Two things, and they will help us understand how corporate and national business friendships are structured.

The first one, at the national level, is between U.S. and China. European Union is also there. Simply, some countries are troubled by China’s success because as it does well, it takes away a piece of the cake which U.S. and EU have enjoyed for decades. That is typical, everyone wants to win and stay winning..

But that is not the end of the story. Tensions over China’s industrial might now threaten the architecture of the global economy. America’s trade representative this week called China an “unprecedented” threat that cannot be tamed by existing trade rules. The European Union, worried by a spate of Chinese acquisitions, is drafting stricter rules on foreign investment. And, all the while, China’s strategy for modernising its economy is adding further strain.

The Western World sees it that China is winning with unfair advantage: it restricts and protects some of its markets while it can compete unfettered in other territories. .There is truth in that. But there is also a fact that China is indeed doing well at home, innovating across many industrial sectors. As I have noted in the past, China is winning at home and now has a clear global ambition, not just in infrastructure construction, but also in technology.

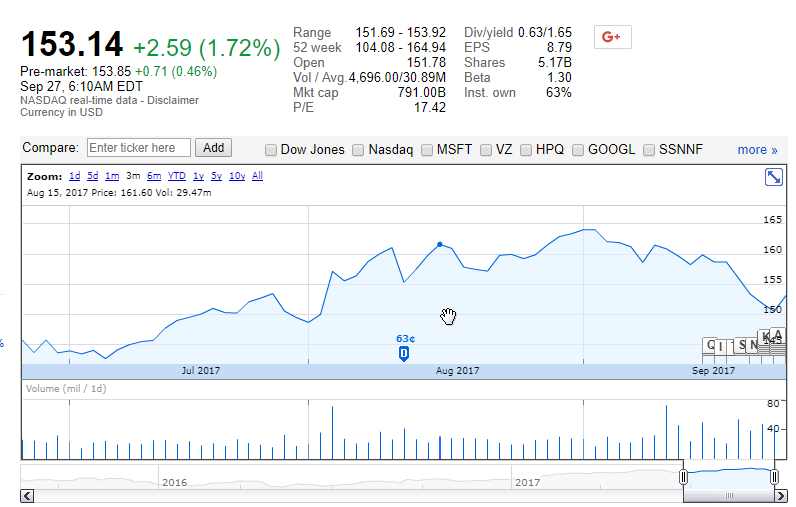

Uber lost to Didi Chuxing in China. Facebook’s WhatsApp is a tech generation behind the innovation of WeChat. DJI is peerless in civilian drone making. Alibaba pioneered a new sector in digital commerce. Baidu has a vision to become the operating system of the autonomous vehicles through Apollo. Chinese companies are ferocious in battles and they are winning, at home. Apple is brutalized, in China

China has always protected its markets. But the problem now is that it seems to be capable of serving the available markets where foreign companies can participate. Had it just ended in protecting its markets and then cannot serve the openly available ones very well, no one will care that much. If WhatsApp had beaten WeChat, Uber crushed Didi Chuxing and DJI lost its hold on drone making, China will be a good global technology player. But today, it is not because it is winning. As it exerts its influence in payments through Alibaba and Ant Financials, it is changing the global order. Many will accuse it of “unfair advantage”. China expects that.

Secondly, Google is showing that it does not like to lose. Simply, companies like to have competitive advantages. For all the nice talks about ecosystem and community friendships, when firms see that you are about to crush them, you will see the other side. Google is showing it to Amazon. Amazon will do it to another firm that comes against it. That is the way it is, provided that you can modify your Terms of Use to exclude a mortal threat. It is part of the game. You simply do not want to surrender. I am yet to get documents created in Windows and Mac to work seamlessly when shared with partners. They can make it work, but they will not because everyone wants to hold its domain.

Google pulled the video service from the smart speaker this afternoon, a move Amazon doesn’t seem too happy about. Echo Show owners weren’t given any advance warning previous to the removal. […]

Google made a change today around 3 pm. YouTube used to be available to our shared customers on Echo Show. As of this afternoon, Google has chosen to no longer make YouTube available on Echo Show, without explanation and without notification to customers. There is no technical reason for that decision, which is disappointing and hurts both of our customers.

This is what it is: until we start winning in Africa, we cannot be seen as threats. But when we begin to win, threats will come. China is experiencing it. Amazon is getting it from all angles. China and Amazon are winning. Bombardier joins them as Boeing sues to ensure U.S. government punishes it. If bombardier is not winning, it will be a friendly competitor to Boeing. That does not mean that Boeing does not have a point. It does, but things change when there is a major threat. Boeing has used low interest funds from US EXIM Bank to finance sales. Airbus had complained for that. No one is happy when losing.

The day has been dominated by the ructions following the US decision to slap 219% tariffs on Bombardier, the result of a dispute with rival Boeing.

For Nigeria, we need to have some wins. The action of Google against Amazon does not seem like what you expect from it. But Google wants to survive and cannot arm its opponent. It is not about Google. It is just the way these companies play.

All Together

Whether it is Yaba, Kaduna or Aba, I am hoping that our moment will come. It will be glorious a day U.S. or China will say that Nigeria is not being fair in its business competitiveness. That shows that we have arrived. It will take time but I do know it will come. Imagine Google blocking API access from a Nigerian company that it sees a as serious threat. That will be glorious.

How do we make it happen? This is my suggestion. Give local and foreign partners 5-10 years and after the period maintain that government will not patronize any solution that does not have major local contents. So, the government must buy local. That will motivate foreign firms to invest locally and also empower local investors to expand knowing that the market is there. The government needs to give time and stick with that plan so that local capabilities can emerge. When we do that for 15 years, knowing that all levels of our governments are customers, you will see top grade Nigerian companies emerge. Then the foreign firms will have design centers and not just sales offices, to serve Nigerian markets. Nigeria can then be accused of being unfair in its business competition. That will be nice, because it means, we are beginning to win. Industrializing Nigeria can only come when the best customer can buy from Nigeria. That best customer in our tilted public sector-driven economy is Government.