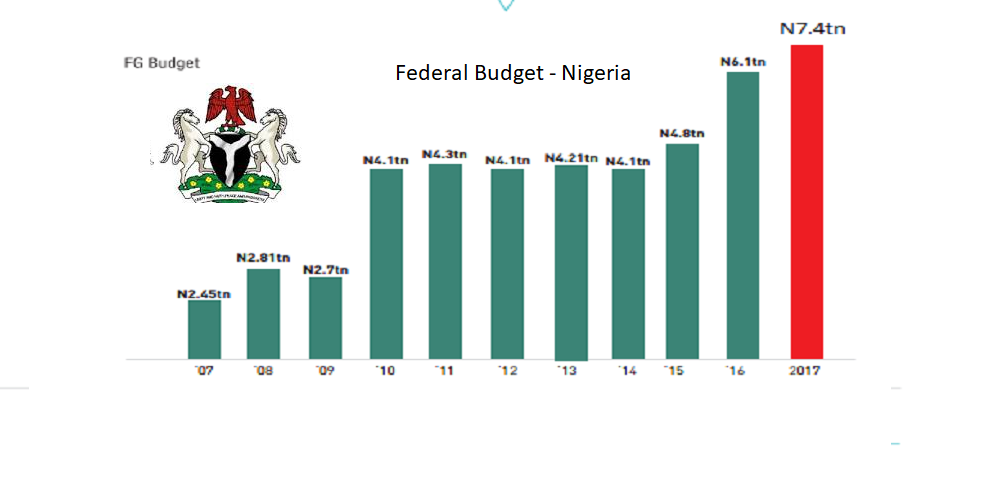

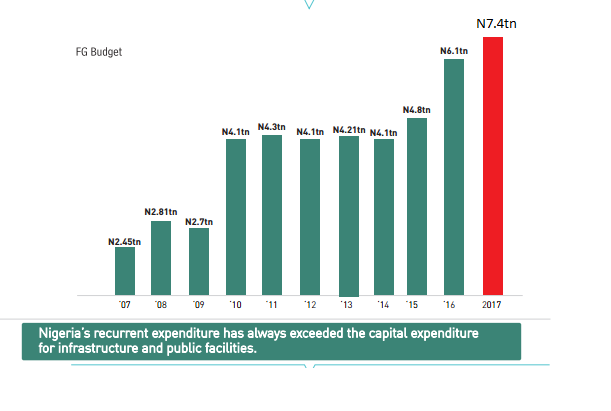

These are the numbers in the 2017 Federal Budget signed by Acting President Yemi Osinbajo. Prof. Osinbajo had on May 19 received the N7.441 trillion budget passed by the National Assembly. He signed it into Law today.

Mr. Osinbajo signed the budget at about 4:40 p.m. on Monday inside his conference room in the presence of the Chief of Staff to President Muhammadu Buhari, Abba Kyari; Senate President, Bukola Saraki, Speaker of the House of Representatives, Yakubu Dogara, Ministers and other top government officials.

The National Assembly passed the 2017 Appropriations Bill on May 10 after raising from the N7.28 trillion earlier proposed by President Muhammadu Buhari in December last year, to N7.44 trillion.

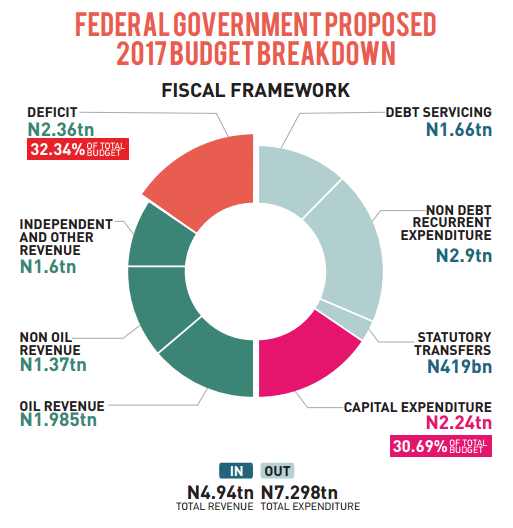

Except the final expenditure numbers, the charts have the proposed numbers as the National Assembly raised the number from N7.28 trillion to M7.44 trillion. The impact is very marginal at N160B difference. So these charts are correct and can be quoted and used.

Meanwhile, the Federal Government has returned the country to a January–December budget calendar, starting from the 2018 budget. The Executive is to submit the draft 2018 budget to the National Assembly by October 2017, while the Assembly pass the budget into law before the end of 2017.

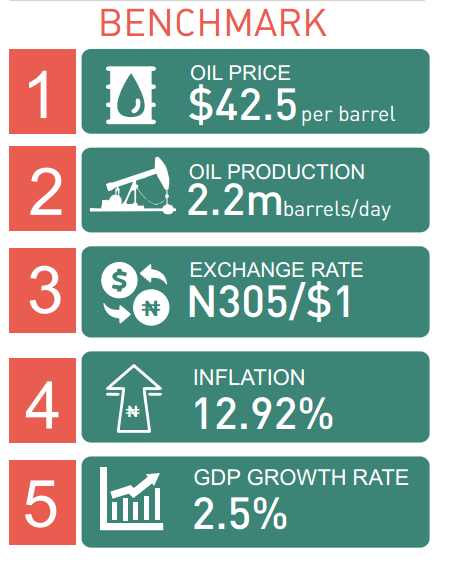

Key Summary of the 2017 Nigeria Federal Budget

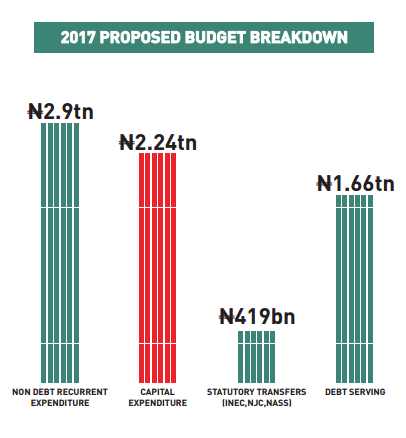

- Total expenditure – N7.44 trillion.

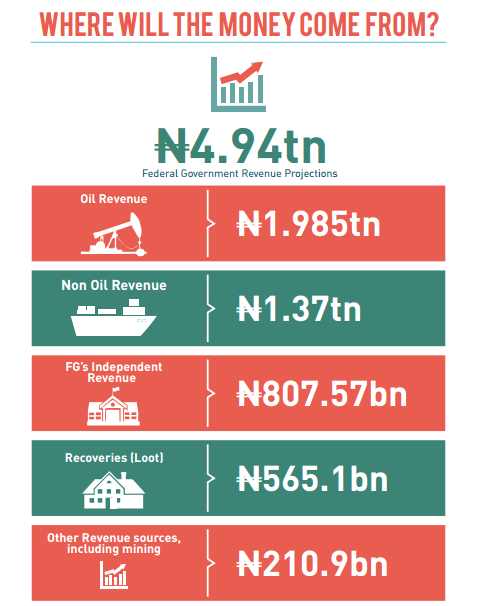

- Total expected revenue- N5.08 trillion.

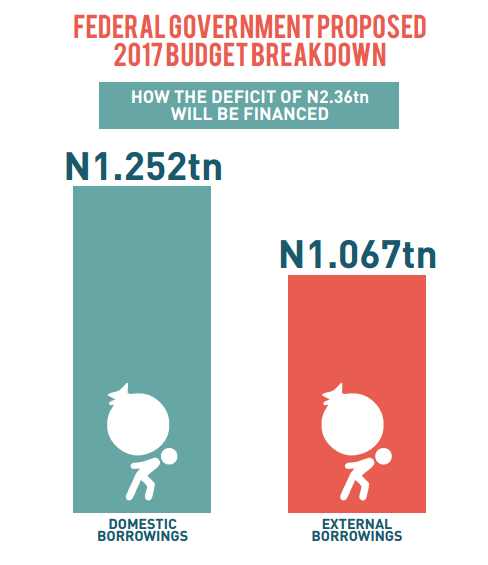

- Projected deficit is N2.36 trillion, to be financed mainly through borrowing.

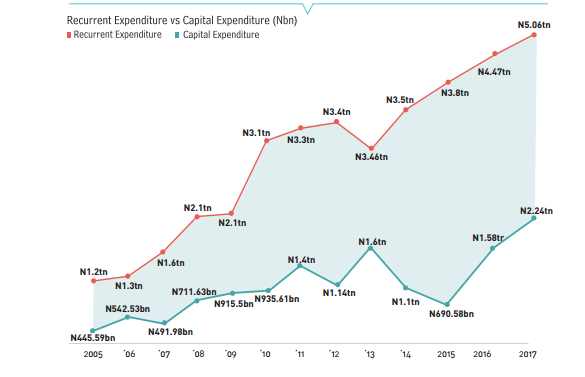

- N2 trillion for capital expenditure

- N500 billion for investments in roads, power and housing projects

- N46 billion for Special Economic Zone (SEZ) for the 6 geopolitical zones.

Budgit did the numbers and calculations when the budget was proposed, in 2016. We updated the budget numbers (second figure) to reflect the minor update on the total budget