they triggered local dominos largely driven from the fall of Lehmann Brothers. This time, it may not be so since the roughly $40 billion market caps of the Nigerian Stock Exchange are mainly local capital.