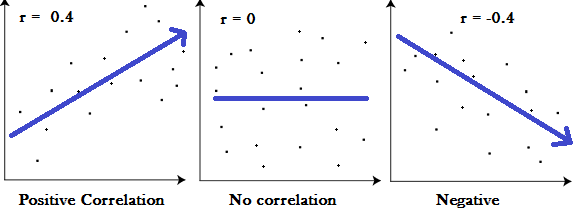

In mathematics and indeed any quantitative field, they have this thing they call Correlation. It gives you the phase of dependency between variables where the change of one variable determines how the other one adjusts. The most common examples are linear relationships, with slopes.

I have referred to correlation to help us explain what I have noticed in the startup ecosystem in Nigeria: our investors want the entrepreneurs to make huge returns, but at the same time, they do not want too much risk. That is a weak point and a very difficult scenario. When you want startups to return big, and at the same time you do not encourage them to take big risks with your money, it simply means the business relationship is on stasis. The usual concept in universal physics is that big force brings out big reaction: action and reaction are equal and opposite. Yes, small risks, small returns; big risks, big returns. That does not mean you cannot have deviations, but it makes sense to think within common occurrences in life.

The investors are good in giving a rule like this: do not lose my money no matter what you do. So, the key is preservation of the investment and making sure no money is lost. There is nothing wrong with that. Where I have issues is when you now add that the entrepreneur must come back with big returns. That is when the association breaks. Building startups does not follow negative correlation because there is a reward for the laborer. There is probably minimal risk producing candles in Nigeria as we are sure of continuous darkness for more years. If that is the business, be ready for the returns it can bring. But when you expect massive gains, that business may not be enough.

The entrepreneur cannot be timid on attacking opportunities and at the same time positioned to create immense value. There are investors that do not want to lose money like pension funds. And most times, they do not expect huge returns. But when a venture capital firm eliminates most of the key risks and expects huge returns, everything is broken.

Few years ago, some local investors were giving loans to entrepreneurs with options to convert to equities depending on the performance of the startups. They call it Convertible Note.

A convertible note is a form of short-term debt that converts into equity, typically in conjunction with a future financing round; in effect, the investor would be loaning money to a startup and instead of a return in the form of principal plus interest, the investor would receive equity in the company

The investors have the money and certainly could take equity, but somehow they like to offer loans to the startups. They always have the first option to determine if they want to convert to equity, in the future. This is the seed fund for the startups and the founders are beginning with loans which must be paid back. In some cases, the startups assets are used to secure the loans. For the founder, the mind is always on that loan. And every decision is influenced by that loan. To add salt to injury, the investors took board seats in the startups as “advisors”. I certainly believe the funds will not succeed in Nigeria because many brilliant entrepreneurs will not bother collecting money from such companies. Nigerian startup ecosystem is not optimized for such structures. It is either you want to take risk or not. And it makes sense to have confidence in the people you want to invest in their companies.

The Ecosystem

We are making progress in the country with regards to startups. Besides the challenge of unrealistic target, these are other issues to take note:

- Entrepreneurs think local investors ask for more equity. I always receive a specific type of email where people ask me if the equity percentage the investor wants for the money being invested is fair. Unfortunately, no one can answer that question for any founder. Though there are tools to help in the valuation of startups, nothing is science in them. Besides, I do not necessarily think that our local investors are greedy. Sometimes it has to do with basic understanding of the business. If you are taking money from someone with good understanding of your tech sector, it will be easier to have a good conversation on the valuation. But when that is not the case, that process becomes challenging. The key is doing a better job to explain the vision and hopefully both can arrive at a fair term to both. Both local and international investors want good returns. Yes, the motives are the same.

- Giving away your company to popular people: Nigerians like big men in their teams. It is like having a very prominent man in your board will magically deliver huge revenue. Once you tell the world that this big man is the chairman of your board, revenue will fall like manna. It is an illusion. The big man may not even have time for you. Yet, you have given away your company to him. Have confidence in yourself and let any person in your board earn that right, irrespective of his or her level in the society. Always remember that your customers make the decisions and most while spending their money do not care that much on the face of the man on the Board section. They want to be sure you can add value to their businesses or lives. Sure, bringing successful people in your Board is part of it. Nevertheless, I do hope you get the point.

- Foreign funds are better: That seems to be a near universal conclusion by most founders. Yes, foreign funds connote that you are now global. Nigerian like everything foreign. So, all efforts to get that foreign funding become the business. That is a big mistake. There are high quality investors in Nigeria just as we have foreign investors. The problem is that many Nigerian rich people did not make money from technology. But helping them to understand what is going on will help them support your venture. But irrespective of the source, a good fund is nice. Go for it. But do not degrade local funds should they become available.

- Raising capital is hard in Nigeria: There is no other way of making that point. While the funding round success is not the end, the difficulty makes it seem so. When you raise that capital, you must still have to execute the business plan. Do not be like some whose energies dissipate after the fund is raised. Yes, sometimes the strategy ends in getting that money. There is no plan to run a company. It is common to see founders who are raising money and at the same time looking for jobs or applying for graduate programs. I found it hard to make sense of the thinking. You want people to give you money in a business you have not committed to build? Building a company is a battle and committing to it is the first phase of the preparation.

All Together

We will have a startup massive exit in Nigeria in the next 5-7 years and that will bring more attention to the ecosystem. U.S. based accelerator, Y Combinator, is already a believer as it has seen the innovation in the land. Our entrepreneurs are growing. From Facebook to Google, Nigeria is a strategic nation. We have the population and we like to spend. The moment will come. There is no doubt on that. Yes, we need to make that happen and create many afro-unicorns so that more quality money will be activated both locally and internationally. When supply improves, great things will happen. Then suddenly, that money everywhere can flow to the shores of our startups.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/56918355/dseifert-echodot2-8.0.jpg)