Bottomline: In this piece, I present five phases which are necessary to build high performing technology-enabled companies in Africa. Indeed, the thesis goes beyond technology but to any specific industrial sector. I also explain that one of the key elements of high performing companies is arriving in the market with new ways of doing things. […]

To bridge the gap in accessing unsecured short-term micro-loans in Nigeria, Interswitch in partnership with six lending banks and three innovative credit providers has introduced a lending services platform.

The lending platform, named Interswitch Lending Services, is an intervention, which essentially resolves the challenge by providing credit analysis and scoring based on customer historical transaction data which bank and non-bank credit providers can leverage to provide collateral free micro and nano loans to individuals and small businesses across the channels

This is going to become the most important product Interswitch will be launching. I do expect ILS to be bigger than the present Interswitch, and over time, may have the present Interswitch folded into it. If the company executes this well, it will have the most important product in the Nigerian financial sector. Nigeria’s credit sector is untapped and any leader that pioneers it will reap huge benefits.

Interswitch has accumulated capabilities with products like Verve (credit: pulse)It is starting with FirstBank, UBA Bank, Heritage Bank, Unity Bank, Fidelity Bank and Ecobank. The lending partners are Paylater, Kwikcash and Ferratum. I expect the pool of the banks to expand in coming months. There is no need for a bank to be outside this league. Yes, it needs to cover all the banks. Provided it is working with NIBSS, ILS can have a very good view of any Nigerian banking customer, preparing the data for the lending partners to make loan. Possibly, the partner banks will have only their customers participating initially.

The Interswitch Tax

ILS is leapfrogging here with no need for brick-and-mortar credit system, moving immediately to the digital-first domains. Internet is going to anchor this vision with the unbounded distribution channels it offers. This makes this product scalable. ILS will serve as an aggregator of data. ILS is a pure aggregation construct business with a high scalable advantage. It aggregates data created by banks and using that data to package a product used by the lending partners. With Internet, the marginal cost of this business goes low which makes it extremely scalable, for Interswitch. As it accumulates more data, ILS gets better and grows. This becomes a positive continuum. The end result is a virtuoso circle of innovation that will have implications in the Nigerian banking sector especially in the retail space. All banks will join and just like that Interswitch Lending Service will become the national credit bureau. With that, everyone will pay Interswitch tax, to tap into that data. ILS may consider some of my suggestions as it becomes a vehicle for the new financial system of Nigeria.

The alignment of the interests of the banks, credit bureaus and citizens will be catalytic in establishing a functioning credit ecosystem in Nigeria. This is not included in the current CBN’s guidelines for establishing credit bureaus in Nigeria. We cannot do it the way the Americans have done it. We need a system that provides a citizen element so that credit bureaus have clear incentives to deliver good services. You cannot be selling people’s data and yet have no incentives to serve the people and protect their data. With this proposed model, the oligopolistic system that runs in the credit bureau industry will be dismantled in the Nigerian model. The outcome will be a virtuoso credit bureau system that secures customers data as it serves its core customers, the banks.

The Aggregator-Bank

With the use of BVN, in future, loans can be offered to non-bank customers. All ILS has to do is to synchronize the BVN of a customer with its phone data. And through the phone, it can even offer loans. So, you can see people getting small loans delivered through their mobile phones with phone/recharge card agents becoming cash agents. The key thing here is the availability of data which provides deeper insights. Banks are not necessarily critical to execute this, though they will be important to initiate it. Interswitch makes that clear in its statement when it noted that “non-bank lenders” can be supported. If Interswitch can effect the loans to non-bank customers, it simply means that it is indeed a bank! But a better bank without the burdens of capital adequacy and financial ratios usually imposed by the regulator, the CBN. Sure, Interswitch is already an entity registered and regulated by CBN, but of course, not as a bank.

The solution focuses on enhancing financial inclusion by providing a tested and reliable end-to-end credit administration infrastructure, which is open and flexible enough to accommodate both bank and non-bank lenders.

The Platform has been integrated by Interswitch to what is perhaps the largest customer database, allowing almost 16 million Nigerians (which includes active customers on Quickteller) to be assessed for possible qualification for a loan. Interswitch had formed strategic partnerships with a number of credit providers to efficiently target customers who are available on those partner platforms, offering nano-loans at attractive interest rates and based on available credit history and predictive analytics through information technology to determine credit-worthiness

Under the aggregation construct, the lenders take the risks. Others supply the data; ILS simply aggregates and packages the data. This positions this company to become one of the most important firms in the nation in coming years. Interswitch is playing at the upstream here, relying on its downstream partners in the Interswitch ecosystem and 16 million people in its database. It has a brilliant vision.

The $1 Billion Business

Interswitch is now moving on its vision to become a truly indigenous unicorn, technology-enabled business with at least a billion dollar in valuation. I do think an effective execution of this business model will put it in that league. ILS will not just grow revenue; it will also bring more customers to the Interswitch ecosystem. Watch out for growth in Interswitch associated debit cards, quickteller and businesses of its bank partners. People will begin to make decisions on how they can be in ILS network in order to build histories that will qualify them for loans. The company will execute this growth at largely minimal risks. The lending partners take the risk but benefit through expanded access to higher pool of customers. The banks will also get a cut for providing the data. Over time, I expect some of the banks to open their own micro-lending products to compete with Paylater and others. At the moment, the business may be small for the cost model the banks can effectively serve. For the banks to play here, especially in the sub-one million naira credit services, they will need to build new ways of doing things. They will have to become more digitalized to save business costs, and serve customers who are usually not within their crosshairs.

All Together

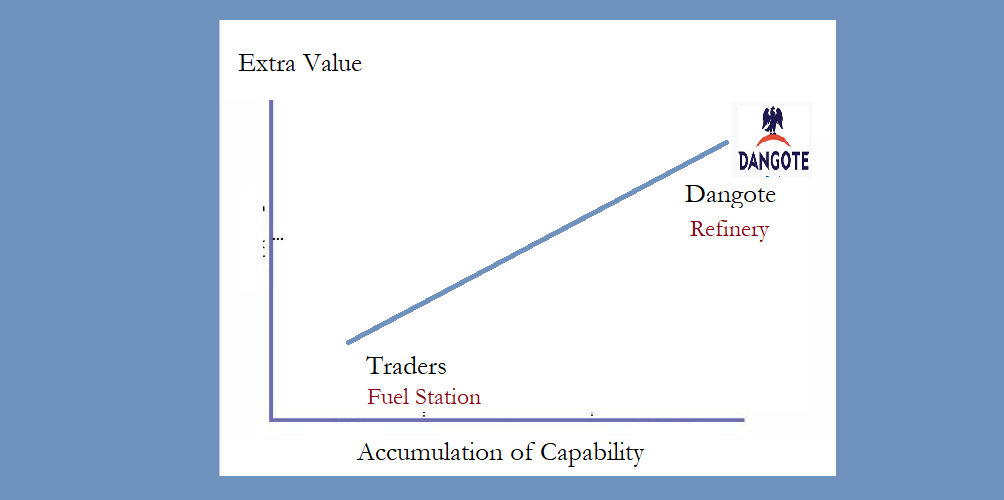

Interswitch has accumulated capabilities in the digital payment sector over the last few years. Now, it is unleashing that data, creating new products. Interswitch has the capability to change the basis of competition in the Nigerian banking sector. That will be transforming and disruptive. It is at the edge of a smiling curve and is just getting started. When companies accumulate capabilities, they see themselves operating in the segments of markets with higher value (usually upstream) compared with where their lower-end competitors operate (usually downstream). In the Nigerian financial sector, Interswitch has moved upstream and is extremely positioned to control most elements of the financial systems with the data it controls.

The internet business is not necessarily who generates the most data. It is who can make sense of it. Aggregators like Interswitch are at the centers making sense of all the data passing through the financial system. Google does that for our web businesses. It waits for us to create the contents. It then aggregates them and serves them to its customers and advertises, abstracting the content creators. Facebook does the same to our photos and feeds, providing a platform for us to post them. It then serves them to our friends and families. Because the data is too much, the value is not really about who has the most data, but who can make sense of the data which is constantly changing in volume, variety and velocity. That is where Interswitch has an advantage over the banks as it can see everything going through its networks from multiple players. You may decide to work with First Bank or GTBank, but those will give you a partial view of the data. Interswitch delivers more and that is why we do not visit BBC or New York Times for major news, we go to Google which then curates and prepares the best content for us. Google has access to all new networks in the world, making sense of the best to serve you. BBC and NY Times are limited even though they could be one of the companies Google will have as destinations. The BBC and NY Times have been abstracted out by Google. Today, Interswitch is doing same for the banks when it comes to retail lending. NIBSS seats at even a better position than Interswitch since all BVN banking data go through NIBSS.

I am so happy for this Interswitch strategy. I wrote many months ago that it should buy Unity Bank to get into lending. It has simply done it in a better way without spending any money. Also, it is not taking any risk. But it is clearly seeding a new era in the Nigeria’s financial sector.

Interswitch should acquire a lending license from Unity Bank. That will help it begin to build a credit system in Nigeria in partnership with NIPSS. Post-acquisition, it will focus on digital banking, closing some branches of Unity Bank and dedicate its efforts to build Nigeria’s first internet-only bank. Through this, the bank will use the data from its ecosystems to perfect lending systems which will help drive it growth.

With small blessing from NIBSS, it provides a clear roadmap to the future of Nigeria’s credit-based economy. The hangover is over, this digital pioneer is back and that is a good thing for Nigeria.