Bottomline: Startups have to grow to survive. They need to hack growth. Scalability is the message but growth is the path to deliver it. Growth is not easy because there are many competitors jostling for the same customers and territories. In this piece, I explain how digital startups can hack growth in the same internet-sphere […]

Uber’s Driver Subscription Evolution

I shared this on LinkedIn and would like our readers on Tekedia to see it

In my book, Africa’s Sankofa Innovation, I identified four core frameworks for running digital businesses. By looking at the frameworks, I can see that companies like Uber and Lyft within the next five years will begin subscription services where drivers pay monthly fees and use their apps ecosystems to link up with riders. Neither Uber nor Lyft will take a cut; the drivers keep all, but the tax/processing fees.

ICT (information and communication technology) provided productivity gains across different industrial sectors in Africa as governments and firms adopted technology to modernize their processes few decades ago. That adoption provided the platforms for new basis of competition as ICT cushioned efficiency in customer service and superior product offering, giving the early adopters opportunities to win market shares. In banking, for example, new banking institutions used technology to compete against the older dominant ones, and in the process redesigned Africa’s banking landscape.

Technology category maturity releases many new business models around my core framework elements. In the Uber case, the fact that drivers are limited, and distribution is infinite through mobile internet, there is a limit to anyone’s pricing power. That constraint and the competitive rivalry will push pricing power away from Uber/Lfyt despite any network effect.

Where they fail to take action, car companies like Ford (hello Chariots) will emerge, looping drivers to make more money. Or better, the drivers will come together to take the destinies in their hands by building an app, locally, for what Uber does. Understanding how the web works and what happens on category maturity determines how future pricing powers can be. I note these frameworks in the book’s chapter 12.

Before Nigeria Scales Credit Bureaus

Nigeria is a cash-based economy. For years, the government has been trying how to re-wire the economy to make it credit-based. The Cashless Policy which encourages electronic transactions and the BVN (Bank Verification Number) policy which links biometrics with bank account numbers are some initiatives government has used to drive this redesign. Through Nigeria Inter-Bank Settlement System (NIBSS), the financial institution can easily build a good chart of any Nigerian banking customer through its BVN. When you add NIMC (National Identity Management Commission) Identity Number to it, you have a new dawn.

The new dawn is that financial institutions can use the data which have been collected from bank accounts and other sources to provide loans, mortgage and other credit services. We are following the advanced nations. But before we clone America or UK’s credit bureau system, we can modify or adapt certain elements in the credit bureau system of the countries. America’s credit bureau system is not optimal. There are widespread identity thefts, cybersecurity risks, and other shortfalls inherent in the systems. The problems are systemic.

Last week, Equifax, a global credit bureau firm, was hacked and the financial data of 143 million Americans and 400,000 British consumers were compromised. The implication is that these people are now left vulnerable to identity theft or fraud for a very long time.

Last Thursday evening we announced a cybersecurity breach potentially impacting 143 million U.S. consumers. It was a painful announcement because of the concern and frustration this incident has created for so many consumers. We apologize to everyone affected. This is the most humbling moment in our 118-year history.

Equifax Security first discovered the intrusion on July 29. Understandably, many people are questioning why it took six weeks to report the incident to the public. Shortly after discovering the intrusion, we engaged a leading cybersecurity firm to conduct an investigation.

At the time, we thought the intrusion was limited. The team, working with Equifax Security personnel, devoted thousands of hours during the following weeks to investigate.

In U.S. and UK, credit bureaus like TransUnion, Experian and Equifax make money by selling confidential data of citizens to financial institutions who use the data to deliver credit services to the citizens. The lenders like banks provide the data from the citizens’ financial records to the credit bureaus at no cost. The credit bureaus need the data to build the credit profile of the citizens and the banks rely on them to sell products and services like mortgage, credit cards, etc. There is no involvement of the citizen in this process. Yet, it is the citizen data that everyone is making money from, but the citizen can neither restrict no control his or her data. The citizen does not need to control its data contents as you want a total picture of unfettered citizen’s credit state. Yet, there needs to be way to ensure protection of citizen data.

What Nigeria Can Do

It is evident that the credit bureaus do not really care about the security of citizen data. Banks do care because losing customer funds through cyber-breaches will cost them money. The credit bureaus do not see citizen data as being that important. Their customers are the banks and not the citizens, and that is why they never care what they send to the banks. The citizens cannot take the jobs away from them. They have no incentive to be absolutely correct on the data they send to banks. The banks pay them and the banks are their customers, and provided they are happy, the citizens are irrelevant.

So for Nigeria, we need to do things a little different. We need to have within the Central Bank of Nigeria a unit that will supervise credit bureaus the way we do to banks. Also, citizens must enroll before any bureau can monetize their data in the specific system. By asking the citizens to enroll before banks can use their data, via credit bureaus, it creates incentives for the bureaus to make efforts to be optimal in their services.

Sure, it can hurt the citizen if the data is not reported but it will also hurt the credit bureau if it has no data to monetize. We have existed for decades with no credit system and can wait for few months to get it right. But for the credit bureaus which are starting, they need the citizens’ data. I recommend the following in Nigeria to make sure we break any oligopoly power as is being experienced in the U.S. credit bureau sub-sector:

- CBN should register and give licenses to at least five credit bureaus

- Credit bureaus can get data from all the banks and approved sources but they cannot profit from them until a customer approves for them to monetize the data. By pushing them to wait until a citizen approves, they have an incentive to be optimal to the services they deliver to the citizen besides the banks

- A citizen must sign up with at least three bureaus at all times

- Where it is evident that a specific credit bureau is not performing well, a citizen can withdraw its approval to report its credit. That can happen once per two years. Once that happens, it will take another two years for that customer to rejoin that specific credit bureau. But at the time, the credit bureau will still be collecting the data but cannot monetize it with banks.

- A citizen at all times must have its credit records approved for monetization with at least three bureaus

By having this structure, a citizen will have leverage thereby reducing the poor reporting and lack of efforts by credit bureaus to harden systems to avoid identity thefts. A credit bureau that neglects its systems resulting to massive hack can lose all customers and will have nothing to sell to banks. So that creates an incentive to deliver better protection unlike what we have today. The addition of this citizen component will seed incentives for win-win in the sector.

All Together

The alignment of the interests of the banks, credit bureaus and citizens will be catalytic in establishing a functioning credit ecosystem in Nigeria. This is not included in the current CBN’s guidelines for establishing credit bureaus in Nigeria. We cannot do it the way the Americans have done it. We need a system that provides a citizen element so that credit bureaus have clear incentives to deliver good services. You cannot be selling people’s data and yet have no incentives to serve the people and protect their data. With this proposed model, the oligopolistic system that runs in the credit bureau industry will be dismantled in the Nigerian model. The outcome will be a virtuoso credit bureau system that secures customers data as it serves its core customers, the banks.

Nigeria’s Future Banking Jobs, Three Things After Current Jobs

Information and Communication Technology ( ICT) anchored the competitive evolution of Nigeria’s new generation banks, by unleashing productivity in the sector. Internet, through its unbounded distribution, has provided new business models for most of the banks. Banks today have digital banking unit which is growing, and outpacing other channels like branches. The dawn of digital banking has anchored a new strategic redesign, and the banks are moving more operations to the web. The customers are responding and banks are expanding customer base.

With these changes, banks are retooling how they do business in terms of human capital, and one thing has been consistent: banks are using lesser number of staff per customer. In other words, the man-hours required to serve a bank customer continue to drop. Productivity enabled by technology has made that possible. We now have ATM which has automated many tellers out of jobs. We have debit cards which have reduced the need for manual cheque reconciliations. As banking moves digital, new dislocations will continue to happen. The impact may even be more consequential in African banking because we can leapfrog therein.

There is nothing anyone can do about these redesigns: most jobs will disappear. From the challenging days of manual ledgers where Union Bank recorded transactions in papers, requiring bank customers to spend hours in bank halls, to the modern days of GTBank speed banking, Nigerian banking continues to evolve. They are using lesser number of staff, per customer served. While owing to growth, the staff strength may be bigger, the reality is that productivity has reduced the absolute staff required, when benchmarked with the trajectory few years ago. GTBank through technology leadership, as noted in its half-year report, captures it all:

The Bank has continued to report the best financial ratios for a Financial Institution in the industry with a return on equity (ROE) of 38.8% and a cost to income ratio of 40.2% evidencing the efficient management of the banks’ assets.

In other words, GTBank is using lesser resources to make more money. There is nothing wrong with that. Yet, what we are seeing today is just the tip of the iceberg.

Three Things After Bank Jobs

Robotics, artificial intelligence, and natural language are collectively after Nigerian bank jobs. ATM is a primitive service of the robotics. The same goes for the present reconciliation engines which run on bank’s general ledger solutions. But in the next 8-10 years, we will see massive adoption of the next level of technologies. I expect the Apple Face ID to be copied by other smartphone companies and that will find itself quickly into banking solutions. With Face ID, you will not have to worry much on agency banking because most components would be built in mobile devices.

Diamond Bank should work to drive agency banking with new technologies that will simplify the process and eliminate most of the inherent risks. People call them financial inclusion for the un-banked customers, but the reality is that a very innovative bank like Diamond Bank can unlock the value here, just as it used DIBS, to create value in 1990s.

BVN is an opportunity, and NIMC (National Identity Management Commission) provides even a richer source of data. The roadmap is to develop a technology that will help make citizens/shops extension of bank branches so that banks are closer to the people that need them, at better cost model. We do not need full scale branches to reach villages and communities. Technology provides the capabilities to scale this and also make it cost-competitive.

These are some of the roles the robots, AI and natural processing will pursue:

- Better customer service. We will see chatbots to drive customer service

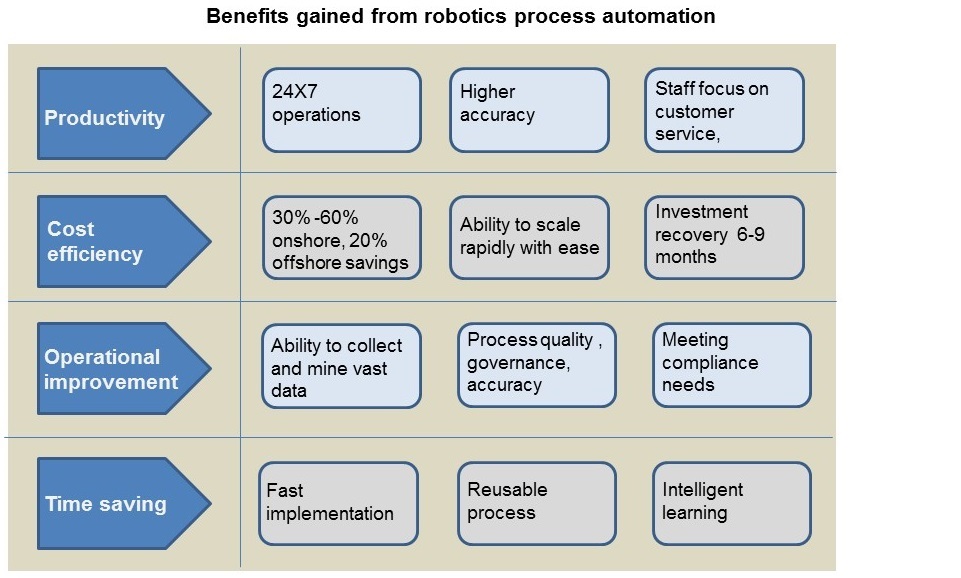

- Process automation: from reconciliation to compliance, AI and robots will deliver higher efficiency, productivity, operational improvement and cost savings.

According to Cognizant, the top drivers for automation beyond cost savings include:

- Reduced error rates (21%)

- Better management of repeatable tasks (21%)

- Improved standardization of process workflow (19%)

- Reduce reliance on multiple systems/screens to complete a process (14%)

- Reducing friction (11%)

Beyond Banking Jobs

Sure, banks will cut some jobs but new jobs will be created because of the new services needed to service the post-AI banking. The following bank jobs are at risk.

…on the future of AI in banking, a study released by Oxford Martin School’s Programme on the Impacts of Future Technology evaluated how susceptible are jobs to computerization. Evaluating around 700 jobs, and classifying them based on how likely they are to be computerized, the jobs in the financial services industry that fit the studies criteria include:

-

Bank Teller

-

Loan Officer

-

Mortgage Broker

-

Insurance Claims and Policy Processing Clerk

-

Insurance Underwriters

-

Claims Adjusters, Examiners and Investigators

-

Bookkeeping, Accounting and Auditing Clerks

-

Tax Preparers

What will happen in the near future is that we will have more software-bankers than tellers, because the jobs will be more algorithmic, meaning that the focus will be making better AI models. That means banks will also hire mathematicians (that do maths), and people that will help to build models and perfect them. While at the moment, banks have used the casualization of staff to compete on cost, in 8-10 years, they will use the deployment of AI, natural language and robotics for competitive edge through cost leadership. The transition will change the structure of the business because anyone that does not make that leap will struggle with severe cost-disadvantages..

All Together

The golden age of banking consulting is coming in Nigeria where startups with solid AI capabilities will rule. Banks will need services, customized and structured for the local Nigerian market. They have skills gaps which tech companies have to fill. The opportunities will be immense. The customization of Siri, Alexa, Assistant and Cortana to understand Nigerian pidgin speakers to enable banks deploy new solutions via voice opens a new market. The integration of Face ID to detect accurately black skins knowing that companies like Apple might have biased their models for white skins will create a boom.

In short, because of AI, robotics and natural language processing, fintechs will boom, not just in dealing with consumer market, but by offering solutions for banks’ back offices. It will take another level of composition for any bank in Nigeria to deploy any voice system in rural areas considering that our spoken English will confuse what Silicon Valley has built. Nigeria will need local flavors of most of these technologies. That is where the new jobs will be created in the banking sector..

Tripod Attributes of Startups

Bottomline: Startups, new business organizations, with scalable capabilities, differ from small businesses because besides the scalability, they are unbounded and unconstrained by geography. Companies which qualify as startups exhibit three attributes which are mutually interdependent. Any firm without these attributes is not a startup. By understanding these attributes, an entrepreneur or one that aspires to […]