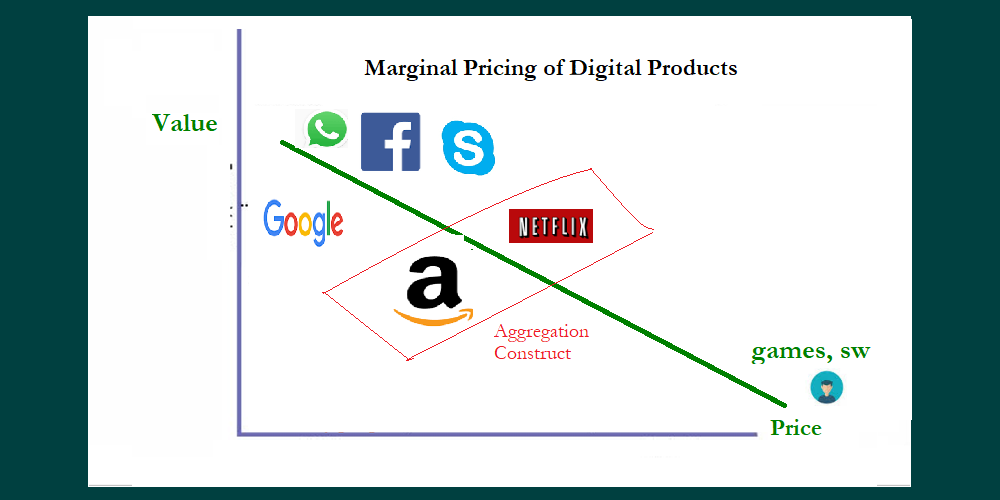

In this piece, I explain why it is very hard to monetize digital products in Nigeria and indeed Africa. The core reason is that in a perfect market, the marginal cost of producing digital product is zero. This implies that its pricing will inevitably go to zero. This is the heart of the freemium model where you get many things free, which is possible because of the aggregation construct, where companies provide those digital products and then create an ecosystem to sell adverts. They benefit more than the suppliers by providing the platforms. As noted in the plot, great companies deliver the $0 marginal price even at high value, making it challenging for anyone that carries a non-zero marginal cost to compete, exacerbated if the product is even not top-grade.

Why Uber And Lyft Will Merge

In this piece, I explain why Uber and Lyft will merge. The trajectories both are following show that they will have challenges with Lyft gaining on Uber, but the overall industry cooling. As soon as that happens, their margins, if they have any, will collapse. Once that happens, they will begin to talk of merger, with each other.

Government will see their struggles, and will dismiss any antitrust concern. The result: it will bless their union. Uber is today’s Category-King, but its past behaviors have slowed it down, offering a window for Lyft to catch-up. As they become peer-competitors and rivalries, they will destroy the sector. Similar rivalries have ended together:: Elance/Odesk (now UpWork), Groupon / LivingSocial, Sirius / XM and Rover / DogVacay.

Please add DraftKings and FanDuel in the list; I predict they will merge also despite any FCC ruling, at the moment. They will struggle, owing to wounds they inflict on each other, in coming years, and will be saved via merger.

Tecno Mobile Should Buy iROKOtv

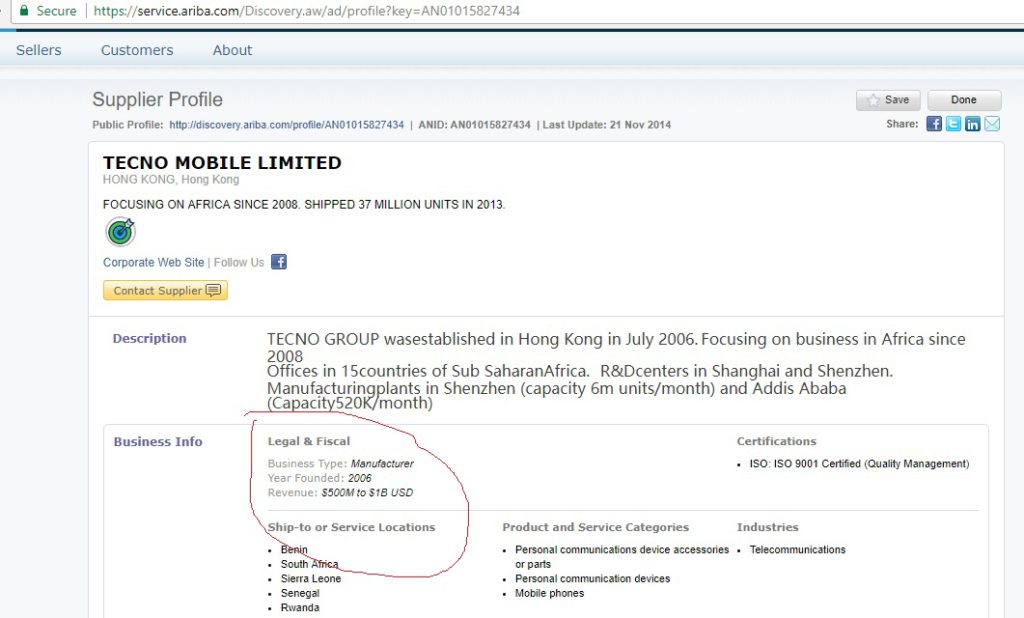

Tecno Mobile is one of the fastest growing mobile device brands in Africa. It started business in 2006, in Hong Kong, and today operates as a subsidiary of Transsion Holdings. Tecno has won hearts with its balance on pricing and quality. It is a brand any mobile phone manufacturer that wants to sell in Africa must study. Today, the company competes for market share against Samsung in the smartphone mobile sub-sector. Apple is not necessarily in Africa to include it in any analysis. Blackberry is history!

The new age of mastering mobile device distribution in Africa cannot be discussed without the company that pioneered dual-sim, making it possible that one does not need to have two devices, to use more than one network, “simultaneously”. Tecno acts locally, but at the heart, it is thinking globally. The dual-sim was hugely successful because it saved people money while at the same time solved a major pain point – network quality varies across Nigeria, one telco could be good in Ikeja but when you get to Festac, another is doing better there. Using the dual-sim, a user can switch to the better alternative, at any point.

The vision of Tecno (Source: Tecno)

We estimate that Tecno commands more than 20% market in most African markets (excess of 12 of them) where it does business, today. Its products are really good and it has the local chemistry. Its latest product, the new dual front Led flash device, Tecno Camon CX, is a great product for Africa, when you consider the price and the quality.

But beneath this achievement, Tecno has a real problem: It is nothing but a mobile device maker, which is nothing but operating at the center of a smiling curve where value is low. With no platform to enjoy, locking customers, it is vulnerable. A better executor will challenge it. ( Yes, I do acknowledge that customer service which Tecno delivers moves parts of its business to the edges of the smiling curve. This gives it a very huge opportunity, since through this service, it is not just a device maker, but a value-adder in the mobile device sector).

iROKOtv

iROKOtv is one of the most visible digital companies in Nigeria. In short, most of the excitements on internet business in Nigeria was unlocked by Jason Njoku, its founder. The vision was pioneering, attacking piracy at its source: take the product online where the piracy happens, but now, legally. You cannot write the history of digital business in Nigeria without iROKOtv.

irokotv is a web platform that provides paid-for Nigerian films on-demand. It is one of Africa’s first mainstream online movie steaming [sic] websites, giving instant access to over 5,000 Nollywood film titles. irokotv is a part of iROKO Partners which is one of Africa’s leading entertainment companies, housing brands such as iROKING, an online music platform and its YouTube website, Nollywoodlove. irokotv was launched on 1 December 2011. Its parent company, iROKO Partners, was founded by Jason Njoku and Bastian Gotter in December 2010, with its headquarters in London, United Kingdom. Dubbed the ‘Netflix’ of Africa, irokotv is the world’s largest legal digital distributor of African movies.

iROKOtv is a company of the future. It has strategic assets with local contents which no foreign brand can displace immediately. It has learnt so many things on taste and culture and understands its customers. Yet, it will take a really long time for iROKOtv to attend huge profitability because its product is video – it costs money to enjoy video in Africa. That is not changing any day, at scale, in near future. The company has raised millions of dollars from leading global investors like Tiger Global. Specifically, iROKO Partners, the operator of iROKOtv has raised excess of $35 million. Today, iROKOtv products are distributed across continental Africa and it remains a key leader in legal video on demand, for Nigerian Nollywood, the largest in the continent.

Why Acquisition Makes Sense?

These two companies – Tecno and iROKOtv – are at their growth phases. They are excellent. But as noted, they have some challenges: Tecno risk of not having a platform as defense and iROKOtv hoping for years for broadband penetration to reach massive profitability phase. Bringing both together will help Tecno close its defenses in Africa while giving iROKO Partners a good exit.

iROKTOtv products are very popular in most markets Tecno operates. So this provides a natural ecosystem to help it drive further growth and lock customers in the video ecosystem.

We propose for Tecno to buy iROKOtv and use the product to deepen its capabilities in Africa and beyond. Our core idea is that Tecno needs to open a unit to be dubbed Tecno TV. It will be one place for anyone in Africa to access television, delivering unified TV experience. This ecosystem will meet the needs for TV shows, movies and broadcasting contents, across the continent. It will be TV and movie content-ready. Through the iROKOtv brand, it will close partnerships with leading local content providers.

To execute this, all Tecno will come with iROKOtv apps, installed. (It could re-brand iROKOtv to Tecno TV) The pioneering brand equity of iROKOtv will rub on Tecno, as it transitions. Tecno will offer premium iROKOtv exclusive to Tecno users in Africa. That will be huge and can help attract new customers who will prefer Tecno over say Samsung.

Make Tecno TV so that no one switches to another platform, in Africa.

The partnership with Manchester City which Tecno sealed will have more value if it begins to build Tecno TV business across Africa. The opportunity is here and iROKOtv offers it.

Tecno is partnership with Manchester City [Source: Tecno]We do believe that if Tecno makes this deal and execute it, showing traction on customer growth, it will have leverage on many telcos in Africa. MTN, Glo, Airtel and 9Mobile (old Etisalat Nigeria) will surely like to consider Tecno as a special company since it will have customers that spend most on video and broadband. Possibly, the subsidization of Tecno devices for rights in Telco networks will come into play, from the telcos.

iROKOtv will give Tecno the strongest business model of the future which it can ride on to build a service business, via Tecno TV.

The Valuation and Deal

We value iROKOtv today at $100 million and Tecno can afford it. It can raise money for the deal which likely will be all-cash based. Tecno generates a revenue of between $500 million and $1 billion. There is nothing on this deal that says that IROKOtv products cannot be available in other devices, but they have to be built to show they are maximum-best on Tecno products.

Simply, Tecno has the capacity to finance such an acquisition and returning about 3X to iROKOtv investors will not be too bad.It is a deal that will make everyone a winner.

Rounding Up

Tecno will face real competitive challenges in coming years in Africa. Finding how to lock its present believers in a platform will be strategic. It has to do that as quickly as possible. iROTOtv provides a golden opportunity to make such “locks” happen. Tecno Mobile should buy iROKOtv and rebrand it Tecno TV, and rule the mobile device market in Africa, through service.

Editor’s Note: After this piece ran, someone noted that Tecno is working on Tecno TV. Great idea, but it needs to make it big with iROKOtv

Amazing Sandra Musujusu Is A Brilliant Mind, Using Macromolecular Science To Fight Cancer

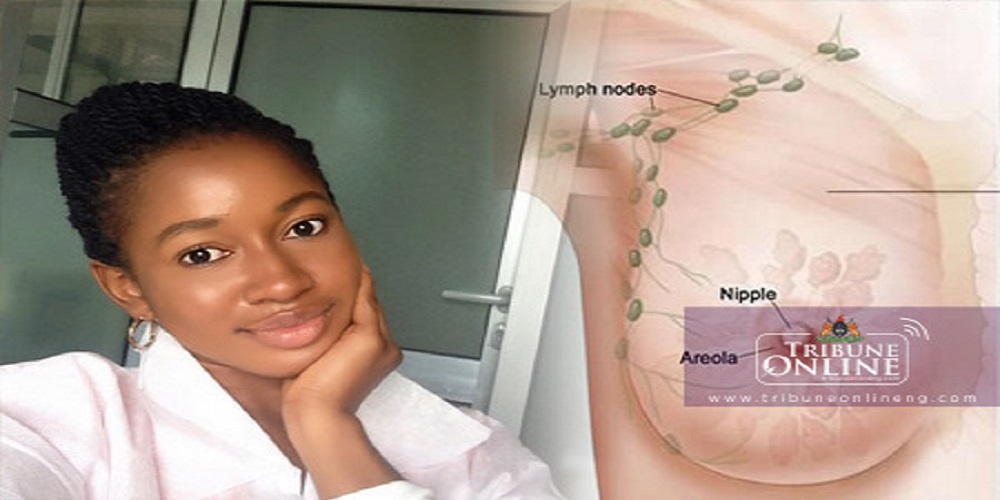

One of the brightest students in Africa right now is Sandra Musujusu, a female student of the African University of Science and Technology, Abuja. She has developed an alternative treatment for breast cancer.

The scientific breakthrough might lead to a lasting solution in the treatment of breast cancer prevalent among women world over, reports Tribune Online.

This was made known on Tuesday in Abuja when the World Bank Education Director, Dr Jaime Saavedra Chanduvi with his team visited the University as part of his assessment tour of the 10 African Centres of Excellence (ACE) centres. Linkedin user summarizes it perfectly.

Meet Sandra Musujusu, a student in Nigeria who has recently developed a scientific breakthrough which will lead to a lasting solution in the treatment of breast cancer prevalent among women world over. Musujusu’s research, using macromolecular science is aimed at developing biodegradable polymer material which could be used as an alternative for the treatment of breast cancer in the near future. She revealed that her research focuses on triple negative breast cancer which is the aggressive sub-type of breast cancer that is common with women from African ancestry. Musujusu, a Sierra-Leonian National is conducting her research under the sponsorship of the Pan African Materials Institute (PAMI).

Musujusu’s research, using macromolecular science is aimed at developing bio-degradable polymer material which could be used as alternative for the treatment of breast cancer in the near future. She revealed that her research focuses on triple negative breast cancer which is the aggressive sub-type of breast cancer that is common with women from African ancestry.

Musujusu, a Sierra-Leonian national is conducting the research under the sponsorship of the Pan African Materials Institute (PAMI), notes Tribune.

Musujusu said, “My research is actually centred on the development of bio-degradable polymers for treatment of breast cancer. I will be focusing on triple negative breast cancer which is actually the aggressive sub-type of breast cancer that is common with women from African ancestry. I believe there is a bright future for Africa, and as a woman there is much more we can do if we are empowered. This award given to me by PAMI has empowered me to face my studies with more confidence and actually contribute to the frontier of knowledge and move Africa forward.”

Out of 19 African Centres of Excellence, 10 Nigerian tertiary institutions won slots to churn out special research works that could compete effectively with global standards.

The Challenge before MainOne and Rack Centre

There are four main cloud providers in Nigeria – MainOne, MTN Cloud, Rack Centre and Vodacom. Two of these companies, MainOne and Rack Centre, have cloud services as one of the key components of their businesses. Sure, MainOne sells bandwidth, delivering connectivity services, but cloud service is a key business. MTN is known for its voice telephony and the broadband services, across Nigeria and beyond. Vodacom Nigeria is largely there to serve enterprise customers, since it is not operating any voice telephony service, yet.

For MTN, MainOne and Rack Center, which I have reviewed their cloud offerings extensively for clients, as part of my company advisory services in Nigeria, the data center technical capabilities are largely the same. They meet most of the industry top standards. However, the pricing model is totally different. (I will not get into which one is most affordable since they do not make their prices public).

MTN can live without the cloud business. Vodacom is testing the market and can retrench if it does not like what it is feeling. For MainOne and Rack Centre, if they fail in the cloud business, they could be imperiled.

Hosting and data center business is challenging because of the constructs of abundance which internet makes possible. If a business can tolerate small latency, anyone, anywhere can compete with anyone on cloud offering. That means U.S. data center providers are competitors to these local ones. From IBM to Microsoft Azure, to Google Cloud and Amazon EC2, local businesses have alternatives, besides the big four in Nigeria, for cloud services. This makes being local not necessarily a huge advantage. You have to be good with strong pricing to compete globally and anything less, is trouble.

Besides latency, there are regulatory elements in some industries, in Nigeria. Banks are not allowed, yet, to put their main servers in public clouds. However, their disaster recovery (DR) data centers can be co-located or stationed in outside companies, provided they are within Nigeria. At this time, MTN Cloud, Rack Centre and MainOne are the qualified ones. These three are competing to host the DR businesses of most of the banks that want so. It is important to note that nothing stops a bank keeping this DR server internal. (I am not sure Vodacom has data centers in Nigeria. IHS Towers also brings something on this through its expanded networking operating center which helps MainOne, its partner.)

Leaving the banking sector where most of the businesses would be expected to come, you move to insurance. The insurance sector in Nigeria is still at technology infancy. They do not really have the core capabilities and enablers to invest in huge data centers because the business is still done without real-time technology components. There is nothing there for them, in the way they operate, to invest in data centers. They have their small Microsoft servers which run their small IT operations.

The SMEs and the startups could be the future opportunities. Unfortunately, looking at the pricing models of the big four data centers, few can easily use them. Sure, some are using them. The American competitors make things far easier, unfortunately, through many schemes and strategies. Sign-up is pretty easy. And Amazon allows you to use their services for extended period, during development, before paying. Microsoft gives you BizSpark for free. But in Nigeria, you have to spend real money to get on board. Few startups have that kind of change in Nigeria when alternatives are largely free to test their business models.

Did I mention government? Oh yes, we have Galaxy Backbone. But that one exists in name. It is supposed to handle government business, when it begins to adopt technology. At the moment, that is not what is happening. Galaxy Backbone itself may need a backup because it has severely under-performed and is becoming irrelevant. Count it as one of those government great ideas that failed.

Now, what is the challenge before MainOne and Rack Centre which must have good data center businesses, to execute a huge part of their strategies.

The Challenge before MainOne and Rack Centre

Amazon is coming. It is never a good thing when Amazon comes into town or in any sector, globally and locally. They have this ruthless business efficiency model that makes everyone look lost.

It is a matter of when rather than if Amazon Web Services opens one of its data centres in South Africa. That is the message from Amazon’s chief technology officer, Werner Vogels, who said on Wednesday the group was working on understanding not only South African entrepreneurs but those across the continent. “We have a lot of customers here already, especially when it comes to young business … but also larger companies, before opening up a region here,” Vogels told Business Times on the sidelines of the company’s summit in Cape Town.

It will not be easy for Amazon because it will have local competition. However, the challenge for the local companies will be dealing with Amazon’s history of doing all to win market share. Amazon can technically agree to host any company in Nigeria free for five years. You cannot compete against free and a really great quality free product, to add. That is the challenge before MainOne and Rack Center and they have to figure out how to deal with that.

MainOne is likely going to be fine since it has a business to sell bandwidth and connectivity. If Amazon comes and gets many people to the cloud, most of those will go through its infrastructure. That means, somehow, it will be paid. MainOne is a highly strategically positioned firm with a very critical infrastructure base that no one can easily cut off. The undersea cable it controls positions it for whatever happens.

(However, the undersea cable can be a dumb pipeline. Entities, like Amazon, pay for the bandwidth and make all the money on it. That is why the data center and hosting business is important for MainOne.)

With its global market position and brand recognition, Amazon will be a big MainOne customer. But if that is what MainOne wants to depend upon, it will have real problems. It needs to be a visible cloud provider. Here is what MainOne and Rack Centre could do.

CEO of MainOne, Funke Opeke, a strong influencer in Nigerian tech sector (image credit: MainOne)

Running Away from Zinox and Omatek Indigenization

MainOne and Rack Centre must not follow the Zinox and Omatek indigenization/protection campaign, which they tried, when they say falling market shares in the PC sector. The government, then, tried to help them by pushing government institutions to buy the local PCs. Unfortunately, quality and pricing issues did not allow the directive to hold-up. In this area of Internet abundance, it is not likely that will work, either.

Nonetheless, they can make a case that some data must be hosted locally. A key factor will be managing it to create a balance that will not use regulation to undermine innovation for local companies. That will depend on pricing and ease of doing business with the companies.

New Data Cities

The last mile problem must have predicated the business model of MainOne – land this intercontinental cable and leave the rest to local entrepreneurs to use fiber to extend it into cities and communities. That has not happened. Sure – progress is ongoing with Glo and other companies expanding capacities. I do think the fiber density will take years and more investment to come to global average parity. Waiting for that will be hard – the companies can try something new.

My proposal will be for them to take selected cities in Nigeria and focus on that. For example, it can take Yaba and make sure it can reach Yaba very well with quality broadband. It takes South East, say Aba and do the same. It picks South South Port Harcourt and so on. And in the cities where it is, it delivers world-class first rate service with better pricing to draw data-hungry businesses and startups within that vicinity. As it makes money, it can then scale to other cities. Where possible, six cities will be optimal. They make them Data Cities of Nigeria, with great bandwidth capabilities and competitive pricing that will attract digital businesses to move and do business.

If they do not do this, Amazon will likely do it when it makes it into Africa and Nigeria, with its piles of cash. Provide connectivity at scale and strategically make people to make decisions on company location based on where data pricing makes sense.

Do not forget VAS

The beauty of Amazon EC2 is that it saves you money, because many suites are there. EC2 was built on the primitive model. The local firms must find ways to make sure they get Remita, Flutterwave, banks APIs and anything possible, all integrated to provide extra value for anyone that signs. Imagine if signing-up to Rack Centre cloud solution saves one costs of paying for the integration of these other local services, because they have already been done.Those value-added services are big components of what makers data centers/cloud services great. MainOne and Rack Center must invest to have the best solutions for Nigeria.

Rounding Up

The datacenter business in Nigeria will hit up in coming years as Amazon, Google, Microsoft Azure etc begin to build data centers in Africa to handle the issue of latency. The local players today must work hard to mitigate the competitive challenges through product and pricing innovations. They have to learn from the local PC makers and move fast to deliver visible products before the foreign brands emerge. Winning this business warfare will be extremely challenging because the foreign ones come with more capital and name recognitions. However, if the local ones can offer solutions that differentiate them, they have the edge, and can win. They need to develop a strategy that uses “primitives model” engraved in Nigerian business processes and systems, which the foreign competitors lack.