We are fixated on the Over-the-Top (OTT) solution providers like WhatsApp, Skype and WeChat which allow people to consume audio, video and other media services directly, via the Internet, as standalone products bypassing telecommunications service providers that typically function as the gatekeepers of such contents. The implication is that OTT deprives companies like MTN, Glo, Airtel and 9Mobile extra revenues besides what customers have paid them to have access to the Internet.

In most strategy conversations, people are focusing on these OTT companies. Interestingly, there is a huge disruption that is coming which may even deprive the telcos the mere opportunity to even earn at least the fees customers pay them to have access to the web to do the WhatsApp and Skype in Africa. KonnectAfrica is leading that charge and it is ferocious. From a newsletter:

Konnect Africa, the Eutelsat-owned satellite broadband service provider, has unveiled SmartWIFI, a new hotspot service, as part of its ongoing commitment to bring digital opportunities to Africans.

This new service leverages Konnect Africa’s powerful, reliable satellite broadband network to enable sales outlets (retailers, hospitalities, gas stations, etc.) as well as healthcare centres or schools to become a connectivity point and digital gateway to opportunity for the surrounding population. Users will be able to access the internet from a distance of several hundred metres around the hotspot. Access can be extended to several kilometres through off-the-shelf Wi-Fi repeaters.

Users can access the SmartWIFI service through vouchers or mobile payment schemes. In addition, SmartWIFI comes with a unique local data storage system, enabling users in remote areas to access smart digital content free of data charges, including online courses and education programmes, sports and entertainment. Mobile and computer applications will also be available to help support daily business activities.

If this company succeeds, we will see a new basis of competition in the telecommunication sector. While many may argue that satellite broadband may not be as fast as terrestrial broadband, the fact remains that the satellite technology has improved over the years for broadband services. What KonnectAfrica is offering is a threat to the present telcos business models. Satellite broadband cost model is better since it is using satellites, meaning that its products will be cheaper.

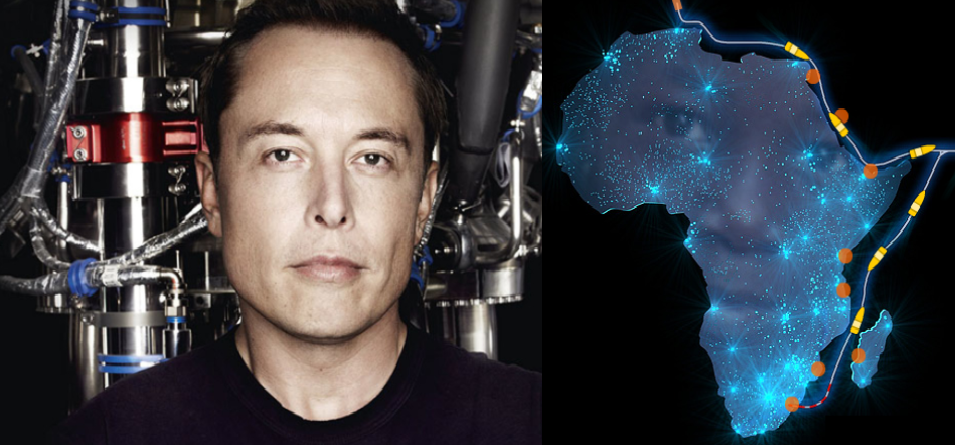

Elon Musk is coming with satellite broadband in 2019 and Africa is one of the main focus areas. Who wants to compete with Musk? He is the most brilliant innovator in our time, and I do think he wants to do good in Africa with these satellites. That means, the price will be low. Innovators offer better services at usually lower costs.

Elon Musk’s SpaceX plans to start launching satellites into orbit in 2019 to provide high-speed internet to Earth. In November, the company outlined plans to put 4,425 satellites into space in a Federal Communications Commission (FCC) filing. But the document gave little detail on the timeline

The SpaceX is expected to cut the cost of broadband in Africa by least a factor of 2. It is going to be a brutal moment in the industry because other players will join the competition. Just as KonnectAfrica is doing, most of these players will bypass the telcos working with schools, churches, mosques, and health centers as business partners to reach their customers. Just like that, terrestrial telcos will be cut-off. The threat is many orders of magnitude to what OTT is giving them today. OTT gives them options to earn internet connectivity revenue; satellite broadband provides a new basis that does not follow their paths.

Meanwhile, many global players have seen that Africa is the growth market for telecommunication services. Nokia and Vodacom have signed partnership to trial “Nokia 5G technology to accelerate the launch of the new technology and enable Vodacom to drive digitalization for the benefit of businesses and individuals in South Africa”. As Vodacom is working with Nokia, MTN and Ericsson have also sealed a deal on 5G trial.

Ericsson and MTN have announced the first 5G trial in South Africa to start in the first quarter of 2018. The two companies signed a memorandum of understanding (MoU) at AfricaCom 2017 to collaborate on the rollout of 5G technologies in South Africa, one of the first in Africa.

All these developments are expected. In my projection, I expect 2022 to be the year Africa will have immersive connectivity. That is turning out to be so, in the making. My models are coming out fine.

In today’s videocast, I make a case that Africa will enter the era of affordable broadband internet in 2022. That will be the year we will begin a new dawn of immersive connectivity where you can eat and surf all you can. Industry players will take off the Internet meter and then focus on service, experience and quality. From satellite broadband vendors to the MNCs with balloons and drones, the sector will become very competitive and service will drive growth. This has happened in the past – every decade, Africa experiences a major industrial transformation. We saw that in banking and voice telephony. 2020s, starting at 2022, will be the decade of immersive connectivity.

All Together

As you build web products and services, have in mind that by 2022, most African cities will be at parity on broadband with most areas of EU and United States. My model and capacity to track technology penetration have given me confidence that our business model can shift to an era of affordable Internet, starting 2022. It will change many things including more global competitors and access to new markets. Even the products we make today which are designed for metered Internet may evolve because Internet will be more affordable: from Facebook to Microsoft, from KonnectAfrica to the telcos, we will see huge price collapse. That will be the beginning of the new era of web business in the continent.