The Thomson Reuters Africa Startups Challenge seeks to find the best new companies coming out of Africa. As a large continent made up of many emerging markets Africa is home to some exciting ventures who are able to leverage new technology and new business models to leap-frog the current players. Thomson Reuters, in partnership with Venture Capital For Africa (VC4A), have developed sophisticated assessment models for identifying high growth high potential companies listed on the VC4A.com platform. This list presents the ventures identified by the challenge, startups tapping into scalable markets with clear potential to scale.

Based on this, Thomson Reuters has announced the finalists for its African Startups Challenge, a competition seeking top startups that make a good investment or partnership opportunity for Thomson Reuters and its customers.

The finalists have innovations in fields such as in Agri-tech, Big data analytics, Blockchain, Digital government, Education, Internet of Things, et al. They are described below.

- Abacus – helps investors make and execute smarter, faster and more decisions by providing access to real time market data, news and analytics for the Nairobi Securities Exchange.

- Academix – is an aggregator and e-library of Nigeria focused research and knowledge resources, cutting across multiple disciplines.

- AgroData – an AgriTech firm which deploys technology to make tropical farming more efficient.

- African Markets – the first web platform, entirely dedicated to African stocks.

- BenBen – uses Blockchain technology to provide Governments , Financial Institutions, Realtors and the general public instant access to property information through an easy to use searchable interface.

- Ensibuuko – offers financial institutions an easy and efficient means to manage and track information and to reach underserved (unbanked) communities such as farmers.

- Farmdrive – a mobile tech, agri-tech startup that looks to advance bankable farmer initiatives.

- Kwanji – an online FX comparison and payment platform providing businesses in Africa with unrestricted access to the very best FX rates.

- Mavuno – a mobile tech and supply chain startup that connects farmers and urban wholesale traders through SMS in East Africa.

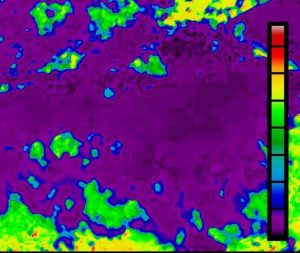

- Ripple Nami – offers an intuitive visualization platform that allows anyone to map their world with real-time information, enabling them to make better and faster critical decisions.

- Smart Finance – makes it easy for micro-businesses to keep track of their financial activities, maintain business records and subsequently gain access to finance.

- Tech 4 Farmers – a global agribusiness and financial services provider operating a digital commodities exchange hedged with warehouse receipts.

- Vault – de-risks investor communications through a SaaS model that ensures timely and relevant information is delivered to investors.

- Zenvus Smartfarm – agri-Tech and IoT startup that uses sensors and algorithms to advise farmers on the health of their crops. The data is also sold (anonymized) to commodity traders.

The winner, who will receive a cash prize, will be announced at Thomson Reuters 2016 Africa Summit in 13-14 October 2016 and an invitation to attend and tour its new Lab in Cape Town.

In addition, all the finalists will be featured in a special section of Eikon EMEA, the global investment platform of Thomson Reuters.

The challenge is organized in partnership with Venture Capital for Africa (VC4A) and The Cape Innovative and Technology Initiative (CiTi).