Qualcomm is innovating big in the mobile device space. Now, it is moving into the electric vehicle space. We do know that the biggest stumbling block in the way of electric vehicles becoming commonplace is their limited range. A petrol or diesel powered car currently has roughly four to five times the range on a tank-full compared to an electric car with fully charged batteries.

Countries like UK and US have charging stations even on the highways to counter this. But stopping frequently to charge the batteries seems like a massive waste of time. And it is. So this new development by Qualcomm is like a godsend.

The company, known more for its semiconductor chips that power mobile phones, claims to have successfully demonstrated its wireless charging technology for cars. While others too are working on inductive charging for cars, Qualcomm’s system is said to work even on moving cars. Wireless charging is a feature found in some flagship mobile devices, so we’re not surprised Qualcomm has translated the technology for use in cars.

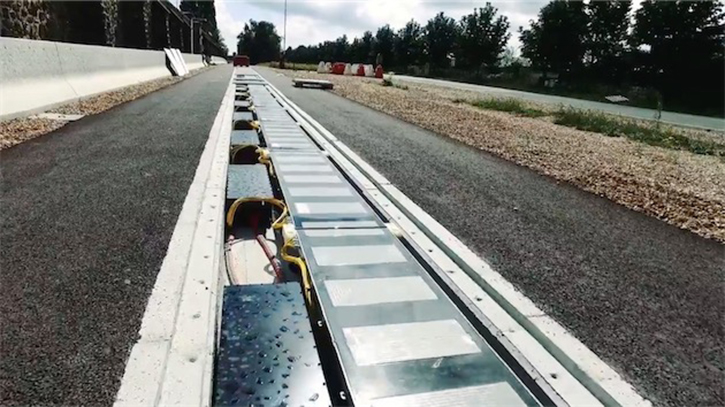

Qualcomm built a 100 meter track in France, where a Renault Kangoo EV was charged at up to 20 kilowatts while on the move at highway speeds. The tech promises to be able to charge a suitably equipped vehicle while moving in either direction. The track used for the test had been prepared with the source part embedded under the tarmac while the receiver was integrated into the car.

If the technology picks up and can be implemented on a large scale, electric vehicles might just become the norm. That is disruption and another source of technology licensing at massive scale for the chip maker.