One of the observations I have arrived at over the course of meeting founders of early stage startups is that often it is not clear during our conversations if they have spent time examining the hypotheses that underlie the business model for the startup they are building.

This post1 is my attempt to outline some of the areas that I consider as I try to understand an early stage startup’s business model and the hypotheses that are the foundation on which its success must rest.2

To ensure we are on the same page, first some definitions;

Definition #1: What is a startup? A startup is a temporary organization built to search for the solution to a problem, and in the process to find a repeatable, scalable and profitable business model that is designed for incredibly fast growth. The defining characteristic of a startup is that of experimentation – in order to have a chance of survival every startup has to be good at performing the experiments that are necessary for the discovery of a successful business model.3

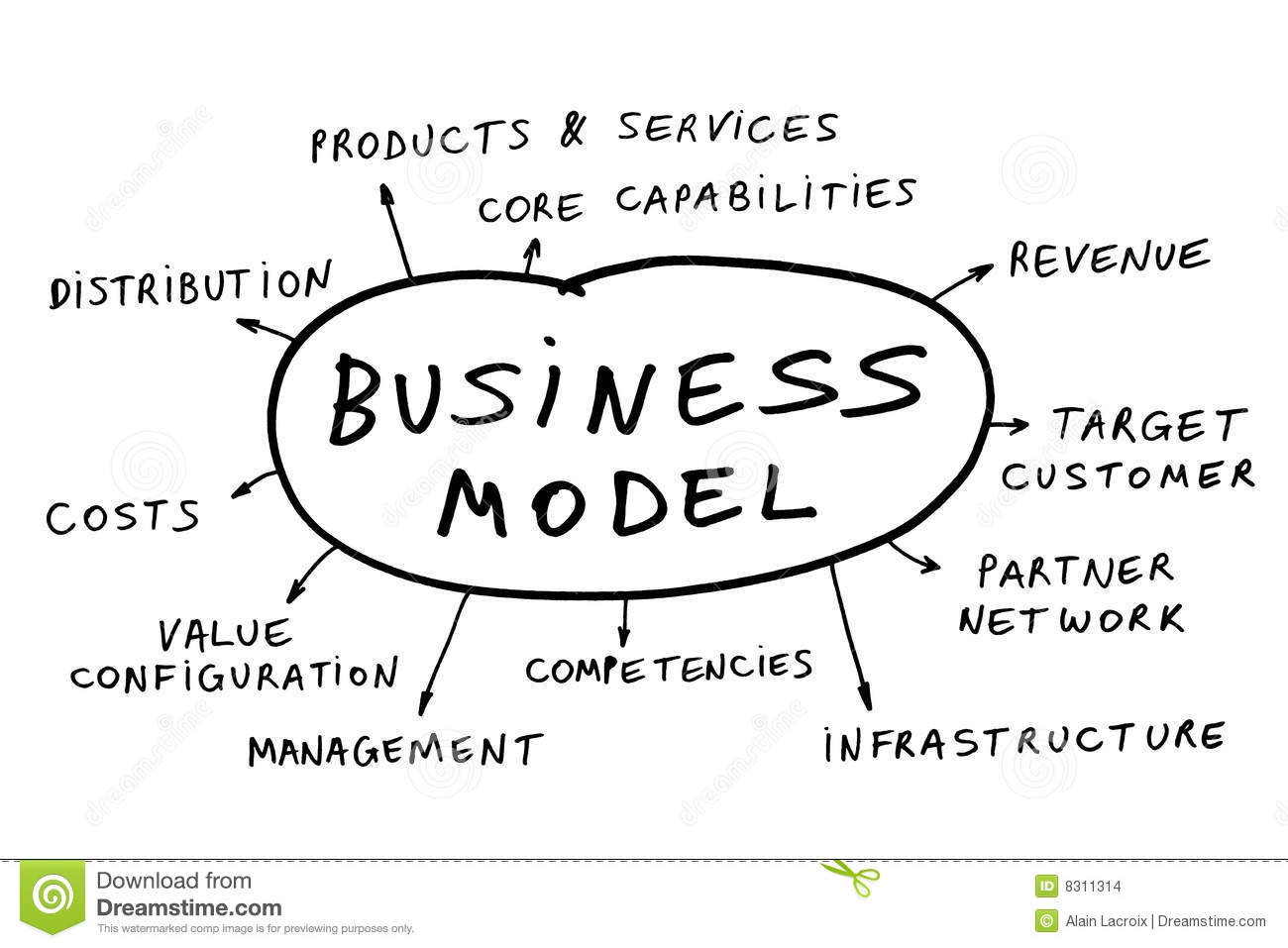

Definition #2: What is a business model? A business model is the description of how a startup will create, deliver and capture value. Alex Osterwalder’s Business Model Canvas is one framework for describing and documenting the elements of a startup’s business model.

Definition #3: What is Customer Development? Customer Development is a 4-step process by which a startup answers the questions it needs to answer in order to find a business model that is repeatable, scalable, and profitable. Step 1 and step 2 of Customer Development cover the “search” phase of a startup’s life-cycle. Step 1 is Customer Discovery. Step 2 is Customer Validation. More on those a little later.

Definition #4 What is a hypothesis? A hypothesis is a statement, or a group of statements, that proposes an answer to a question, or a solution to a problem, in a manner that is testable through experimentation. The goal of experimentation and testing is to determine if the hypothesis is correct, and to inform the subsequent actions that the startup should take on the basis of that evidence.

Step 1 in the Customer Development Process: Customer Discovery – this involves translating the initial vision behind the startup into a set of hypotheses about each component of the business model. This allows experiments to be performed that either validate or invalidate each proposed hypothesis. In my experience the exercise of testing hypotheses about the business model with prospective customers accomplishes at least two things. First the startup entrepreneur gets to hear directly from customers about the elements of the business model’s value proposition that are most critical from the point of view of the startup’s customers or partners. Second it jump-starts the sales process even before the startup has invested much time or money into building a product. The founders of a hardware startup discussed their idea for an innovative new product with a potential partner. The partner’s input proved crucial in determining the direction they followed with regard to product design – it evolved from a product with one offering to one with three distinct but complementary offerings.

The revenue model also changed based on those discussions. Even better, the partner agreed to work with this startup to bring the product to market when it is ready. Obviously, there’s still a lot to be done – product design, product development and manufacturing for example. Yet those initial discussions have been critical in conferring the kind of credibility that has made it possible for the startup to seek an audience with other potential partners. Customer discovery for this startup also involved market research to determine the priority of features from the perspective of individual end-use customers – the men and women who might actually decide to purchase the startup’s offering once it becomes available to consumers.

Step 2 in the Customer Development Process: Customer Validation – this step proves that the work done in step 1 is easily repeatable, scalable, and capable of delivering the customer volume required to build a profitable company. The startup I described above is now building prototypes based on all the information it gathered during the Customer Discovery process. Eventually we will test our ability to deploy the product in the field – a few hundred first, then a few thousand, and barring any major setbacks, tens-of-thousands, then hundreds of thousands.

During that process we will test how well the back-end software works with the hardware that we have designed and manufactured once people are actually using the device. At each step I expect we will go back to the drawing board on several aspects of the product and the business model. For example, our pricing model may not reflect reality since our market research confirmed the hypothesis that our potential customers have never encountered a device like the one we are developing. We may discover that customers will gladly pay more for the value proposition we offer than we currently plan to charge. It is important to note that we have gone through a number of product pivots during Customer Discovery. For one, we made an incorrect hypothesis about the amount of space our partners would be willing to devote to this new device, never mind all the assurances they gave us during early conversations.

We also made a number of pivots in terms of the user experience and the interface through which users will interact with the device because we realized that a number of hypotheses we had made about certain design, engineering, and manufacturing issues related to the product were just flat out wrong. The product we will soon show to our partners satisfies the desires individual end-use customers told us they seek in a product like ours4, in a manner that accounts for the constraints our partners expressed they would eventually have to contend with in deploying the devices when they come to market. Moreover, this exchange of information led us to develop a product with performance characteristics far superior to what we would have achieved within the parameters of our previous vision. We expect to make a few more pivots before all is said and done.

Developing Hypotheses During Customer Discovery

The first step in customer discovery is developing a rough estimate of market size and sketching an initial business model for your startup using the business model canvas, which I have discussed in some detail in What is Your Business Model? Using the business model as a guide, develop a hypothesis brief for each component of the business model canvas. A hypothesis brief should contain a succinct statement of the hypothesis itself as well as a sufficiently detailed but brief outline of the information that makes the hypothesis a reasonable and valid one for that business model component.

The market size hypothesis is probably the most critical, even though it does not correspond directly to any of the business model canvas components. Investors like to back companies that target potentially large markets. At the same time, be careful to differentiate the total addressable market opportunity, the serviced addressable market, and your target market. Needless to say, your initial target market will be the smallest of these three. In most cases a bottom-up estimate is better than a top-down estimate because it is relatively easy for an investor who wishes to do so to replicate a bottom-up estimate. Whereas, a top-down estimate could be viewed as “hand-waving” with no basis in reality.

The value proposition hypothesis should discuss the problem your startup solves for its customers. A segment of this brief should capture product features, and a minimum set of initial product features that early customers would be willing to pay for. This is the minimum viable product, a bare-bones version of your product that solves the “core” problem your customers face. Put another way, your minimum viable product is the least developed product that you can create in order to validate your most important hypotheses about the problem you are solving and what your customers or users will accept.

The customer segments hypothesis forces you to answer the questions “Who are my customers?” and “What problems do my customers face?” The hypothesis brief should discuss customer problems, types, and archetypes respectively. Understanding “a day in the life” of your typical customer is a powerful way to understand your startup’s customers. Finally, Steve and Bob suggest you develop a customer influence map. There is an important aspect finding customers that can be overlooked. What is the smallest group of customers that is experiencing the pain or problem you are solving most acutely? Perhaps they do not have enough money to be attractive to incumbents. Or, perhaps they are a niche that is considered weird and unprofitable by your competitors. Start your experiments there. Why? If your product indeed solves their problem, they will adopt it quickly. On the basis of broad adoption within that niche, you can plot a path to other communities of customers who are facing the same problem. In other words, find the groups of people who will be your “Innovators” and “Early Adopters” and focus your early efforts on those groups.

The channels hypothesis should differentiate between physical, web, and mobile channels. An important consideration during the development of this brief is whether your product fits the channel. At this stage it is important to pick the channel with the most potential and to focus on gaining customers and cultivating sales through that channel to the near exclusion of every other alternative. With very few exceptions, since you are still testing your hypotheses, developing your business model, and determining what product is best positioned to solve your customers problems avoid the temptation to launch via multiple channels.

I was having lunch with the founder of an early-stage startup on Thursday, last week. She was giving me an update – the struggle to raise seed capital from investors, what she’s learning about building a team, and so on. We got to talking about how she would distribute her startup’s MVP. Her initial plan would have cost her a lot of money – capital she can’t afford to spend and a significant portion of the round she’s trying to raise, because she was thinking about traditional channels – the most obvious route to the customers she thinks she needs to get to. I pointed out that without further testing, she was taking a very risky gamble whose most likely outcomes do not favor her startup. Instead I suggested she spend the least amount of money she can to test non-traditional channels, and maximize the yield from those avenues before she does anything big and splashy through traditional channels. In this example, her hypothesis was poorly formed because it failed to take her startup’s capital constraints into full consideration.

The market-type and competitive hypothesis discusses the nature of the market into which your startup is entering and tries to anticipate the competitive landscape of the market that you will be attacking. You might consider it the second half of the value proposition hypothesis – your product solves a product for a group of customers, or a market. In broad terms a market already exists, or your startup is creating a completely new market where none existed previously. Your market entry strategy will depend on the market type you identify, as will your cost of entry into that market. In an existing market, your startup will have to position itself against the competition in a manner that ensures it can win given the basis upon which you have chosen to compete.

The customer relationships hypothesis describes how you get, keep and grow your customers. It is similar to the LBGUPS model, which I discussed in What Is Your Business Model? There’s no need to emphasize that this is an important hypothesis brief – without customers or users your startup will die a not premature death. How you get, grow and keep customers is very channel dependent. Your analysis should take that into account, and should also factor in related costs.

The key resources hypothesis discusses how you’ll obtain resources that are critical to your startup’s operations but that you do not have within the startup. These resources might be physical resources, financial capital, human capital, or intellectual property. In each case it is important to list the resource and an outline of how it will be secured to enable the startup run its operations. For example, servers can be rented in the cloud at a cost that is lower than managing your own server. Another example, a first-time founder who does not yet have a technical co-founder might partner with an outsourced software development shop to build and MVP with which to run some experiments. Often the devshop will remain as a service provider till the startup becomes self-sufficient enough to bring that work in-house. I have a bias for startups that control their intellectual property.

The key-partners hypothesis describes the partners that are essential to enabling your startup to succeed. It also describes the value-exchange that keeps the partnership alive. For example, a startup might have all its development and design work done by a software engineering consulting firm established for that specific purpose. In this case the startup pays the software engineer money in exchange for software engineering related to its product. Key-partner relationships might take the form of a strategic alliance, a joint new business development effort, a key supplier relationship, or co-opetition. Certain of these are more common early in the startup lifecycle, and others are more common late in the startup lifecycle. It is important to realize that a partner should not have control over anything that is critical to your startup’s ability to exist and do business.

The key activities hypothesis summarizes your startup team’s understanding and assumptions about where its energies should be most focused in order to create the most value for its customers. These are those activities that you feel cannot be left to one of your startup’s key partners. For example, a hardware startup might view design as a key activity, while assembly is left to a manufacturing partner in a low-cost manufacturing jurisdiction.

The revenue and pricing hypothesis brief is important because it ensures that the startup can extract value for itself and its investors. It asks a number of simple questions all related to revenue. The nature of the specific questions asked depends on the channel, but the essence of those questions remains the same. Together they should enable you determine if there’s a business worth pursuing along the path you have chosen for your startup.

The cost structure hypothesis brief forms the second half of the value extraction hypotheses – the first being the revenue and pricing hypothesis. Your startup’s cost structure must ensure that it can effectively deliver on the value proposition it has promised customers, and keep a portion of the revenues that the startup cultivates in the form of profits. Here too the questions asked will be relatively simple, and will reflect the channel and the market type. For example, a startup whose only channel is the web will have a lower cost structure than one with a physical channel.

Once your hypothesis briefs are complete, your entire startup team should discuss the output. Seek contradictions, conflicts and inconsistencies. The most important reason for developing these hypotheses is to ensure that the actions that your startup is taking have the highest probability of yielding success that is possible.

During my conversations with founders I listen carefully to determine if the startup has thought about these issues, or is thinking about them – it depends on the stage. I become concerned when I get the sense that important questions have been left unasked and unanswered.

- Any mistakes in quoting from my sources are entirely mine. This post is an updated and adapted version of my posts The Startup Customer Development Model and Customer Discovery Phase I: State Your Business Model Hypotheses? which were published at Tekedia.com on September 3rd, 2012 and January 21, 2013 respectively. Large portions of this update are identical to the originals. ?

- I have adapted portions of: Chapter 2 and Chapter 4 of The Startup Owner’s Manual Vol. 1: The Step –by-step Guide for Building a Great Company, Steve Blank and Bob Dorf, Pub. March 2012 by K and S Ranch Publishing Division. ?

- I am paraphrasing Steve Blank and Bob Dorf, and the definition they provide in their book The Startup Owner’s Manual: The Step-by-Step Guide for Building a Great Company. I have modified their definition with an element from a discussion in which Paul Graham, founder of Y Combinator discusses the startups that Y Combinator supports. ?

- Market research involved nothing more than a description of the device. In other words, we relied on potential customers’ ability to imagine a future in which they could use the device we were setting out to develop. ?