Nigerian entrepreneurs are innovating in the financial sector. Despite all the challenges we face on building companies, our young people are finding ways to demonstrate that we can think and redesign our economy, through hardwork and commitment to excellence. We have seen the amazing works from AppZone, Paystack and other startups across the nation. I am introducing one here today which is going to the heart of average Nigerian core financial problem: lending.

Our banks do not have memories. No matter how many years you bank with them, if you need credit, they will ask for collateral. Yes, they may know that in the last 10 years, you have received at least N200,000 monthly, but that was the “last ten years”. They will remind you that anything can happen, from tomorrow. So, if you do not have collateral, that loan cannot be extended. Before we talk of credit bureaus, most banks already have enough customer data to give credits, but most do not without extra securities.

That is why Paylater is exciting. Owned by One Finance & Investments Ltd, Paylater is going after that market where the highest pain points are found in the Nigerian banking sector. We can surely live without shopping through the modern digital payments. But we know that it is challenging when there is an urgent need for funds and no friend or family can help. That is what happens across Nigerian families today. Challenges go beyond how to move money fast across digital channels. Simply, we want credits. Paylater focuses on short-term loans, mainly for emergencies.

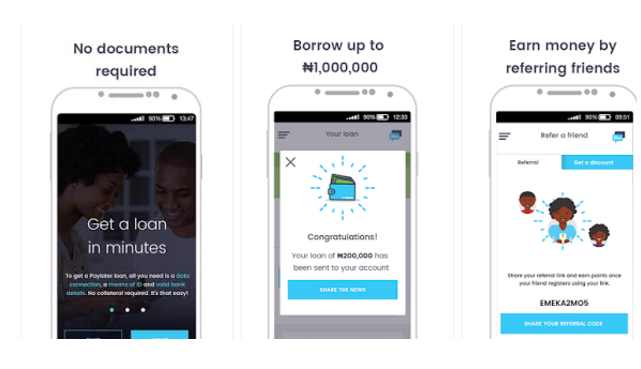

Paylater is a simple, entirely online lending platform that provides short-term loans to help cover unexpected expenses or urgent cash needs. You can apply for a loan 24 hours a day, 7 days a week with our quick application process that lets you know your status within minutes.

Yes, we like the payments and remittance fintechs, but lending is going to be a key part of what will help many families move up. The capacity to take loans and pay school fees, or during those tough moments like taking a child to a hospital, when all borrowing options have been exhausted, will be another layer in the fintech evolution in Nigeria.

Paylater is focusing on those moments of craziness and it is finding success. It now disburses 1,000 loans daily. The firm is a CBN-licensed and regulated lender, meaning that CBN understands the need to bring new ideas into the lending sector in Nigeria.

At the start of the year when we were disbursing about 200 loans a day, we set ourselves what we felt was an aggressive target of 1,000 paylaterng loans issued on a daily basis. We felt it was ambitious not because of a lack of demand (who hasn’t got a friend that needs a loan?) but rather the challenge to risk-assess 1,000 people that we had never met, living in all states of Nigeria and then disburse within a short time frame to their customers accounts.

Today we are happy to say that over 60% of these 1,000 loans are disbursed within 1 minute with the rest all under 5minutes and they span a range of N7,500 to N200k for first time borrowers. The inevitable question is “yes, great but are you profitable? Any monkey can give out loans – but are you collecting?. Our mothers told us not to boast so let’s say that our default is between 10% and 20% but trust us that its a manageable number. If you don’t believe us then look out for us early next year – if you are right, then we won’t be around!!!

Whilst we are pleased with the team effort that has got us so far, we are not content. Our mantra is “credit for all” and there are too many within Nigeria who don’t have access to credit. We only give @paylaterng loans via smartphones so the 60% of Nigerians that have feature phones unfortunately are excluded. Moreover, for most local banks, “financial inclusion” is just another way of saying “let me provide another channel to take your savings”. Less than 10% of customers have accessed loans from any formal financial institution but you don’t see banks showing the same energy to grow their retail assets as they do their retail deposits.

The Products

The product is a simple digital product with clear focus on the digital and mobilized citizens of Nigeria.

The produce is a simple, entirely online lending platform that provides short-term loans to help cover unexpected expenses or urgent cash needs. With just an Android device and basic requirements, you can apply for a Paylater loan 24 hours a day, 7 days a week with a quick application process that lets you know your status within minutes.No collateral, guarantors or application fees required. Just a few clicks of a button.

We currently offer two loan packages: PAYLATER (loans available to all) & PAYLATER PLUS (loans for salary earners). We’ll discuss both in a bit more detail below, so you can decide which best fits your needs.

The Opportunity

Paylater has a huge opportunity ahead of it. It is in a very growth industry. However, it is evident that it is going after the formal workers who can demonstrate they are employed. It is an app with no desktop version. So, the focus is the mobilized Nigerians with smartphones. They are also the people largely employed in the formal sector. Paylater needs that to mitigate exposure to risks. Of course it has the lower segment where it can lend N10,000 but that is not necessarily significant for me. The opportunity lies in the N500,000 bracket.

Paylater® is a simple platform that provides short-term loans to help cover unexpected expenses or urgent cash needs. You can apply for a Paylater loan 24 hours a day, 7 days a week with a quick loan application that lets you know your status within minutes, and credits your account immediately.

It’s fast, secure and reliable. Currently available across Nigeria.

YOU’RE JUST A FEW STEPS AWAY FROM GETTING A LOAN

– Download the Paylater app

– Complete registration and submit the short loan application

– Receive your loan straight to your bank account within minutes

– Earn increased amounts and better loans by repaying loans on time

The Challenge Ahead

Running a lending business without a credit system will be a challenging business to scale. But what constitutes a credit system can vary. Some may use cellphone SMS data. Others have used Facebook feeds. They just make the loans and for most, it is working. There are risks in all these models. The entrepreneurs are managing them since most times, they do not ask for huge collateral like banks do. Of course, they do not give as much money as banks do, preferring to lend below N500,000.

That limit is the challenge. If the entrepreneurs cannot find a novel model to overcome that limit, they will not easily scale to serve more profitable customers who may need at least N1 million. The market today is mainly for students, and lower scale of the middle class with jobs. The middle and upper middle class may not necessarily be in positions to complete forms online for N500,000. Most will have access to the banks as they already have reliable income (the reason why they are middle/upper middle class) and today Paylater is not competing for their opportunities.

What Paylater is doing is tough. Despite the Bank Verification Number (BVN) and access to customer earning capacities, banks do not have so much confidence to give decent credit without collateral. They have their data and they cannot be wrong, on why they never lend liberally. The lending startups will learn over time on how their loans are performing to explore how they can tighten the lending requirements. Once they can get to N1 million, a new market will open for them that will now begin the trajectory to challenge the banks. At that high amount, we can see small businesses going to companies like Paylater for loans. But those businesses cannot expect to hold the loan for long owing to the interest rates. I expect Paylater to also evolve by serving those small businesses when the time comes.

A Paylater loan attracts interest rates starting from as low as 2% monthly on the first loan. It is intended to meet urgent, short-term cash needs. Because of this, we have limited the lowest loan amount to NGN7,500 (for first-time applicants) and loan duration ranging between 60 days and 6 months, so you are not paying excessive interest rates. We also do NOT charge any additional fees – for late repayments or processing costs. Please do not take a Paylater loan if you intend to service long-term debts.

The company is aware of the risks and it is working to make it harder for defaulters to access the credit market. Government needs to get in and help build a centralized database so that responsible borrowing can emerge in Nigeria. Paylater with the CBN certification has access to BVN of customers. It is possible that it evaluates credit worthiness through data pooled from NIBSS (Nigeria Inter-Bank Settlement System Plc) which handles transaction details of Nigerian bank customers. I am not sure about this but since it asks for BVN, I do not understand any other value BNV offers than checking account history. NIBSS or Paylater can explain what it does with BVN.

Failure to pay off any loans taken trigger a notice to the consumer credit reporting agency which would negatively impact an individual’s credit score. Late payments can also affect your ability to borrow in the future, so please ensure timely repayments of obligations.

There are other players like Wema Bank’s ALAT and Piggybank.ng. These are competitors and also coopetitors and together these entities can pioneer a new sector that will make banking a sports for many Nigerians: something to cheer.

All Together

Paylater is pioneering a new area in fintech along with other lending startups in Nigeria. Though their annual interest rates can vary from “31% to 213%”, for most people, it is better than nothing. Simply, they are meeting the needs of customers, left behind by banks. For the very fact that they are CBN regulated, it means that they have to disclose every element of their loan terms in ways that customers will understand.

For Paylater, the firm is totally online, away from the bulk of the people that need its loans. That is the main weakness but also the strength since the Internet gives its unbounded distribution channel to scale, even while excluding the millions of Nigerians who are not yet online. Most of the excluded people are the people that desperately need the product. But Paylater has to start from somewhere and succeed first. It cannot serve everyone. The Internet helps it to operate lean with positioning to serve its desired customer segment efficiently. I see brilliance in this company and its mission.