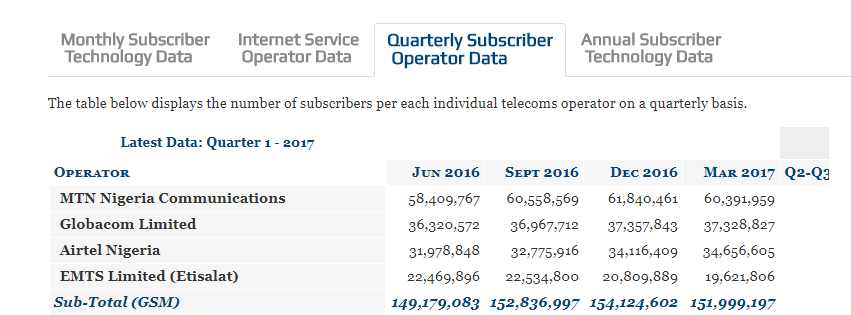

Few days ago, I wrote about the massive latent opportunities for the telcos in Nigeria. In that piece, I explained that MTN, Glo, Etisalat and Airtel could build a new business in the agricultural sector, focusing on linking and connecting farms and farmers.

Yet, these companies have opportunities to unlock more value if they can move into certain new industries like agriculture. They need to move into providing services that help farmers improve their businesses and that will help them find new sources of revenue.

Today, I will like to discuss how they can execute this mission from a product evolution phase. I will propose they introduce a new currency which will help them manage the challenges which are inherent in an informal sector like Nigerian agriculture, without being tethered to the innovation-challenged Nigerian banking, which for generations have failed to provide services to millions of citizens, especially in rural communities.

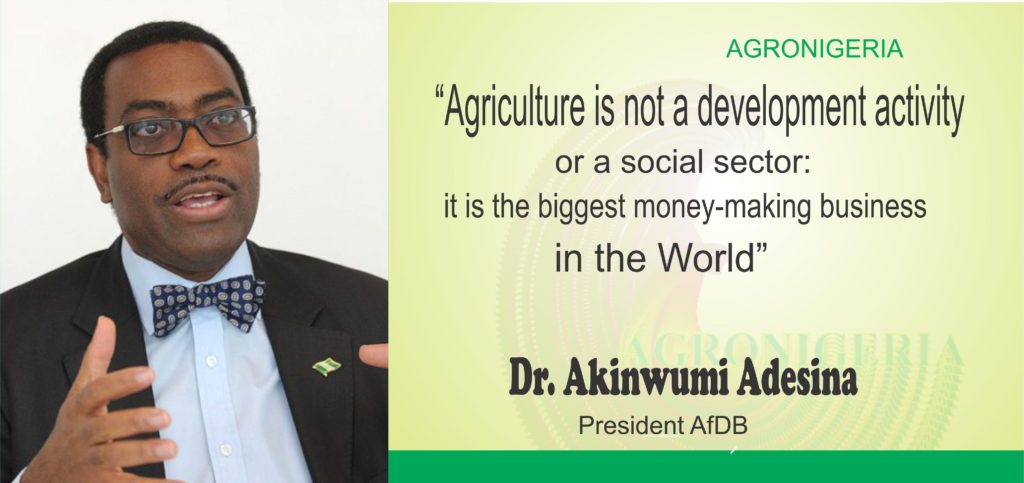

But before we do that, let me refer you to a quote by the President of African Development Bank and former Agriculture Minister of Nigeria, Dr Akinwumi Adesina.

Dr Adesina made it clear that Agriculture is huge and it is indeed the biggest money making sector in Africa. It employs more people in the continent, more than 60% of the working population. But yet, unlocking the value is hard because of the infrastructural level infancy – electricity for storage, roads for farm equipment, etc. The telcos have huge opportunities in agriculture. Agriculture accounts for 17.8% of Nigeria’s $493 billion (nominal) GDP. In other words, it is an $88 billion sector, in Nigeria.

New Architecture for Nigerian Agriculture

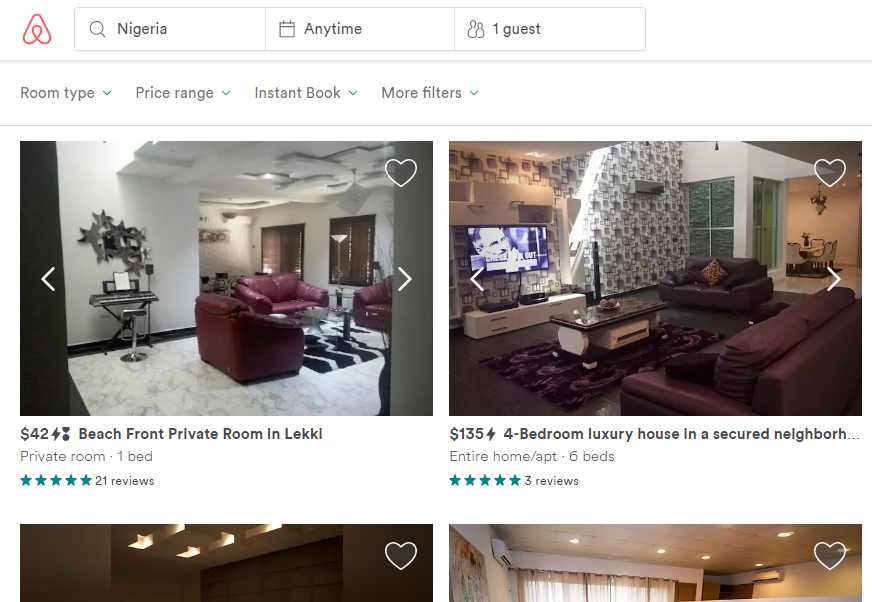

In the referred post above, I explained that sensors and market data will be critical. The telcos can build a modern infrastructure to power the systems.

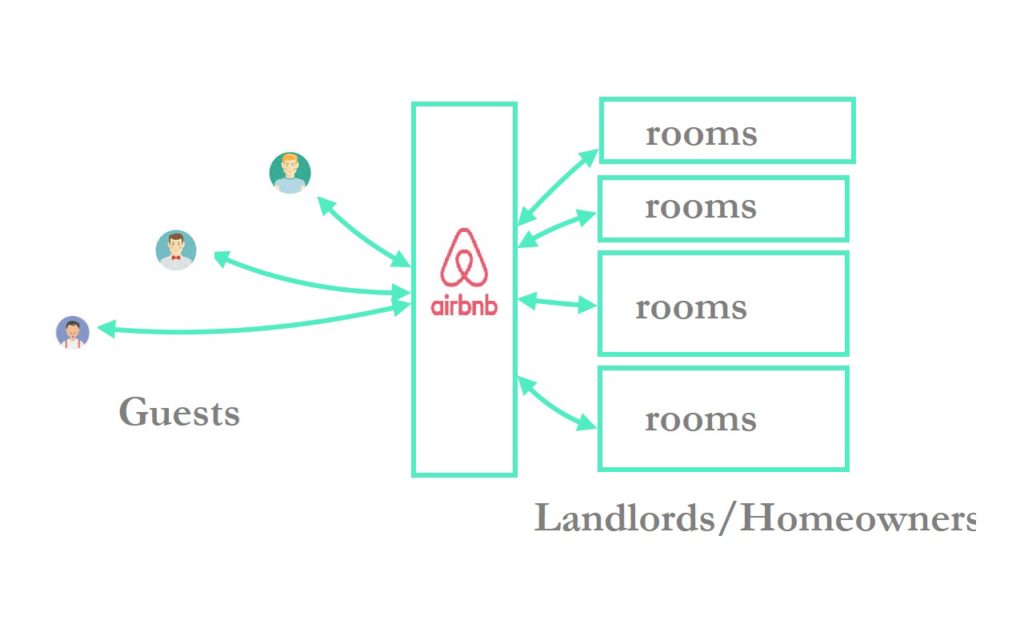

The telecom companies will help the sensor partners handle connectivity issues with a national standard set in the nation for the agriculture space. This is good business; NCC, the regulator, should not be anywhere close. We just suggest the telcos work together and build a new business segment. Bringing a network and a platform together will quickly help drive this innovation process.

In addition to providing farmers with the ability to track everything that’s happening in their fields such as irrigation, and efficient fertilizer application, the telecom firms working with smartfarm sensors will aim to provide farmers with prescriptive and predictive recommendations based on the combination of historical, geospatial and on-farm data via dashboard. This is not just for farmers, even local gardeners will be on board and the telcos will benefit.

They need to build connectivity systems but most importantly, they need to help pioneer a new way of doing business that may do less with today’s banking system which has minimal presence in most Nigerian communities and villages. Expecting banks to support such a system will be waste of time, owing to their cost models, which may not be profitable serving farmers. For that, I propose a new “currency” that is not Naira, but pegged to the Naira. I name it Nia.

The telcos need to decouple this from the Naira to enable them innovate out of the Nigerian banking sector which has failed to serve the under-served and reach out to rural communities over generations. Having the Nia will ensure the telcos can push the limits without concerns with the Central Bank of Nigeria and the banking institutions.

The NIA Currency For Nigerian Agriculture

Nia will power every aspect of Nigerian agriculture, providing a payment system that will reach any farmer without sophisticated banking systems and processes. Nia will be the farmers’ currency; it will be pegged to the Naira. The farmers cooperatives will be the custodians. Nia will begin like a voucher which is printed by the cooperatives and distributed to specific outlets across the country. These outlets will be Cold Storage Warehouses, Farmers Hubs, Equipment Outlets/Hire etc where farmers can go and exchange produce for the voucher. For example, a tomato farmer can visit a warehouse and “sell” the tomatoes. He will be given a Nia voucher as compensation. That Nia is pegged to Naira, meaning the farmer is paid.

Modern farming requires measurements with sensors

That Nia is as good as money. The farmer can also use the voucher to buy new seeds, rent equipment etc. I want government to remove all levels of taxation for transactions done on Nia. We want Nia to be structured for only agriculture. That will stimulate investment in agriculture which is at the moment less than 1% of commercial lending.

For the agriculture system, it will form a legal tender. People can buy Nia from the cooperatives. The farmers group will put the money in interest bearing account and over time use the proceeds to invest in Cold Rooms across Local Governments in Nigeria in partnerships with telcos who will provide connectivity and technology for farmers. The vision is to build a modern layer for agriculture in Nigeria.

Every Nia in circulation must expire within two years. This will ensure we keep it off as a means of storage of value, and escalating risk of the Naira. It is expected that any farmer no matter the location will have the opportunity to convert its Nia to naira within the two years. Any unused one will expire and irredeemable.The Nia will be pegged to Naira and the cooperatives will work with banks to close the settlement.

Nia will be digital and traded online so that buyers and sellers can exchange with the currency. Printed Nia will start once implemented and end within five years. Then all Nia will move digital. It will then be traded as a currency. It will be still be pegged to the Naira. The farmers cooperatives will administer it with experts working with them.

The core vision is to make it easier for farmers to innovate and for government to provide clear incentives for investors in agriculture knowing that NIA-denominated transactions have zero taxation.

The Roles of Telcos And How They Benefit

We want the telcos to facilitate the infrastructure to power Nia, providing the connectivity and systems that will make it possible, Waiting for the banks to do so will take another 40 years. Also, the printing of Nia will be supported by Telcos since they have experience with prepaid card. They already have the biometric of most farmers, so they can roll this out faster.

Modern farming is a digital system

This is not mobile money because you want it to be out of the controls of the Central Bank of Nigeria. We want farmers to just find a way to connect members who have been neglected for generations by Nigerian institutions and governments. It sounds crazy but I do think this can work. We do think this will double the size the telecom sector within a decade of implementation.

Implementation of Nia

The following steps will help to implement Nia:

- Telcos must come together and work together like the ways the Bankers Committee in Nigeria do. They have to agree on cooperative agreement to use Nia to deploy massive support to Nigerian agriculture.

- Use the biometric data which have been collected during SIM registration and build a credit system specifically used to help offer telecom services to customers. The goal is that people that take services and do not pay will be easily tracked and penalized

- Use the credit file to open opportunities for farmers to acquire digital systems while making sure there are local community anchors to educate and train them. Those community anchors will be compensated

- Push for all monthly-payment billing where every phone line is contracted. This will happen because of the data coming from the credit system. People that take the services and do not honour the spirit will be denied SIM card access until they pay compensation. (Telcos can still keep the Pay As You Go but make it more expensive.)

- Deploy the Nia currency to make it easier for farmers to do business within the networks. At the top convert that currency into the Naira.

- Liberate agriculture and reach farmers at their levels with massive infrastructure made possible through zero-tax investments on warehouses, cold rooms etc across Nigerian communities. Telcoms can bring partners to invest therein. Only telcos in Nigeria have the best chance to help agriculture owing to their experiences in developing infrastructures in our challenging environments.

Rounding Up

Our banking system has neglected agriculture. A new currency will help bypass the stasis of not providing services to farmers.by the banking sector. Nia, powered by the telcos, will open a new dawn in Nigerian agriculture. We will see a fusion of technology and farming innovation, at scale. That will result to better welfare to our citizens.

Updated: A reader posted this comment on LinkedIn, which I responded below. This will help provide more insights on Nia.

Comment: The agriculture business is not for Telcos. The Sensor partners as you called them should own the business and look for the best network in their location to carry their traffic. Yes! Telcos have infrastructures, they have mobile money in place and this traffic will be an opportunity for them. Therefore they should assure quality network to capture it. Note that Google, Facebook and even LinkedIn and etc.., didn’t wait for association with Telcos to start. And I do not figure very well how this Nia Currency will work. If it is going to work like recharge card, why not continue with the existing recharge (Note that physical recharge card is a cost to them for which they are willing to totally replace by virtual recharge). And if Telcos are coming together like you proposed, they will need another body like CBN in the banking sector to do compensation. And you are rejecting NCC, the regulator, in this operation. May be you need to clarify again Nia. My personal point of view is that The Telcos are already supportive and they will continue to work along with partner that have taken step ahead.

Ndubuisi Ekekwe: Sure – Google, FB, LinkedIn etc did not wait for telcos because they had a govt. People tend to forget that US allowed many barons to make money to build U.S. infrastructure. Carnegie etc made money in steel and railway so that they can use their assets to provide infrastructure. Farmers need someone to make that money but offer them infrastructure in NG. I do not want Nia to be under the control of CBN because banks have done nothing for agriculture. For generations, they have not seen a need to find ways to reach out to them and offer services. See Nia as a currency that the govt will allow for zero taxation. It is not a recharge card. The regulator should not be against it because telcos will only facilitate not own – the cooperatives of farmers will own. On sensors – the fact remains that the sensors people can select from the telcos available, the very reason I want them together. Just as BVN works – all banks agree. Opening UBA bank account with BVN captured in GTBank does not rob GTBank. Best network quality without expanding market size does not help that much. You can have the best network for 60m people and you will reach a ceiling. It is better to expand that 60m people to 120m. On NIA, I will put out a whitepaper on that. I was struggling with space and never wanted the blog to be a tome

/photo credit: agronigeria.com.ng