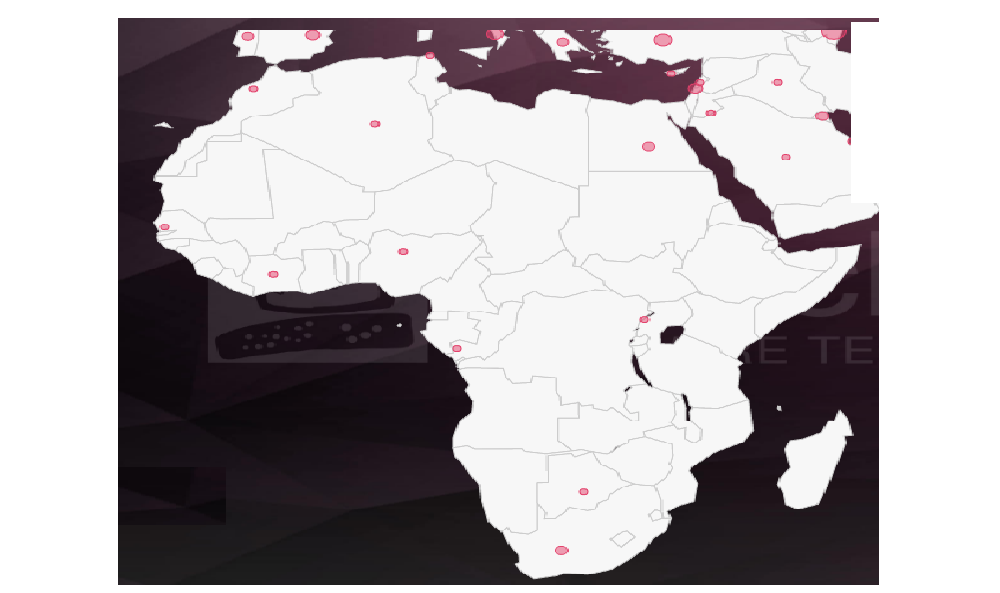

WannaCry Ransomware Infection Map – Africa

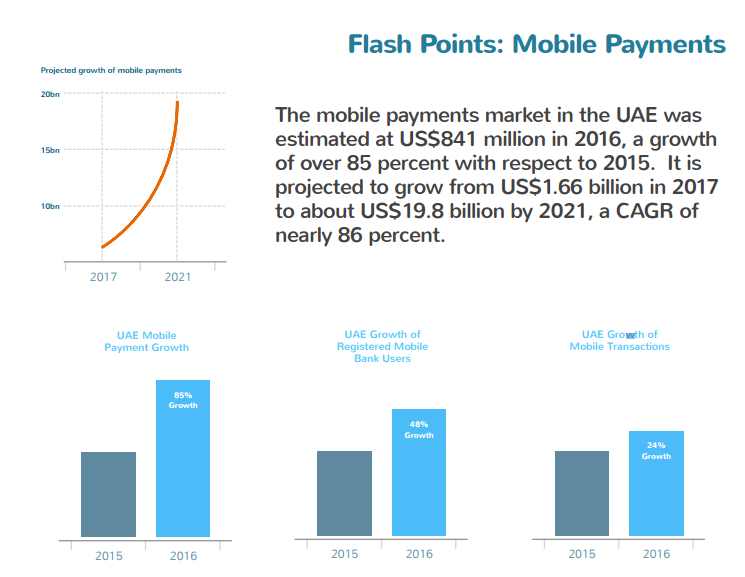

United Arab Emirates (UAE): Digital Finance & Payments Trends

The UAE banking industry is highly competitive with about 23 national banks and 35 foreign banks operating as of January 2017; The UAE has a banked population average of 83 percent, compared with a global banked population average of 62 percent and 52 percent for the Middle East.

Card penetration for the UAE is estimated at 37 percent, while the global average is estimated at 18 percent and the Middle East average at about 15 percent. As of December 31, 2016, total banking assets amounted to US$711 billion. Emirates NBD has the largest branch network in the UAE (155 branches). The bank had a market share of 17.2 percent in terms of total banking assets, and 20.0 percent each in terms of loans and deposits for the year ended December 31, 2016.

By the year 2020, the Dubai government will eliminate the need for paper documents and fully transition to blockchain technology. As part of its “Dubai Blockchain Strategy”, by 2020, all transactions will be conducted using this technology.

Financially Dynamic

The United Arab Emirates (UAE) represents one of the most financially dynamic and liberal markets in the Middle East region. About 85 percent of the UAE population of 9.3 million is between the ages of 15 and 64, according to 2016 data. As of November 2016, the country boasted nearly 228 mobile subscriptions and 15 broadband Internet subscriptions per 100 inhabitants. In addition, the UAE has one of the world’s highest smartphone penetration levels (about 78 percent), an additional driver for increased adoption of digital payments: the use of digital banking is rising fast and likely to accelerate in the future

Government Initiatives: Promoting Digital Payments

The UAE government has been actively promoting digital payments through various initiatives such as the Wage Protection System and the Dubai Smart City initiative. In 2016, the UAE government earned about US$759 million via its e-Dirham service, an electronic payment and collection of revenue system for both government and non-government fees. The number of e-Dirham cards increased from 1.76 million in 2015 to 2.41 million in 2016, a growth of over 37 percent. During 2016, the government partnered with the National Bank of Abu Dhabi (NBAD) to launch various e-Dirham services including direct debit, payments via direct transfers from the consumers’ bank accounts, an eDirect facility to credit a customer’s eWallet balance, etc.

Government Initiatives: Financial Inclusion

Trriple is an UAE-based payment provider that has partnered with Ericsson to offer mobile wallet solutions to over 500,000 unbanked customers in the UAE. This digital platform straddles across the mobile financial services value chain. Apart from being able to access government services, customers can store and transact money via their mobile phones.

Banking Sector: Competition Driving Investments in Digitalisation

As credit growth was weak in 2016, banks have embarked on a digital journey to boost profitability and enhance competitiveness, by targeting additional revenue streams and a better customer experience. For instance, the Dubai Islamic Bank, the largest Islamic bank in the UAE, introduced the Visa payWave cards, thereby promoting contactless payments. The Abu Dhabi Islamic Bank (ADIB) has partnered with IBM to offer various digital products and services, including mobile banking iOS apps. Emirates NBD became the first player in the Middle East and Africa region to introduce Visa Token Service (VTS) technology via its Emirates NBD Pay in 2016.

Mobile is fast emerging as the “go-to” option for banks, propelled by increasing smartphone penetration. The UAE Banks Federation estimates that given the implementation of mobile wallets in May 2015, the use of cash will decline by nearly US$13.6 billion—representing a market share of 35 percent—over the next five years in favour of mobile wallets. This will be made possible through the upgrading of the overall payments infrastructure to enable mobile payments. Selbourne Research estimates that nearly half of the 100,000 odd PoS terminals are currently contactless-enabled.

With the average UAE customer having about two cards (excluding loyalty cards), a high degree of competitive intensity exists in the UAE banking industry. This has forced banks to be innovative in terms of marketing, customer service, and offerings. Banks are increasingly forced to invest in technology that gives them a competitive edge. For instance, Emirates NBD recently announced its intention to invest more than US$136 million over the next three years just in digital innovation and multichannel transformation.

In 2017, Emirates NBD launched its digital-only bank, Liv, which enables customers to open their account with their smartphones by merely scanning their Emirates ID card. Apart from routine banking transactions and real-time analytics that facilitate personal financial management, it also offers consumers a daily feed of happenings, exclusive food deals specific to the time of day, fitness trackers, and the like. Furthermore, the app facilitates fund transfers from social media platforms such as Facebook and WhatsApp. The Commercial Bank of Dubai (CBD) plans to launch a digital-only bank via its mobile app in 2017.

Banking Sector: Consolidation Inevitable

Consolidation is inevitable in the UAE payments industry, as illustrated by the recent merger announcement of National Bank of Abu Dhabi PJSC (NBAD) and First Gulf Bank PJSC (FGB), resulting in a behemoth with an asset base of US$175 billion. Further industry consolidation is expected with the likely mergers of Abu Dhabi Commercial Bank (ADCB) and Union National Bank, as well as of Abu Dhabi Islamic Bank and Al-Hilal Bank. In February 2017, OMA Emirates, a UAE-based payments solution provider, acquired MobiSwipe, a mobile payments solution provider. The latter’s technology enables merchants to accept digital payments by letting their mobile phones emulate PoS terminals via a pocket-sized card reader that is connected to the MobiSwipe app through Bluetooth. Also, in early 2016, Network International acquired Emerging Markets Payments Group (EMP) for US$340 million. This veritably created the largest payments processor in the Middle East and Africa, servicing over 170 banks and 70,000 merchants across the entire region.

E-commerce To Trigger Growth in Digital Payments

Souq.com, is one of the Middle East’s most recognised online brand and its largest digital sales portal. Souq started in 2005 as an auction platform and has transitioned into more of an Amazon-like platform with a mix of 1P/3P business through M&A (sukar.com in fashion), building out logistics (Q Express) and payments (Payfort). Souq.com attracts over 23 million visits per month and is fast growing as more consumers shop online in the Middle East

Amazon the online auction and ecommerce leader bought the Middle East platform Souq.com in a deal circling $700 million in March 2017. This is a strategic move forward for Amazon, as Souq.com rank among the larger acquisitions in Amazon’s history. The deal is key to unlocking the doors to markets in the Middle East. Souq provides Amazon a big leg up in the region with a large brand, customer base and logistics

Additionally, the rising rivalry forthcoming from Noon, another ecommerce platform about to hit in the Middle East, is a catalyst for the deal. Noon is a soon-to-be-launched ecommerce platform with strong backers promising a large selection, same-day delivery, in-house repairs and payments. Noon will start in Saudi Arabia and the UAE and plans to enter Egypt and Kuwait in 2018.

E-commerce Payment Solutions

A lack of varied non-cash payments solutions can act as a barrier to increasing digital sales. Digital sales account for just 1.8 percent of all retailing activity in the Middle East, but the sector is growing at 28 percent a year, with young consumers particularly active in a region with widespread smartphone usage.

Estimates by Souq.com, suggest that card payments typically account for just 20 percent of all transactions on its website, the rest of being made on cash-on-delivery payment method. In April 2016, Souq partnered with Mastercard to offer its customers a payment solution. This solution seeks to understand the shopping behaviour of customers with a view to offering targeted products and enhancing the customer’s shopping experience.

Similarly, Mastercard and PAYFORT, an online payment service provider, announced their collaboration in August 2016. This partnership aims to enhance the online shopping experience by offering customers greater ease and higher security through the Masterpass secure facility and PAYFORT’s secure online platform. Such partnerships are likely to further boost card acceptance

Contributed by Selbourne Research

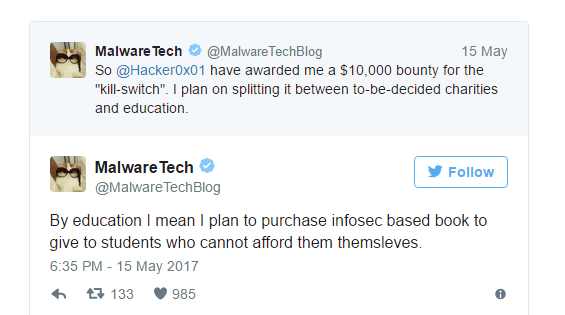

The 22-Year Old Marcus Hutchins Who “Killed” WannaCry Ransomware Is Donating $10,000 To Charity

Marcus Hutchins, the young cybersecurity expert, who managed to halt the spread of the WannaCry ransomware’s first wave last week says he plans to donate monetary reward offered to him to charity. Hutchins, was responsible for halting the inexorable march of WannaCry on Friday, when he followed clues from the malware’s code and registered a domain name the attackers were using as a kill switch.

Ever since, his identity has been outed by British media and has been inundated with communications from the media, the cybersecurity world and more. He’s now even been offered a $10,000 by HackerOne, a platform for cybersecurity professionals to report potential security flaws in exchange for bounty rewards. However, Hutchins says he doesn’t want to take the money, and no instead plans to donate the amount to charity. “I plan on holding a vote to decide which charities will get the majority of the money,” he wrote on Twitter.

Google Moves From Mobile-First To AI-First Strategy

Search giant, Google, has announced a broad strategy which is going to be driven by machine learning in its developer conference. Simply, the company is moving from a “mobile-first” to an “AI-first” strategy, said chief executive Sundar Pichai in a keynote at Google IO. “In an AI-first world, we are rethinking all our products,” he said, announcing a new group, Google.ai, which will develop tools and applications to make machine learning more widely available.

Pichai also announced Google’s second-generation TensorFlow Processing Unit (TPU) as key to its future data center architecture. “We are rethinking our computing architecture again…We want Google Cloud to be the best cloud for machine learning,” he said, echoing hopes of rivals such as Amazon, Facebook and Baidu.

Demos of new features in Google’s translation and photo services were among the most impressive efforts using machine learning. “All Google came from understanding text and Web pages, so the fact we can understand speech and images [with neural networks] has profound implications for us,” he said.

Separately, Google previewed the next version of Android as well as a new variant, Android Go, for entry-level smartphones with as little as 512 Mbytes storage. It also hinted at plans for an OEM program for Google Home that will spawn third-party products by the end of the year that compete with rival Amazon’s Echo and Dot.

The move comes at a time when all big data centers are reinventing themselves for a world in which neural networks are delivering new capabilities to recognize speech, images and more.

Apple was out early with Siri, but Amazon has the most traction with Alexa. Google seems to be stepping on the gas with its Assistant and Home. Microsoft’s Cortana is among other competitors along with options emerging from China’s big three data centers.

Google Makes A Really Fast Microprocessor, RIP Core Competency Concept

Nonsense to the concept of core competency. Anyone can do anything because the cost of doing everything is lower. That is one of the problems of companies that have no platforms. That is why IBM is struggling because it has no platform. Everything it does can be easily done by its clients with marginal pains. As technology costs drop, there is no need to outsource. You can simply build in-house.

Google, Facebook and host of many companies are doing so. Facebook makes some of its servers, using largely open source solutions. Google has entered into the chip business.

Google has designed and deployed a second generation of its TensorFlow Processor Unit (TPU) and is giving access to the machine-learning ASIC as a cloud service for commercial customers and researchers. A server with four of the so-called Cloud TPUs delivers 180 TFlops that will be used both for training and inference tasks.

The effort aims to harness rising interest in machine learning to drive use of Google’s cloud services. It also aims to rally more users around its open-source TensorFlow framework, the only software interface that the new chip supports.

The Cloud TPU supports floating-point math, which Google encourages for both training and inference jobs to simplify deployment. The first-gen ASIC used quantized integer math and was focused solely on inference jobs.

What is it that Google cannot do?