Over the last 500 years, productivity increase has driven GDP (gross domestic product) growths across nations. When nations improve their productivity capabilities, they always experience expansion in GDPs. And when GDPs expand, the results have correlated with higher standard of living. Higher standard of living is better living welfare for citizens.

Technology penetration or diffusion has been a catalyst to this global economic redesign. Technology anchors innovation which typically drives productivity gain. Before 1500 AD, the world was largely an inventive society with so many ideas but little products and services for people to buy. Of course, during that period, the world experienced great scientific discoveries, demonstrating that mere expansion of scientific output does not necessarily give rise to improvement in the welfare of citizens.

Abu al-Khwarizmi, the Father of Algebra, had lived centuries before (780 to 850 AD), pioneering modern Algebra. Yet, in Baghdad, the land was poor.

Hipparchus had perfected Trigonometry in Greece (190-120 B.C.) and Euclid of Alexandria invented Geometry (300 BC). Yet, the Greek land was largely poor.

Across the world, there were empires and kingdoms, but man was truly poor. That poverty was due to lack of productivity. It was not because of lack of intelligence or capacity to think. From Babylon to Alexandria, man invented great things. But all stalled at inventions. Minimal innovations.

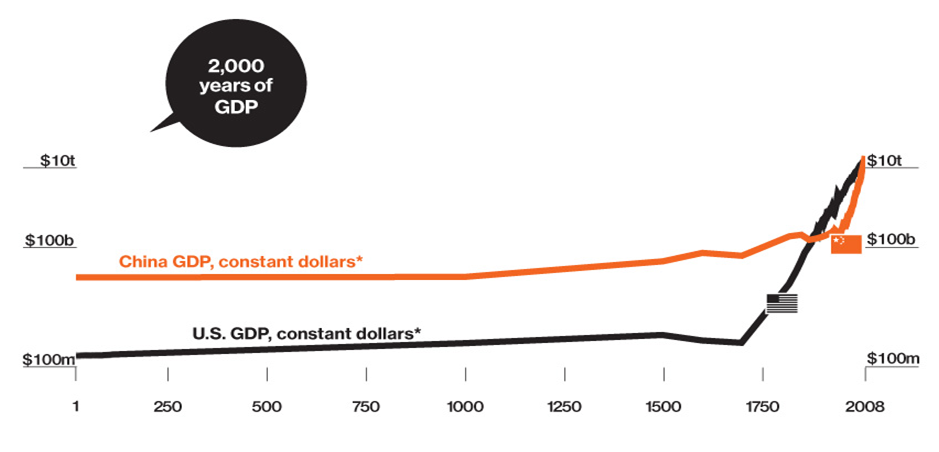

For more than 15 centuries, neither China nor USA improved productivity. Consequently, the GDPs were on stasis. Then innovation came via technology and the rest is history.

As shown in the plot above, using the two most dominant economies today, the gross world product (GWP) started expanding around 1700. Then, some parts of the world began the transition from inventive economies into innovation economies. China, England and India were global epicenters of science and discovery. China was already a globally undisputed leader in science. Chinese military strategist Sun Tzu, around 5th century BC, has written a treatise for warfare. Yet for centuries, Chinese economic growth was flat.

It was England which redesigned the world through the first Industrial Resolution (1760 to 1840) with manufacturing systems and processes. That brought enormous productivity gain which boosted trade and living standards. The innovation economy was born as science met Engineering and Technology. By the time U.S. took over as the world’s largest economy, around 1896, England had morphed from a nation of Science and Technology to one of Philosophy and Law. In the Houses of Lords and Common, there were more lawyers than scientists, then.

Oxford University and Cambridge University had the same dominance in education as the Pharaohs had during the time of Moses in the Bible. When God chose Moses to liberate Israelites from Egypt, part of the reason (ask me), was Moses was eminently educated under the Pharaohs. He commanded presence before Pharaoh. He understood the Logic, more than any Israelite, then.

The best “university” was in Egypt and the best astrologers worked for Pharaoh. Joseph, son of Jacob, produced the most important dream interpretation that preserved humanity during the Great Famine. Egypt kept the human race alive. Egypt prospered, and took many into slavery, building empires like the pyramids and other wonders. But Egypt faded as Pharaohs systematically moved from creating knowledge to showcasing ornaments!

Likewise, England lost the “steam” in the steam engine. The unrivaled Oxford University had morphed into Logic and Law, from science. Cambridge has also changed. England had faded in the production and dissemination of knowledge. The nation of Faraday is no more.

America brought entrepreneurial pragmatism, bulldozing itself to the top. Even China which had dominated the global GDP, at least 6 times in the last 10 centuries, was nowhere, with leaders deconstructing what made China great, to start with.

The innovation economy is born and America is rich. The bravado of America can be likened to the one experienced by Italians when Rome dominated the world. From 67 AD, when General Vespasian and (later) Titus, both Roman Emperors, attacked the rebuilt Temple of God of 408 BC (originally built by Solomon in 10th century BC), Rome was on its class. The temple was destroyed.

Immediately, when Catholicism was formed, and Apostle Peter was crucified upside down, Vatican was consecrated as the Holiest spot on earth and existed undisputed before the birth of Prophet Mohammed (born 570 and died 632 AD), father of Islam.

In these countries, the key was knowledge and using that to dominate. But across history, from the Babylonians during Nebuchadnezzar in 605 BC to Roman Empire, to British, it is a dynamic process. But unlike in the past, many can rise at the same time.

The above construct is the simple reason why some nations are poor and others rich. Knowledge is the driver and that knowledge drives innovation which is experienced through productivity.

The sub-Saharan Africa is still in the era of inventive society with so many ideas but practically little products and services to support them. People have ideas on energy, clean water, transportation etc but yet no one can experience those services because they are not available in markets.

Its processes are relatively primitive because most lack productivity capacities. One of those industrial processes is Agriculture.

In my firm, FASMICRO Group, a young and dynamic conglomerate, we spend enormous time identifying sectors in Africa where we can harness opportunities. We have identified five key sectors or sub-sectors; agriculture is one of them.

The following are the key agtech innovations we expect in coming years to redesign the agriculture sector in the continent. (I ought to have put agtech in the title, but LinkedIn will make it float over lines). Our business, Zenvus, is playing major roles in these areas.

· Farmland Registration for Financial Inclusion: Governments across the continent are working to drive the formalization of farmlands. This is very critical for financial inclusion where farmers can use their lands as collateral in the financial sector. It is unfortunate, in Africa, that a man that owns 5,000 hectares of man is considered poor, owing to lack of formal documents, of his land. Zenvus Boundary makes it possible for farmers to map their farmlands without any external help.

The output of the Zenvus Boundary. A farmer takes this to government and the farmland ownership is ratified. The farmer must be in a cooperative to use this.

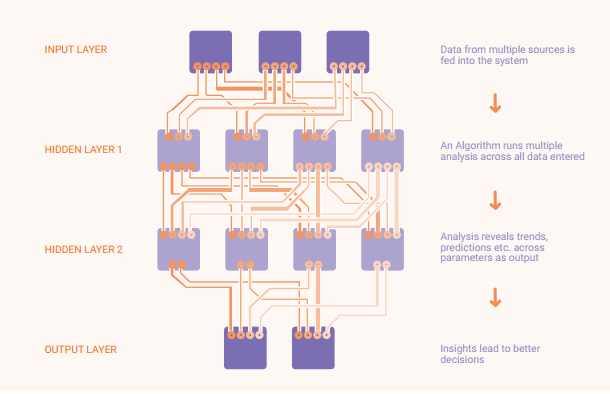

· Precision Analytics for Farm Productivity: The moment has come to make agriculture data-driven, instead of the guesswork strategy which has yielded nothing but poverty over decades in the continent. It is a shame that a woman can work for 12 hours in farms, and still be very poor. Analytics will improve decision making and enable a virtuoso era of farming productivity. Zenvus Insights enables farmers to have better insights on what is happening in their farms, making it possible for them to improve farming practices like irrigation, fertilizer application etc. Zenvus Insights Pro help companies that invest in farms to have clear insights on what is happening in farms they have invested in one dashboard. Our Smartfarm and Yield technologies, respectively soil fertility sensor and hyper spectral cameras, are engines to power this future of precision farming in Africa.

o Zenvus Smartfarm: Zenvus Smartfarm is an intelligent electronics sensor which when inserted in a farm soil collects pertinent data like humidity, temperature, pH, moisture, nutrients etc and wirelessly transmits the data to a cloud server where advanced computational models help to make sense of what is happening in the farm. It is powered with solar with battery capacity that can last for days.

The Zenvus Smartfarm

o Zenvus Yield: Yield provides farmers with deep insights on the vegetative health of their crops. The Yield is a special hyper-spectral imaging camera that works with Zenvus Web App to provide farmers actionable information for their farming businesses. By analyzing the images, stressed crops, droughts, outbreaks of pests and diseases etc can be seen and managed. Also, with Yield and Smartfarm working together, farmers can evaluate the effectiveness of irrigation and fertilizer application by correlating soil data with overall vegetative crop health.

· Personalization of Farm Fertilization: Historically, fertilizer companies have sold fertilizers without regard to the locational soil fertility condition of the farms. So, you have a farmer in my village (Ovim, Abia State, Nigeria) using the same fertilizer with someone from Kano despite specific differences in the soil fertility chemistry. The reality is that we do not apply the right type of fertilizers, wasting resources and missing productivity gains. The future is one where fertilizers are produced for regions, pre-production, and shipped to mitigate the deficiencies in soil nutrition in those regions. That means Notore, the fertilizer maker in Nigeria, could make an NPK fertilizer with higher N for places lacking urea or Nitrogen while compensating for lack of P. Zenvus Fusion, with a mission to build the Soil Fertility Geography in Nigeria, will drive this process as it works with partners.

· Fintech Platforms for Market Access. For all the innovations from the fintech ecosystems in Africa, few are engineered to deal with the largest industry in the continent (by employment). Agriculture employs more than 60% of Africa’s working population. Yet, it has largely zero payment infrastructures. We do think ag-fintech ecosystems will be catalytic. Zenvus is emerging with some platforms which will seed a fintech engine, under development:

o zCapital: zCapital helps Zenvus farmers raise capital (loan or equity) by providing independent farm data from our sensors to help banks and investors evaluate overall profitability of farms.

o zCrowdfund: zCrowdfund helps Zenvus farmers crowdfund capital from local donors who they can deliver produce after harvest. Our sensors validate these farms providing partners with confidence.

o zInsure: zInsure helps Zenvus farmers insure their farms by providing independent farm data from our sensors to insurers. This helps them evaluate the risks based on actual farm data.

· Market Efficiencies and Breaking Information Asymmetry: In Africa, farmers do most of the works but merchants and others in the food chain make all the profits. There is information asymmetry which hurts farmers. Zenvus Financial solution has the following services to help farmers:

o zMarkets provides a platform for Zenvus farmers to sell their produce. It is an avenue to expand their markets by removing geographic limitations. Farmers list their harvest days and buyers connect.

o zPrices empowers rural Zenvus farmers with real-time produce prices across major cities. It provides farmers with data to effectively negotiate prices with merchants who normally pay them little.

To improve farmer’s capacities to transform into businesspeople, zManager is an electronic farm diary that helps Zenvus farmers record all phases of farming from planting through harvest to sales. It keeps all records – financial, staff, tools, etc in one secured place. Our goal is to give them tools to begin to act as businesspeople and not just like “cultural farmers” doing what their ancestors did, irrespective of the outcome.

The Zenvus technology is also making it possible for farmers to enjoy Farming-as-a-Service (FaaS) through Zenvus Smartfarm, provided they are in a cooperative. FaaS is critical as the model will allow farmers to share and rent tools, and get better productivity from improved tech-driven farming. And they do not have to be well-capitalized.

Zenvus will be making an important presentation in April 2017, in Lome (Togo), titled “Building Africa’s Soil Fertility Geography with Fertilizer and Crop Recommendation Engines”. This event hosted by IFC and USAID will showcase how cooperation in Africa will drive the future of farming in the continent.

I believe in Africa and have this undeniable optimism that tomorrow is awesome. I am confident that if we improve farm productivity by a factor of 2, farming output will double, and poverty will be halved in Africa. There is no other sector with generation transformational capability to remake the beautiful continent than agriculture. That is why I am meeting farmers, helping them to improve, and innovate for assured Food Security.

Believe in Africa!!!

Like this:

Like Loading...